- United States

- /

- Electrical

- /

- NYSE:AYI

Acuity Brands (AYI): Assessing Valuation After News of Smart Lighting and Building Management Leadership

Reviewed by Simply Wall St

Acuity (AYI) has been drawing renewed attention after news highlighted its leadership in smart lighting and building management systems. The company’s strong gross margins and impressive returns on capital are fueling fresh investor curiosity.

See our latest analysis for Acuity.

While Acuity has made headlines for its moves in smart lighting and building automation, what is really fueling excitement is the momentum in its numbers. The stock is up 20.2% on a 90-day share price return and has delivered a remarkable 20.8% total shareholder return over the past year, building on even stronger multi-year gains. So, whether you see recent dips as short-term noise or long-term opportunity, performance trends so far have been hard to ignore.

If Acuity’s recent strength piques your interest, now is a great moment to find other fast-moving opportunities using our fast growing stocks with high insider ownership.

Yet with the stock’s robust run and impressive track record, investors are left to wonder: is Acuity still trading at an attractive value, or has the market already priced in all of its future growth potential?

Most Popular Narrative: 10.5% Undervalued

With Acuity closing at $357.30, the most followed narrative suggests its fair value sits higher, hinting at meaningful upside based on future earnings and margins. The story behind this valuation centers on major product investments and strategic expansions.

Acuity's investment in its electronics portfolio, including market-leading lighting controls technology and proprietary drivers, positions it to improve product vitality and enhance productivity. This could potentially drive revenue growth and improve net margins. The recent acquisition of QSC, which enhances Acuity's capabilities in built space management and cloud connectivity, is expected to contribute to future sales growth and margin expansion in the Acuity Intelligence Spaces segment.

Want to see what powers this bold price target? Key future projections for sales, profits, and margin upgrades shape this valuation, painting a much bigger picture than recent headlines. Crack open the full narrative to discover the figures that really sway the fair value math.

Result: Fair Value of $399.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and uncertain demand trends could quickly dampen the optimism. This underscores that recent gains are not guaranteed to continue.

Find out about the key risks to this Acuity narrative.

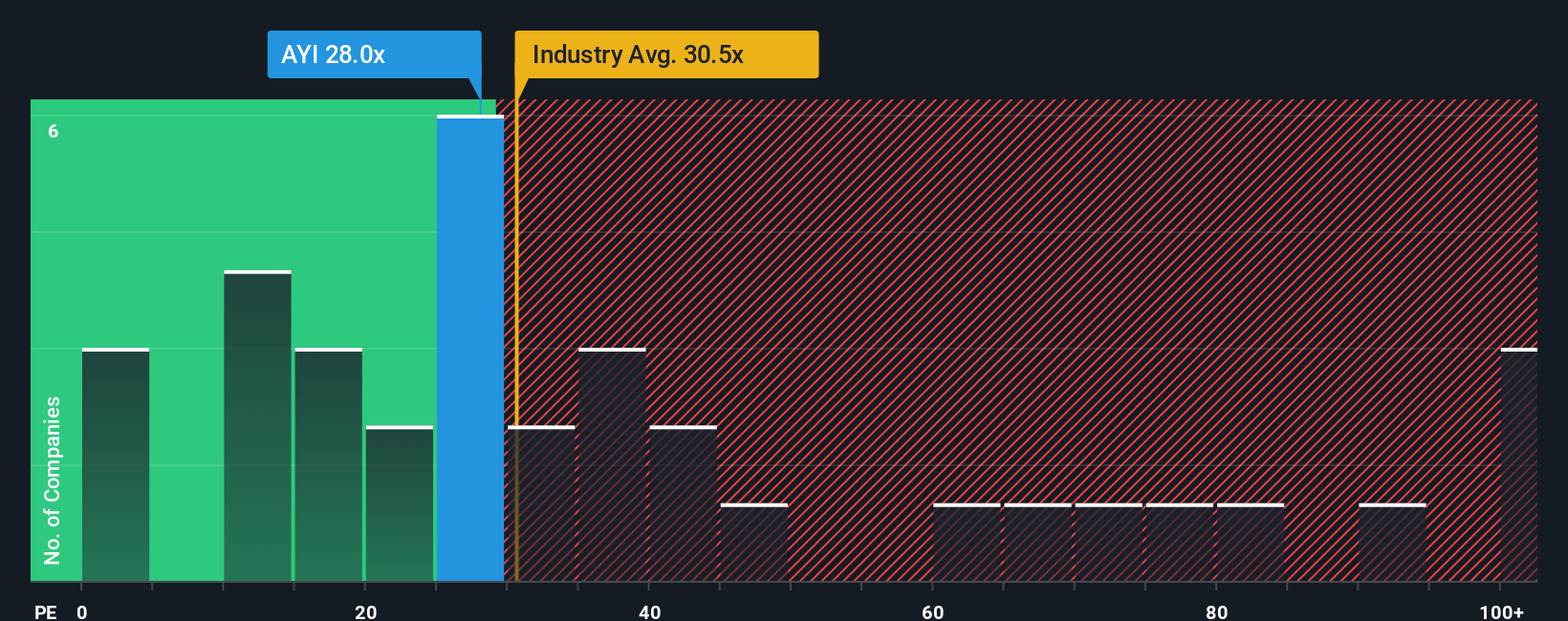

Another View: Valuation Through the Price-to-Earnings Lens

Looking at Acuity’s valuation through its price-to-earnings ratio offers a different perspective. The company trades at 27.3x earnings, which is lower than the US Electrical industry average of 30.8x and the peer average of 38x. However, it is higher than the fair ratio of 24.7x that the market could revert to. This creates a situation where the stock appears reasonably valued among its peers but carries the risk of a pullback if the valuation shifts toward the fair ratio. Could relative value still present an opportunity, or is there more risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acuity Narrative

If you see things differently or want to dive into the latest numbers yourself, you can put together your own narrative with just a few clicks. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Acuity.

Looking for More Investment Ideas?

Don't wait to spot the next big winner. Use the Simply Wall Street Screener for powerful, ready-made stock ideas that can sharpen your portfolio and give you an edge.

- Supercharge your passive income by evaluating high-yield opportunities with these 17 dividend stocks with yields > 3% offering yields above 3%.

- Seize the potential in the healthcare revolution and see which innovators are gaining momentum through these 33 healthcare AI stocks.

- Ride the digital transformation wave by tracking emerging trends with these 80 cryptocurrency and blockchain stocks shaking up global finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AYI

Acuity

Provides lighting, lighting controls, building management system, location-aware applications in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives