- United States

- /

- Electrical

- /

- NYSE:AYI

Acuity Brands (AYI): Assessing Valuation After Strong Earnings and Intelligent Spaces Growth

Reviewed by Kshitija Bhandaru

Acuity (NYSE:AYI) grabbed market attention after posting strong fourth-quarter results. Net sales jumped 17% year over year, supported by rapid growth in the company’s Intelligent Spaces segment and recent acquisitions.

See our latest analysis for Acuity.

Acuity’s strong quarter was closely watched by investors, and the stock initially dipped after the results before finding its footing. With a 1-year total shareholder return of nearly 20%, momentum is still building, supported by ongoing innovation and recently affirmed dividends.

If the buzz around Acuity’s transformation piqued your interest, this could be an ideal moment to see what other companies are thriving. Discover fast growing stocks with high insider ownership

But with these robust financials and a strong year behind it, the key question remains: is Acuity’s current share price an opportunity for value, or are investors already pricing in all that future growth?

Most Popular Narrative: 4.5% Overvalued

Acuity last closed at $356.14, just above the narrative’s fair value estimate of $340.88. This sets up a debate over whether modest upside is justified by future performance or current momentum.

Acuity's investment in its electronics portfolio, including market-leading lighting controls technology and proprietary drivers, positions it to improve product vitality and enhance productivity. This could potentially drive revenue growth and improve net margins. The recent acquisition of QSC, which enhances Acuity's capabilities in built space management and cloud connectivity, is expected to contribute to future sales growth and margin expansion in the Acuity Intelligence Spaces segment.

Want the inside story behind this seemingly precise target? What if the secret is in bold acquisition bets and expectations for margin transformation? Ready to see which market moves could make or break this call? Find out what drives this fair value narrative and decide if you agree with the consensus.

Result: Fair Value of $340.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariffs and ongoing market uncertainty could strain Acuity’s margins and dampen revenue growth. These factors may challenge the optimistic outlook for the company’s future performance.

Find out about the key risks to this Acuity narrative.

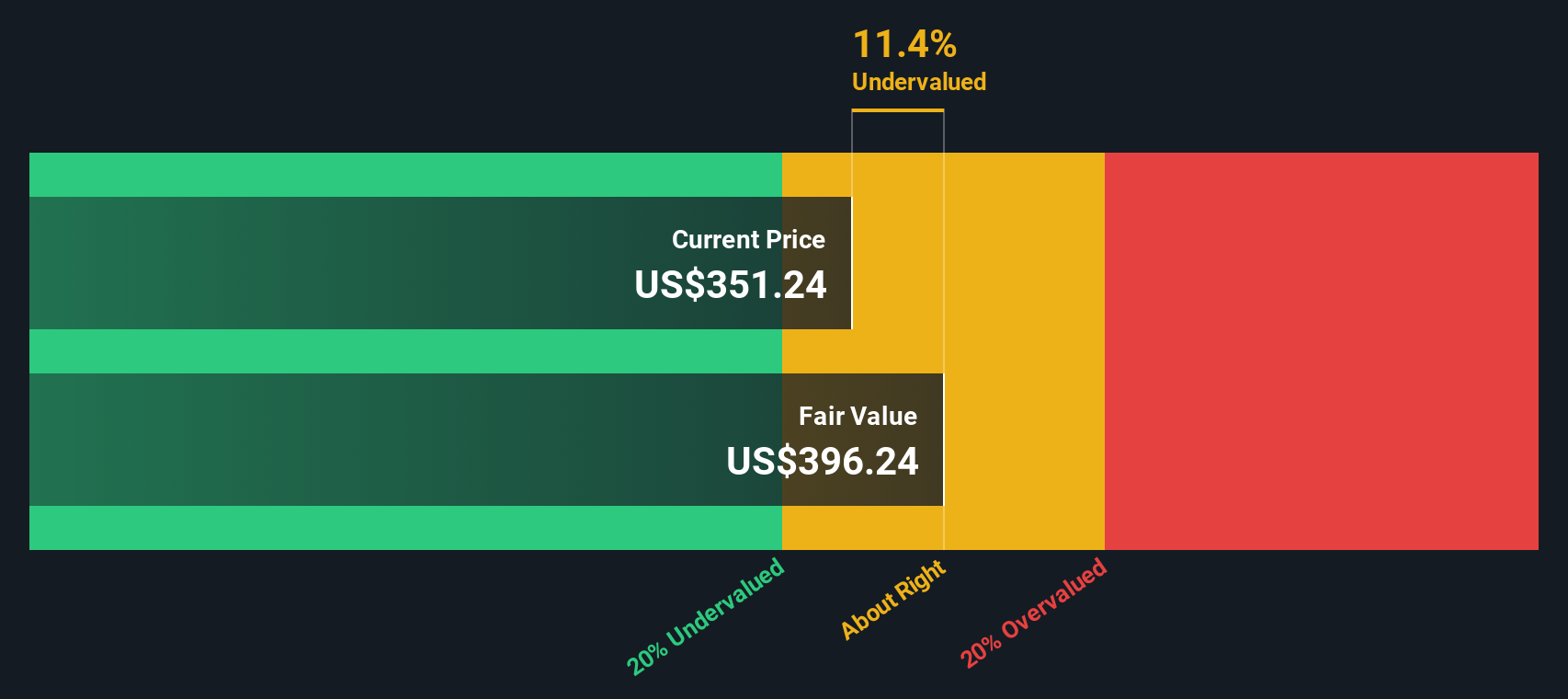

Another View: Discounted Cash Flow Model Suggests Undervaluation

While the analyst consensus points to Acuity being slightly overvalued, our DCF model arrives at a different conclusion. According to the SWS DCF model, Acuity shares are trading around 10% below their estimated fair value. Could this signal overlooked upside, or are analysts right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acuity Narrative

If you have your own perspective or want to dig into the details, you can craft a personal take in just a couple of minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Acuity.

Looking for More Smart Investing Ideas?

You could be missing exceptional opportunities if you stick with just one stock. Use the Simply Wall Street Screener to spot high-potential companies that align with your goals and take your next step as an investor with confidence.

- Boost your search for tomorrow’s tech leaders by targeting innovation, with these 23 AI penny stocks shaping industries across artificial intelligence and automation.

- Capture income potential by scouting these 19 dividend stocks with yields > 3% and benefit from solid dividend yields that reward shareholders year after year.

- Tap into fresh market breakthroughs by evaluating these 26 quantum computing stocks, paving new possibilities in quantum computing at the edge of transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AYI

Acuity

Provides lighting, lighting controls, building management system, location-aware applications in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives