- United States

- /

- Industrials

- /

- NYSE:BBUC

Some Confidence Is Lacking In Brookfield Business Corporation's (NYSE:BBUC) P/S

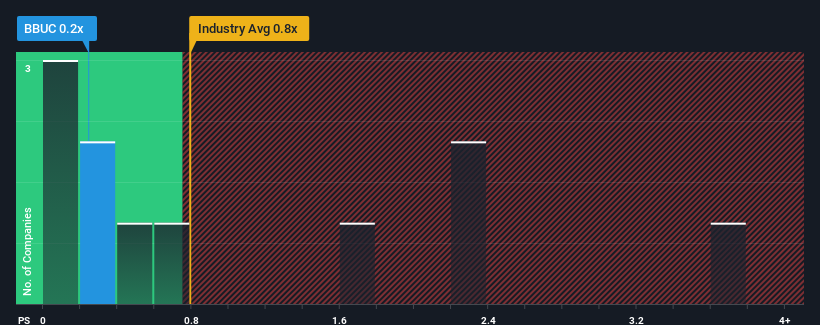

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Industrials industry in the United States, you could be forgiven for feeling indifferent about Brookfield Business Corporation's (NYSE:BBUC) P/S ratio of 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Brookfield Business

What Does Brookfield Business' Recent Performance Look Like?

The revenue growth achieved at Brookfield Business over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Brookfield Business' earnings, revenue and cash flow.How Is Brookfield Business' Revenue Growth Trending?

In order to justify its P/S ratio, Brookfield Business would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 21% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 3.2% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange that Brookfield Business is trading at a fairly similar P/S in comparison. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Brookfield Business' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Brookfield Business currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Brookfield Business that you should be aware of.

If these risks are making you reconsider your opinion on Brookfield Business, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives