- United States

- /

- Building

- /

- NYSE:AZZ

AZZ (AZZ): Exploring Valuation After Mixed Earnings and 2026 Outlook Reaffirmation

Reviewed by Kshitija Bhandaru

AZZ (NYSE:AZZ) just announced second-quarter earnings and revenue that fell short of expectations, as strength in its Metal Coatings segment was offset by softer results in Precoat Metals. Management is holding firm on its full-year 2026 guidance despite the mixed quarter.

See our latest analysis for AZZ.

After surging for most of the year, AZZ’s share price slipped 14.6% over the past month as investors digested slightly softer-than-expected earnings and some volatility in demand. Still, the company’s one-year total shareholder return stands at an impressive 27.6%, and multi-year returns remain stellar, signaling that the long-term momentum behind AZZ is far from faded.

If AZZ's latest moves have you rethinking your watchlist, it could be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

Given the recent dip and analysts' upbeat price targets, is the market offering a real bargain, or has AZZ's strong run already baked in all the future growth investors can expect?

Most Popular Narrative: 21.7% Undervalued

With the narrative fair value sitting at $125.89, considerably above AZZ’s last close of $98.59, the stage is set for a debate on whether the stock’s recent drop opens up a rare window of opportunity, at least according to the widely followed narrative.

AZZ's new greenfield facility near St. Louis, Missouri is ramping up production, which could drive future revenue growth as it expands capacity and taps into strong local demand. This investment is expected to positively impact earnings as the facility becomes fully operational and contributes to higher sales volumes.

Curious why expectations for AZZ’s profit margins and future growth diverge so sharply from what the market is pricing in? The narrative’s bullish view hinges on bold expansion plans and a level of projected earnings power that has surprised many. Want to learn which calculation assumptions drive this premium fair value and whether they hold water? Experience the full story for yourself.

Result: Fair Value of $125.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, adverse weather disruptions and ongoing tariff uncertainties could quickly shift the outlook. This may challenge the case for sustained revenue momentum and margin growth.

Find out about the key risks to this AZZ narrative.

Another View: Market Ratios Paint a Cautious Picture

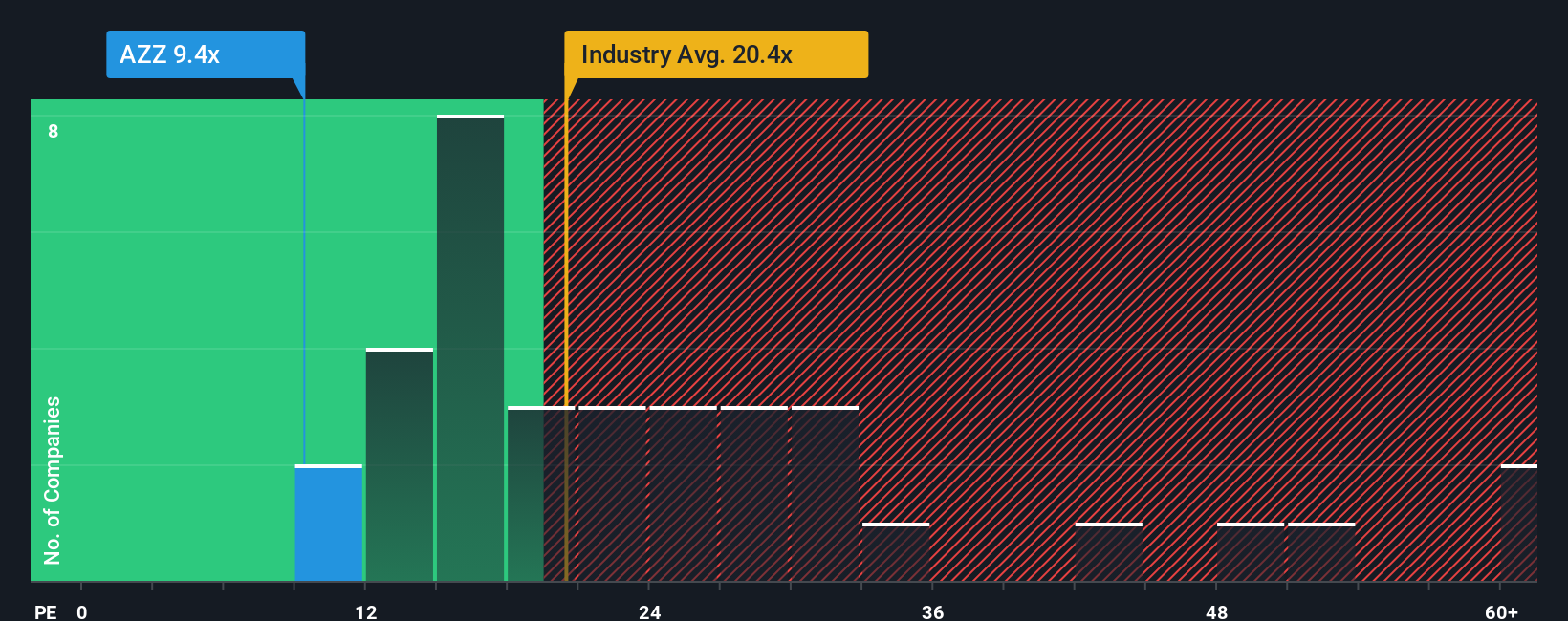

While analyst consensus points to significant upside, AZZ’s price-to-earnings ratio sits at just 9.4x, well below both its industry average of 21.9x and a peer average of 29.4x. Interestingly, this is also beneath the market’s fair ratio estimate of 11.2x. This steep discount might signal opportunity or simply reflect skepticism about future profit trends. How should investors weigh this apparent value gap?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AZZ for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AZZ Narrative

If our perspectives spark debate or you prefer to chart your own course, dig into the numbers and craft your personal view in minutes: Do it your way

A great starting point for your AZZ research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when so many unique investment stories exist beyond AZZ. Use these popular hand-picked screens to uncover your next winning stock:

- Unlock the potential of companies positioned for the AI revolution by starting with these 24 AI penny stocks. These are set to shape tomorrow's technology landscape.

- Capture steady passive income and robust yields by checking out these 19 dividend stocks with yields > 3%, which consistently reward their shareholders.

- Capitalize on rapid innovation in healthcare by acting on these 33 healthcare AI stocks that use artificial intelligence to drive medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZZ

AZZ

Provides hot-dip galvanizing and coil coating solutions in North America.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives