- United States

- /

- Electrical

- /

- NYSE:AYI

Acuity Brands, Inc.'s (NYSE:AYI) Business Is Yet to Catch Up With Its Share Price

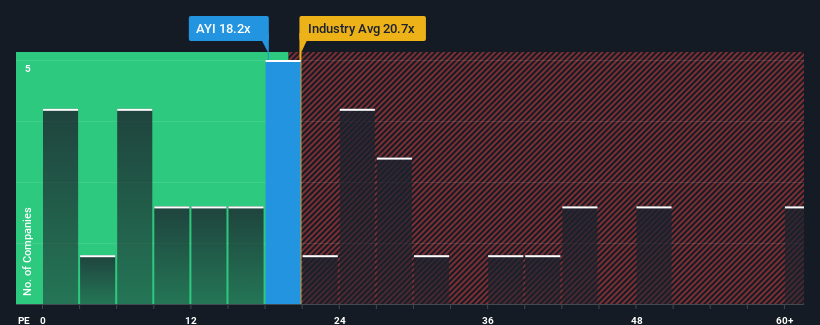

It's not a stretch to say that Acuity Brands, Inc.'s (NYSE:AYI) price-to-earnings (or "P/E") ratio of 18.2x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Acuity Brands has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Acuity Brands

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Acuity Brands' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.2%. Still, the latest three year period has seen an excellent 80% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.0% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10%, which is noticeably more attractive.

In light of this, it's curious that Acuity Brands' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Acuity Brands' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Acuity Brands currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Acuity Brands with six simple checks.

If you're unsure about the strength of Acuity Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AYI

Acuity

Provides lighting, lighting controls, building management system, location-aware applications in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives