- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing’s Internet-Based Flight Communications Push Could Be A Game Changer For Boeing (BA)

Reviewed by Sasha Jovanovic

- Boeing and United Airlines previously completed ecoDemonstrator Explorer flight tests on a 737-8 to trial Internet Protocol Suite data communications, aiming to improve safety, cut fuel use and emissions, and ease air traffic congestion through more efficient, internet-based links between pilots, air traffic control and airline operations.

- This live testing, following a decade of development and involving major aerospace suppliers, government agencies and academia, shows how Boeing is trying to hard‑wire digital efficiency and environmental gains into future commercial operations.

- Next, we’ll examine how this push toward modernized, internet-based flight communications feeds into Boeing’s broader investment narrative and recovery story.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

Boeing Investment Narrative Recap

To own Boeing today, you need to believe it can turn a large, loss‑making commercial business and heavy debt load into a steadier cash generator as production stabilizes. The ecoDemonstrator IPS tests support Boeing’s efficiency and safety message, but they do not materially change the nearer term catalysts around 737 production and certification, or the key risks tied to negative margins, execution issues and balance sheet pressure.

What ties closest to this ecoDemonstrator work is Boeing’s broader technology push, including its collaboration with NASA on new wing designs, which also targets efficiency and operating cost benefits. Both initiatives sit alongside efforts to lift 737 and 787 output and integrate Spirit AeroSystems, reinforcing the idea that operational execution and supply chain stability remain the real swing factors for the stock over the next few years.

Yet, behind this innovation story, Boeing’s high debt load and ongoing cash burn are pressures investors should understand before they...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion revenue and $7.1 billion earnings by 2028. This requires 14.9% yearly revenue growth and an $18.0 billion earnings increase from $-10.9 billion today.

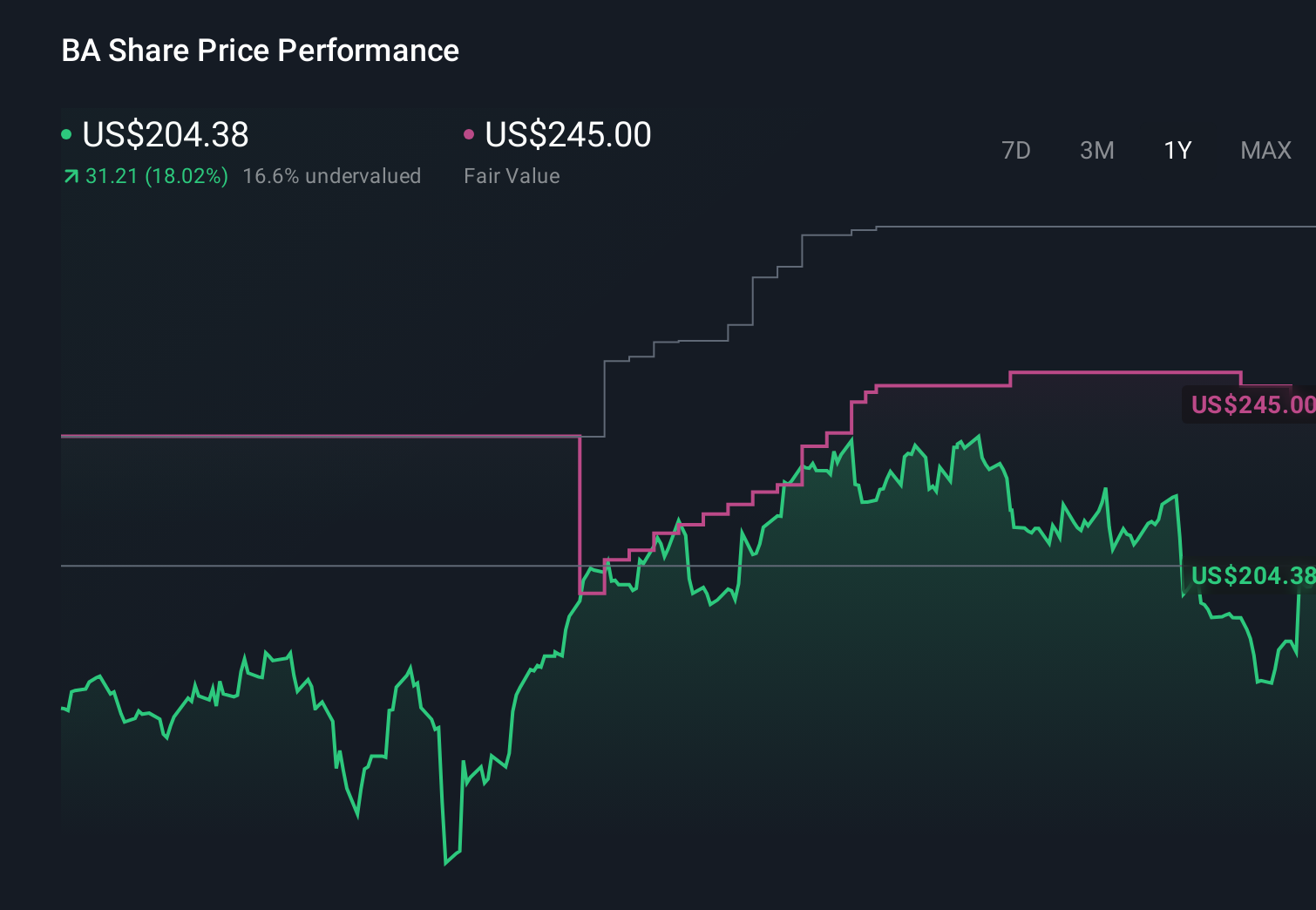

Uncover how Boeing's forecasts yield a $244.33 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Seventeen members of the Simply Wall St Community currently see Boeing’s fair value between US$206.79 and US$326.80, reflecting a wide spread of expectations. You should weigh those views against the central risk that persistent 737 certification and production setbacks could prolong losses and strain the balance sheet, then explore how different investors are thinking about that trade off.

Explore 17 other fair value estimates on Boeing - why the stock might be worth just $206.79!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion