- United States

- /

- Industrials

- /

- NYSE:BBUC

Brookfield Business (NYSE:BBUC) Is Paying Out A Dividend Of $0.0625

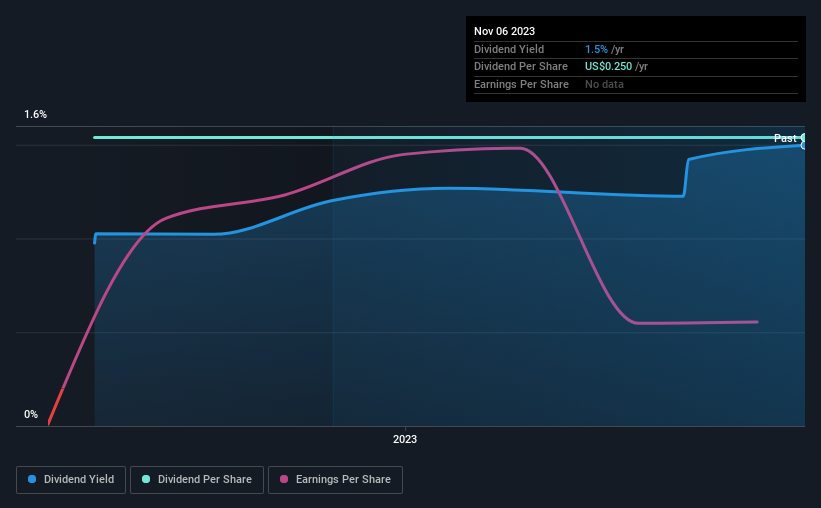

Brookfield Business Corporation (NYSE:BBUC) has announced that it will pay a dividend of $0.0625 per share on the 29th of December. This means the annual payment will be 1.5% of the current stock price, which is lower than the industry average.

View our latest analysis for Brookfield Business

Brookfield Business' Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Based on the last payment, Brookfield Business was earning enough to cover the dividend, but free cash flows weren't positive. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, EPS could fall by 65.6% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 20%, which is definitely feasible to continue.

Brookfield Business Is Still Building Its Track Record

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Brookfield Business' earnings per share has fallen 66% over the past year. Reduced dividend payments are a common consequence of declining earnings. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Brookfield Business (of which 1 is potentially serious!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

If you're looking to trade Brookfield Business, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United Kingdom, Australia, the United States, Brazil, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives