- United States

- /

- Industrials

- /

- NYSE:BBUC

Brookfield Business (NYSE:BBUC) Is Paying Out A Dividend Of $0.0625

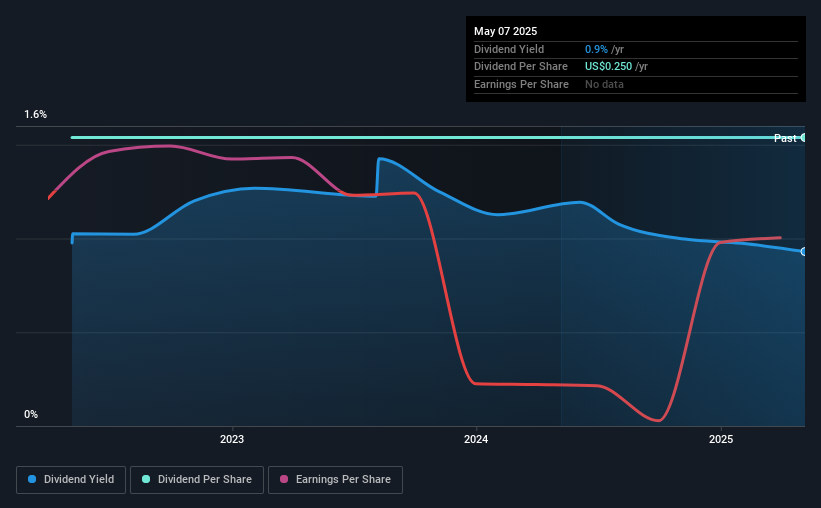

The board of Brookfield Business Corporation (NYSE:BBUC) has announced that it will pay a dividend on the 30th of June, with investors receiving $0.0625 per share. This means the annual payment will be 0.9% of the current stock price, which is lower than the industry average.

We've discovered 1 warning sign about Brookfield Business. View them for free.Brookfield Business' Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Despite not generating a profit, Brookfield Business is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS might fall by 82.6% based on recent performance. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

See our latest analysis for Brookfield Business

Brookfield Business Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The most recent annual payment of $0.25 is about the same as the annual payment 3 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past three years, it looks as though Brookfield Business' EPS has declined at around 83% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of Brookfield Business' Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Brookfield Business that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026