- United States

- /

- Industrials

- /

- NYSE:BBU

Is the BBU Inc. Merger Reshaping Brookfield Business Partners’ Investment Case (BBU)?

Reviewed by Sasha Jovanovic

- Brookfield Business Partners announced plans to simplify its corporate structure by merging its limited partnership and business corporation entities into a single publicly traded company called BBU Inc.

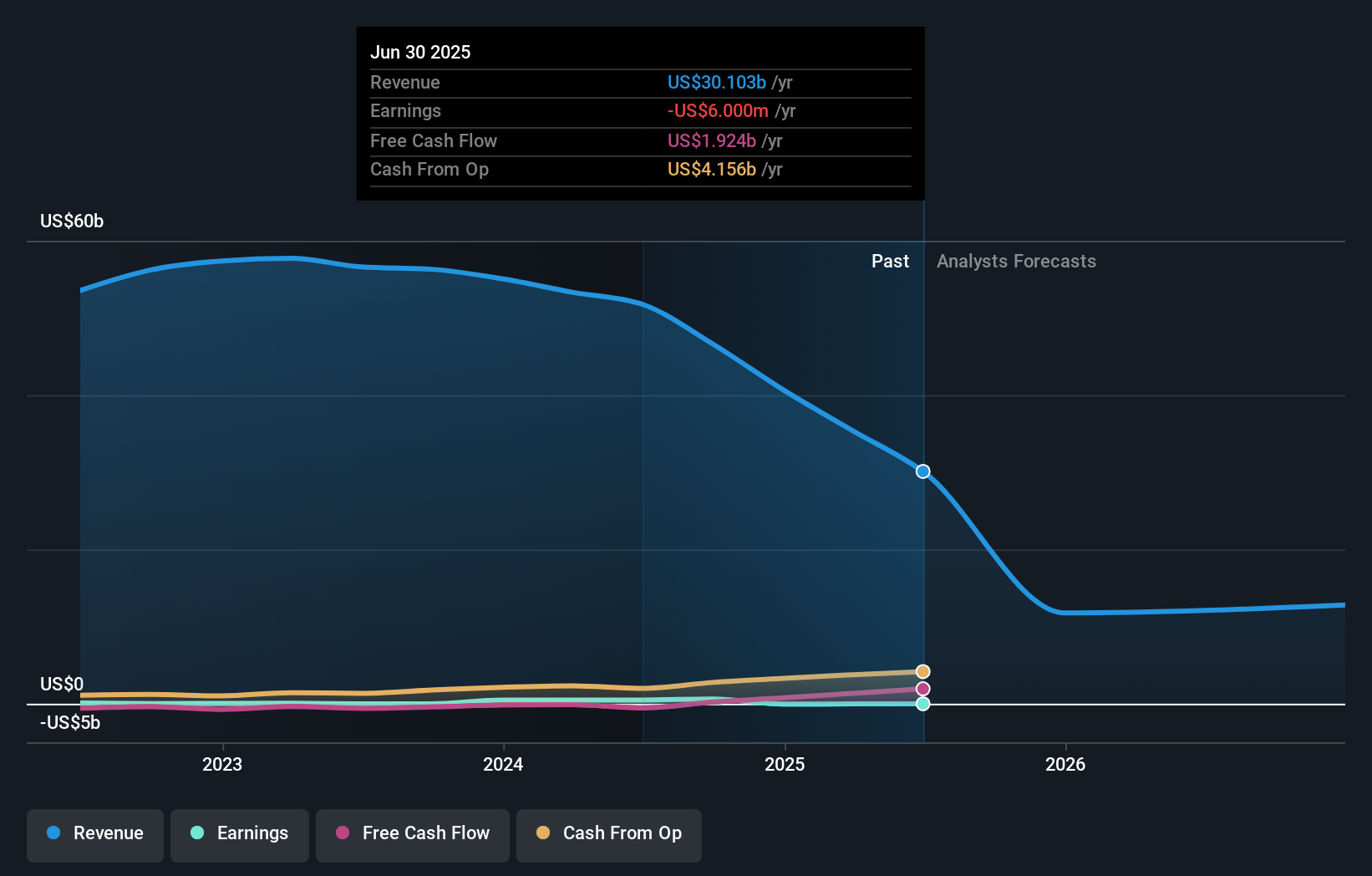

- This consolidation is intended to streamline operations and corporate governance, with recent earnings showing strong revenue performance despite missing EPS forecasts.

- We’ll examine how the move to combine entities into BBU Inc. could influence the company’s investment narrative and operational outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Brookfield Business Partners' Investment Narrative?

To be a shareholder in Brookfield Business Partners right now, you have to be comfortable with a company in transition, as the move to combine its partnership and corporation entities into BBU Inc. is designed to address complexity that has been a feature of the investment story so far. That announcement comes at a time of solid revenue performance, continued buybacks, and active asset management, such as potential divestments in Healthscope and La Trobe Financial Services. On balance, the simplification could remove a structural overhang and reduce governance concerns, and recent share price gains hint that the market is welcoming this change. However, risks have not disappeared: the company remains unprofitable, with forecast revenue declines and ongoing exposure to restructuring execution. Overall, the biggest near-term catalyst now becomes the success of this merger, which will likely define investor sentiment for quarters to come. Yet, the merger’s impact on future earnings remains a risk investors should be keenly aware of.

Brookfield Business Partners' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Brookfield Business Partners - why the stock might be a potential multi-bagger!

Build Your Own Brookfield Business Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brookfield Business Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Business Partners' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives