- United States

- /

- Industrials

- /

- NYSE:BBU

Brookfield Business Partners (NYSE:BBU): Evaluating Valuation After Corporate Restructuring and Investor Optimism

Reviewed by Kshitija Bhandaru

Brookfield Business Partners (NYSE:BBU) unveiled a plan to merge its LP and Corporation entities into one publicly traded company, BBU Inc. Investors have welcomed the move, and shares reached a new 52-week high.

See our latest analysis for Brookfield Business Partners.

The buzz around Brookfield Business Partners is building, as its restructuring news and management’s recent share buyback program fueled a fresh 52-week high. While earnings per share missed expectations, solid revenue results and streamlining initiatives have kept investors upbeat. The momentum is reflected in a strong total shareholder return of over 41% for the past year, suggesting that confidence in the company’s long-term direction remains intact.

If you’re tracking where momentum is really building, use this as a springboard to discover fast growing stocks with high insider ownership.

The market’s optimism is clear, but with BBU shares already on a tear and trading near analyst targets, the key question for investors is whether there is still room for upside or if future growth is already reflected in the current price.

Price-to-Sales of 0.2x: Is it justified?

Brookfield Business Partners is currently trading at a price-to-sales ratio of 0.2x, positioning its valuation well below both the industry and peer averages. At the last close price of $33.36, this suggests investors are paying less for each dollar of revenue compared to the broader industrials sector.

The price-to-sales ratio gauges how much the market values every dollar of a company’s revenue. For capital-intensive and cyclical sectors like industrials, sales multiples can indicate value when profitability is lumpy or non-existent.

Compared to the global industrials industry average of 0.8x and peers at 1.2x, BBU’s multiple is attractively low. The estimated fair price-to-sales ratio for BBU itself is also 0.2x, which implies the market is close to a level that fundamental analysis supports. This signals that, despite its recent share price rally, the stock may already reflect much of its realistic upside based on revenue expectations.

Explore the SWS fair ratio for Brookfield Business Partners

Result: Price-to-Sales of 0.2x (ABOUT RIGHT)

However, persistently declining annual revenue and ongoing net losses could quickly undermine the recent investor optimism and share price momentum.

Find out about the key risks to this Brookfield Business Partners narrative.

Another View: SWS DCF Model vs. Market Value

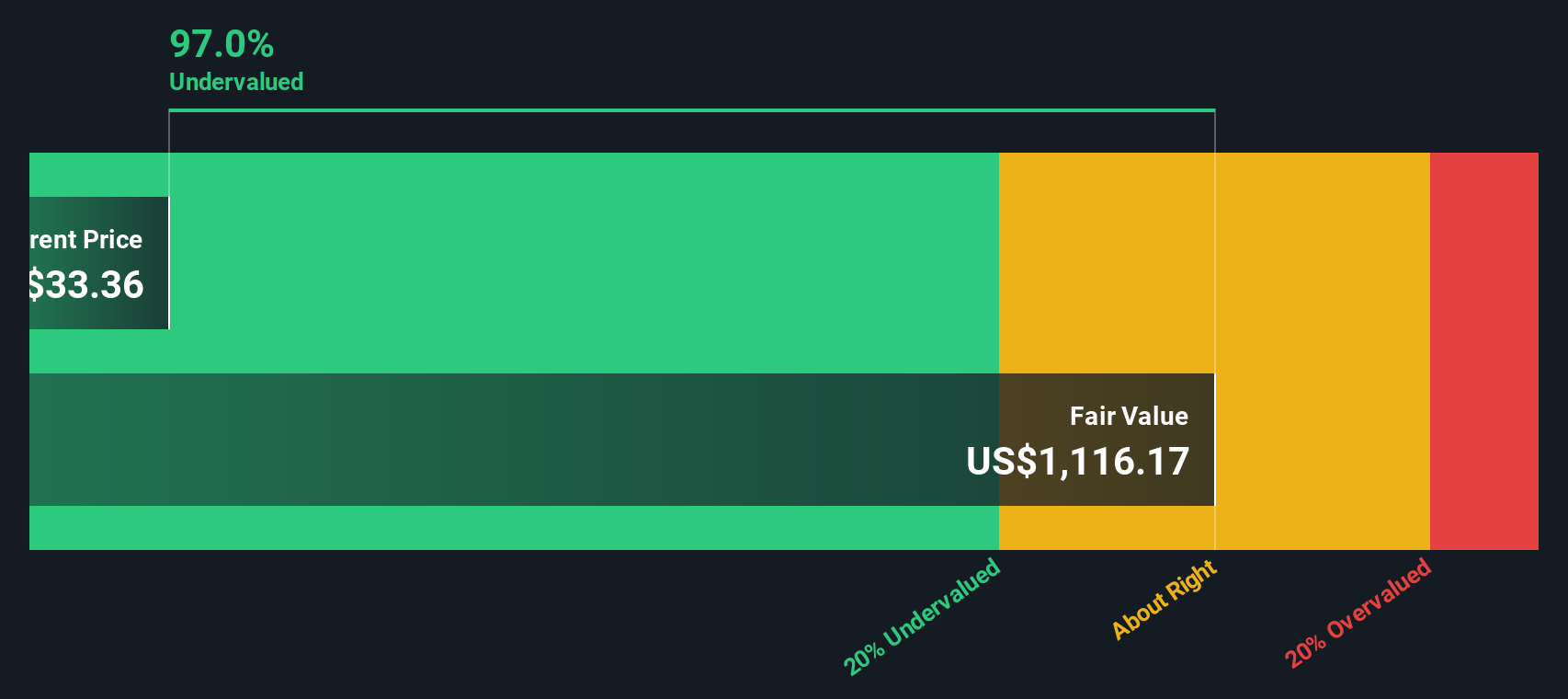

While the price-to-sales ratio suggests Brookfield Business Partners is in line with its fair ratio, our SWS DCF model presents a noticeably different perspective. According to the discounted cash flow method, BBU is trading well below its estimated intrinsic value, which could indicate a significant undervaluation. Does this long-term potential justify the current momentum, or is the gap a red flag for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Business Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Business Partners Narrative

Keep in mind, if you see things differently or want to take your own approach, it’s easy to form your own view in just a few minutes. Do it your way.

A great starting point for your Brookfield Business Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

There’s a world of smart investment ideas just waiting for you, each tailored to unique trends and opportunities that the market is rewarding now. Don’t sit on the sidelines!

- Earn passive income by taking action on these 19 dividend stocks with yields > 3% that consistently deliver strong yields and show financial resilience.

- Tap into innovation with these 24 AI penny stocks pushing boundaries in artificial intelligence, automation, and the next wave of digital transformation.

- Get ahead of the curve by investigating these 896 undervalued stocks based on cash flows trading below their intrinsic value, offering compelling upside potential for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBU

Brookfield Business Partners

A private equity firm specializing in growth capital, divestitures, and acquisitions.

Good value with worrying balance sheet.

Market Insights

Community Narratives