- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (BA) Expands Global Satellite Network With Successful O3b mPOWER Launch

Reviewed by Simply Wall St

Boeing (BA) has seen its share price rise by 33% over the last quarter, a period marked by significant advancements in its product line and organizational changes. The successful launch of the 9th and 10th O3b mPOWER satellites has underscored Boeing's position in satellite technology, potentially bolstering investor confidence. Additionally, new leadership appointments, including Stephen Parker as President and CEO of Boeing Defense, Space & Security, may signal a focus on stabilizing the defense sector, reinforcing the company's strategic direction. These developments support Boeing's alignment with the general market uptrend, which saw an 18% rise over the past year.

Boeing has 3 warning signs (and 1 which is potentially serious) we think you should know about.

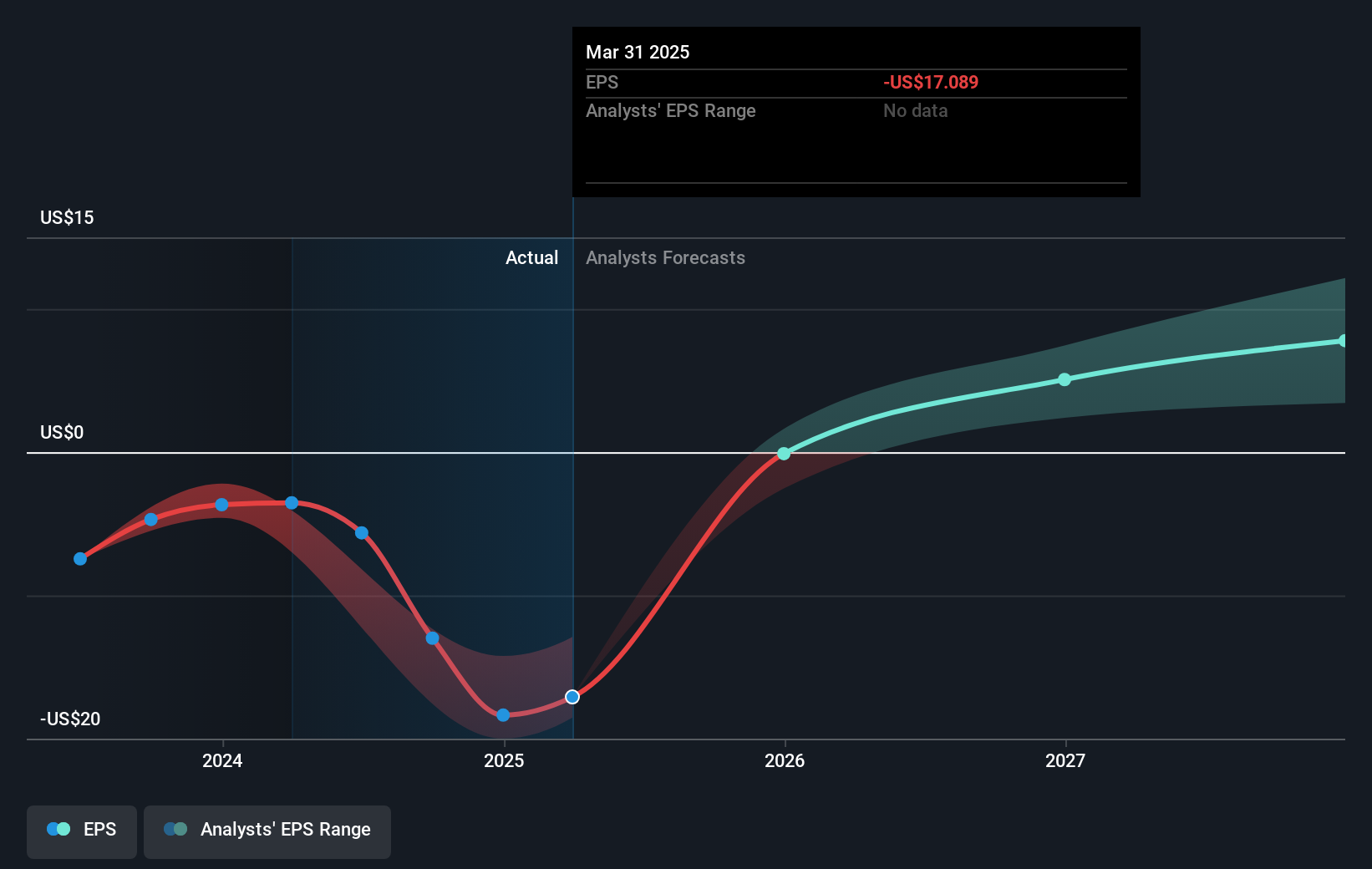

Boeing's recent share price increase of 33% over the last quarter, driven by advancements in satellite technology and leadership changes, could lay the foundation for a positive trajectory in the company's revenue and earnings forecasts. Stabilized production and increased output of the 737 and 787 aircraft are supportive factors, aligning with Boeing's ongoing strategy to strengthen its market position. The company's recent strategic shifts, including a focus on defense contracts, could enhance long-term stability and earnings in that sector.

Over the past three years, Boeing's total shareholder return, including dividends, stands at 49.84%. This performance indicates significant recovery, notwithstanding a challenging period marked by operational and financial headwinds. In the more recent one-year span, Boeing's performance lagged the US Aerospace & Defense industry, which saw a 41.7% return, emphasizing Boeing's need to tackle specific sector challenges.

Regarding analyst expectations, Boeing's recent share price movements set it close to the consensus price target of approximately US$237.47, implying limited room for immediate upside according to current projections. However, the firm's initiatives, such as the divestiture of the Digital Aviation Solutions business, aim to bolster cash flow and strengthen the balance sheet, potentially improving the company's ability to meet and possibly exceed revenue and earnings forecasts. The current share movement reflects a narrow discount to the consensus target, suggesting that the market views Boeing as approaching fair valuation.

Evaluate Boeing's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives