- United States

- /

- Trade Distributors

- /

- NYSE:BCC

Does Boise Cascade’s (BCC) Valuation Offset Profit Growth Concerns for Long-Term Investors?

Reviewed by Sasha Jovanovic

- Recent coverage has highlighted that Boise Cascade is trading below its intrinsic value while also facing a negative profit growth outlook of 5.5% over the next couple of years.

- This combination of perceived undervaluation and growth headwinds has caused investors to reassess the company's long-term prospects and risk profile.

- We'll explore how concerns about future profit growth are shaping Boise Cascade's investment narrative and its outlook among analysts.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Boise Cascade Investment Narrative Recap

To be a shareholder in Boise Cascade, you need to believe in the company’s ability to navigate through cyclical headwinds and capitalize on its investment in efficiency and distribution, despite the forecasted profit decline and weak near-term growth. The recent news confirming both undervaluation and continued negative growth does not materially alter the most important short-term catalyst, which remains operational modernization, nor the biggest risk, which continues to be ongoing volume and margin pressures from subdued demand.

The most relevant recent announcement in this context is Boise Cascade’s second-quarter earnings report, which highlighted a 3% year-over-year sales decline and a near halving of net income. This reinforces concerns surrounding shrinking profitability but does not negate ongoing initiatives in production upgrades, which may help offset declining end-market demand if sustained over the coming quarters.

In stark contrast, investors should be mindful of how continued high capital intensity could impact returns if market demand remains weak...

Read the full narrative on Boise Cascade (it's free!)

Boise Cascade's narrative projects $7.0 billion revenue and $285.8 million earnings by 2028. This requires 2.4% yearly revenue growth and a $23.5 million earnings increase from $262.3 million currently.

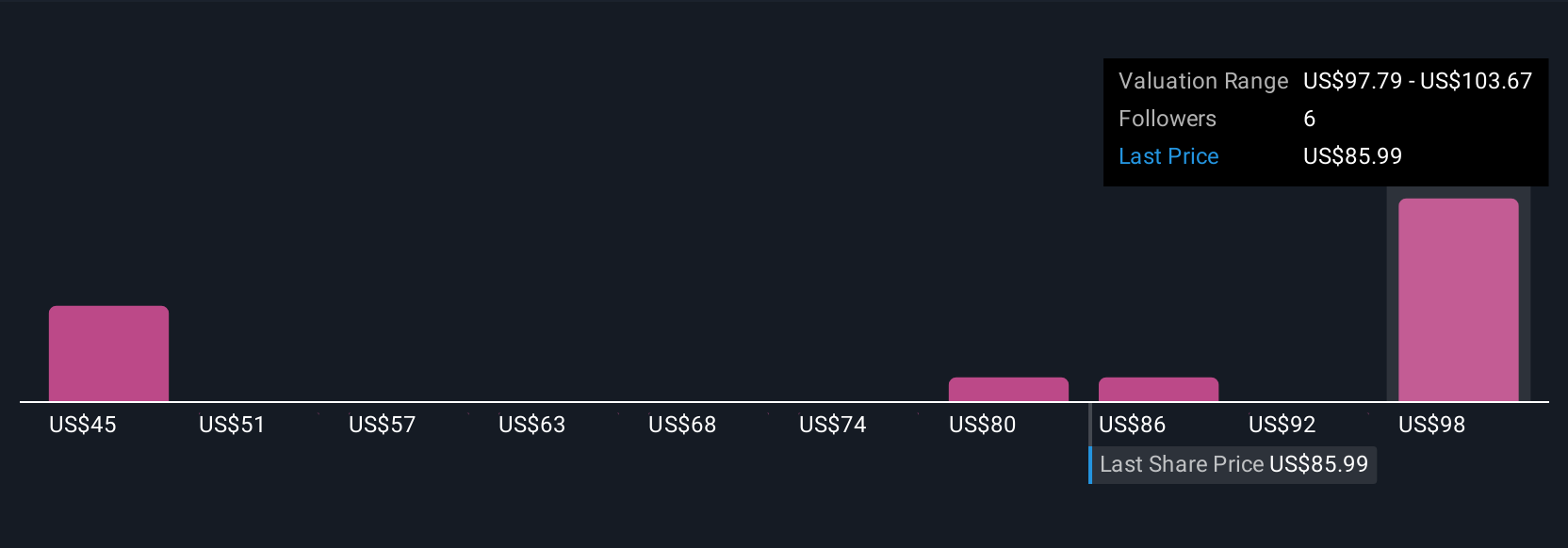

Uncover how Boise Cascade's forecasts yield a $99.83 fair value, a 29% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed 5 fair value estimates for Boise Cascade, ranging widely from US$70 to US$124,160. While many see value, concerns about persistent earning pressures and margin declines remain prominent and warrant further consideration for those tracking performance versus expectations.

Explore 5 other fair value estimates on Boise Cascade - why the stock might be worth 10% less than the current price!

Build Your Own Boise Cascade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boise Cascade research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Boise Cascade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boise Cascade's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boise Cascade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCC

Boise Cascade

Engages in manufacture and sale of engineered wood products (EWP) and plywood, and wholesale distribution of building materials in the United States and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives