- United States

- /

- Building

- /

- NYSE:AZZ

AZZ (AZZ): Assessing Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

AZZ (AZZ) shares have edged lower recently, catching the interest of investors tracking its month and past 3 months’ performance. With returns slipping 14% over the past month, some are reassessing the stock's near-term outlook.

See our latest analysis for AZZ.

While AZZ’s share price has lost ground over the past month, it is worth noting that its overall momentum remains upbeat, with a robust 1-year total shareholder return of nearly 26% and an even more impressive three- and five-year total return performance. It appears that recent pullbacks are just a breather for the longer uptrend.

If the changing pace at AZZ has you rethinking your watchlist, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

This raises a key question for investors: Is AZZ currently trading at a discount that signals an attractive entry point, or has the market already factored in future growth expectations, leaving little room for upside?

Most Popular Narrative: 22.4% Undervalued

AZZ's most widely-followed narrative places its fair value at $125.89, a significant premium to the latest close of $97.75. This prompts questions about what could drive further upside from here.

AZZ's new greenfield facility near St. Louis, Missouri is ramping up production, which could drive future revenue growth as it expands capacity and taps into strong local demand. This investment is expected to positively impact earnings as the facility becomes fully operational and contributes to higher sales volumes.

Curious how this growth story justifies such a rich valuation? The secret to this price target lies in aggressive expansion bets, future profitability assumptions, and an industry multiple that breaks with the norm. Ready to see what bold forecasts make this stock leap above the current market price?

Result: Fair Value of $125.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain, including potential setbacks at new facilities and ongoing tariff uncertainties. Both of these factors could pressure AZZ’s margins and future outlook.

Find out about the key risks to this AZZ narrative.

Another View: What Does the SWS DCF Model Say?

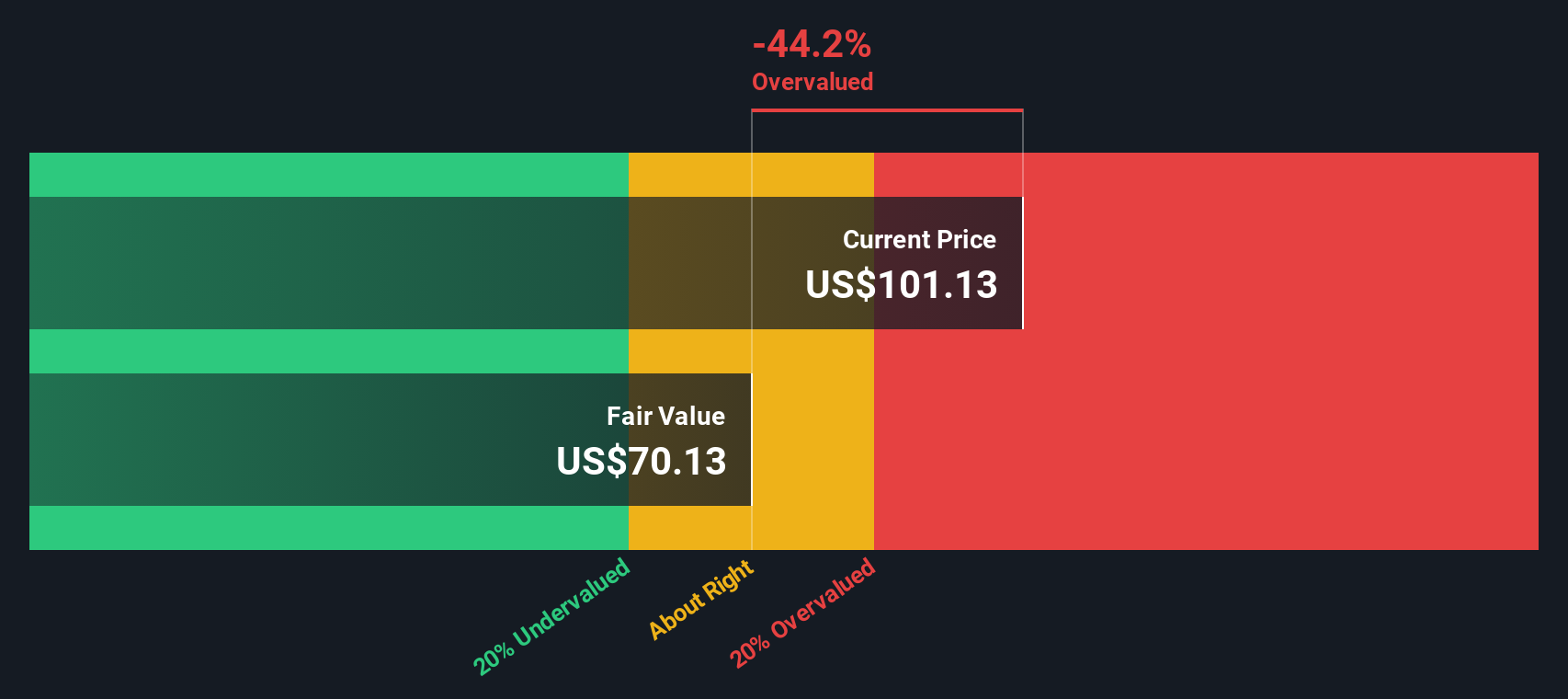

While analyst consensus paints AZZ as undervalued, our DCF model tells a different story. It suggests AZZ is actually trading above its fair value estimate of $70.50. Could this mean the market's optimism is overdone, or is the crowd onto something the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AZZ for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AZZ Narrative

If you're the type who trusts your own instincts over consensus opinions, you can dig into the numbers and craft your own take on AZZ in just a few minutes. Do it your way

A great starting point for your AZZ research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to one opportunity. It's time to take action and scout new stocks that could match your goals before the next big theme breaks out.

- Access the potential of promising up-and-comers with these 3596 penny stocks with strong financials that have solid financials and room for explosive growth.

- Power up your portfolio by targeting strong income opportunities with these 18 dividend stocks with yields > 3% offering yields above 3%.

- Seize a front-row seat to technological innovation with these 24 AI penny stocks, where artificial intelligence is transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZZ

AZZ

Provides hot-dip galvanizing and coil coating solutions in North America.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives