- United States

- /

- Industrials

- /

- NYSE:BBU

Will Brookfield's Corporate Merger and Simplification Strategy Shift the BBU (BBU) Investment Narrative?

Reviewed by Sasha Jovanovic

- Brookfield Business Partners recently announced plans to merge Brookfield Business Partners LP and Brookfield Business Corporation into a single publicly traded entity called BBU Inc. as part of a corporate simplification strategy.

- This move aims to streamline operations and improve investor understanding, even as the company faces mixed earnings results and restructuring costs.

- We’ll explore how the planned corporate merger and operational streamlining could influence Brookfield Business Partners’ investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Brookfield Business Partners' Investment Narrative?

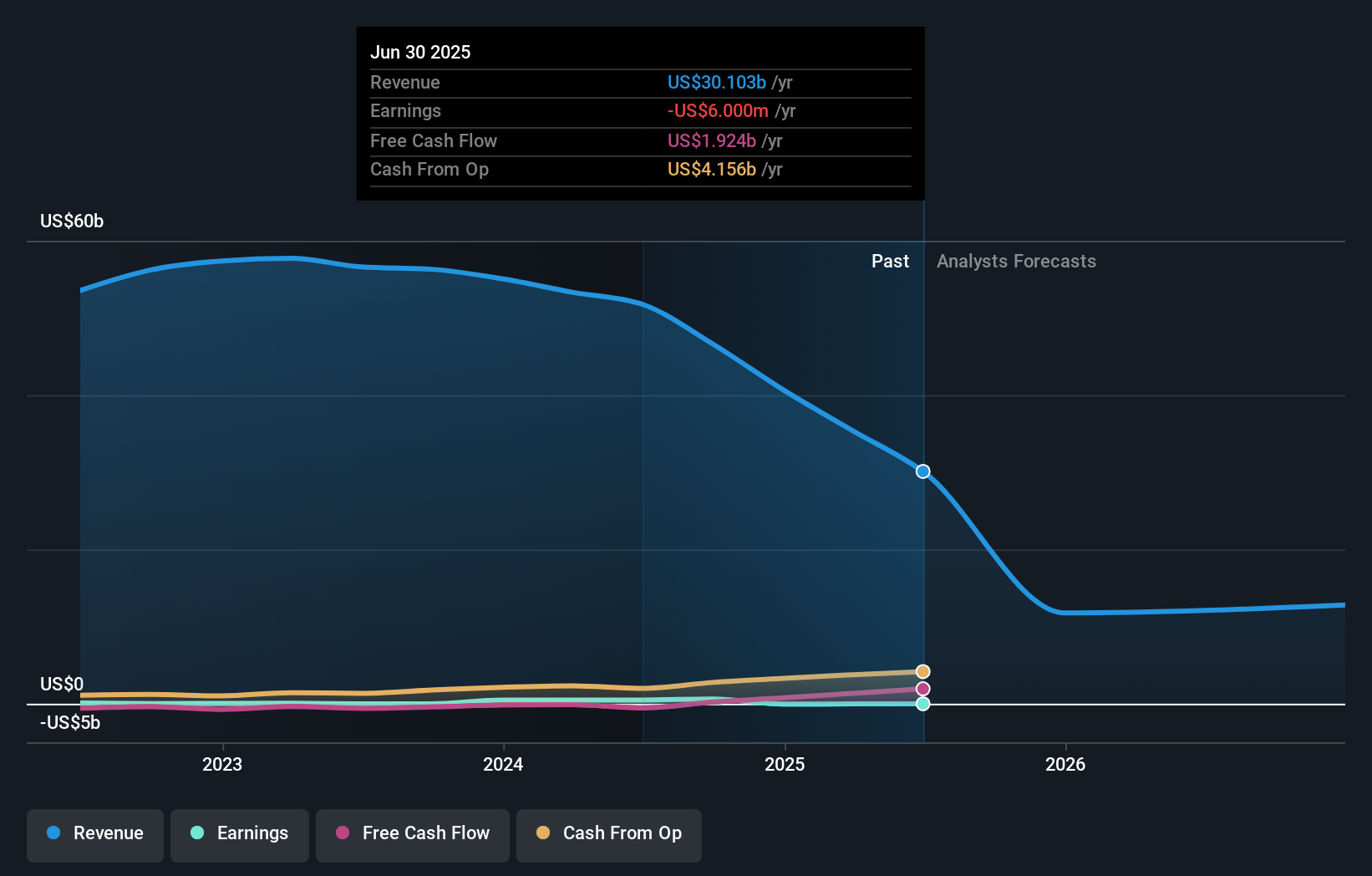

To be a shareholder of Brookfield Business Partners, one has to believe in the group’s ability to harness operational improvements, asset sales, and corporate streamlining to create value from a diverse global portfolio, even in times of muted earnings and revenue contraction. The latest merger announcement combining Brookfield Business Partners LP and Brookfield Business Corporation into BBU Inc. signals a renewed commitment to clarity and simplified operations, which could help offset recent restructuring costs and challenges from uneven earnings. This streamlining, alongside active buybacks and the potential sale of assets such as La Trobe Financial, might become a key short-term catalyst by unlocking capital or clarifying the investment story. On the risk side, a sharp forecasted revenue decline and ongoing unprofitability remain front and center, though the improved governance and new board expertise hint at renewed attempts to manage these headwinds. The immediate share price reaction suggests investors see the consolidation as positive, but until improved profitability is evident, risks from restructuring costs and uncertain asset sales loom large.

By contrast, the forecast for steep revenue declines is something investors should keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business Partners - why the stock might be worth just $1116!

Build Your Own Brookfield Business Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brookfield Business Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives