- United States

- /

- Trade Distributors

- /

- NYSE:BCC

Boise Cascade Company (NYSE:BCC) Passed Our Checks, And It's About To Pay A US$5.21 Dividend

Boise Cascade Company (NYSE:BCC) is about to trade ex-dividend in the next three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Boise Cascade's shares before the 3rd of September in order to be eligible for the dividend, which will be paid on the 16th of September.

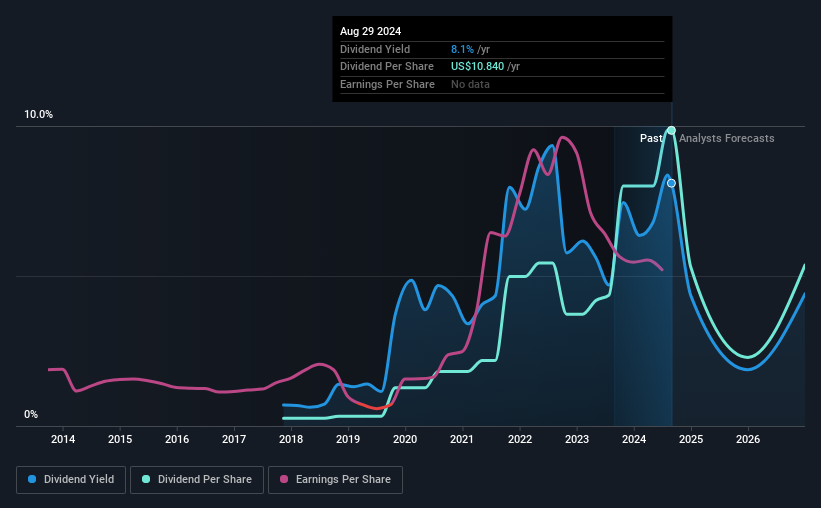

The company's next dividend payment will be US$5.21 per share. Last year, in total, the company distributed US$10.84 to shareholders. Based on the last year's worth of payments, Boise Cascade has a trailing yield of 8.1% on the current stock price of US$133.93. If you buy this business for its dividend, you should have an idea of whether Boise Cascade's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Boise Cascade

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Boise Cascade is paying out just 6.9% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Luckily it paid out just 8.7% of its free cash flow last year.

It's positive to see that Boise Cascade's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Boise Cascade's earnings have been skyrocketing, up 86% per annum for the past five years. Boise Cascade earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past seven years, Boise Cascade has increased its dividend at approximately 69% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

The Bottom Line

From a dividend perspective, should investors buy or avoid Boise Cascade? Boise Cascade has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past seven years, but the conservative payout ratio makes the current dividend look sustainable. Overall we think this is an attractive combination and worthy of further research.

In light of that, while Boise Cascade has an appealing dividend, it's worth knowing the risks involved with this stock. To that end, you should learn about the 2 warning signs we've spotted with Boise Cascade (including 1 which is a bit unpleasant).

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Boise Cascade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BCC

Boise Cascade

Engages in manufacture and sale of engineered wood products (EWP) and plywood, and wholesale distribution of building materials in the United States and Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026