- United States

- /

- Building

- /

- NYSE:AWI

Should Armstrong’s Seventh Consecutive Dividend Increase Shape How Investors View AWI’s Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Armstrong World Industries announced that its Board of Directors approved a 10% increase in the company’s quarterly cash dividend to $0.339 per share, payable November 20, 2025, to shareholders of record as of November 6.

- This marks the company’s seventh consecutive annual dividend increase since introducing its dividend program in 2018, highlighting continuing confidence in Armstrong’s growth strategy and cash flow generation.

- We’ll examine how Armstrong’s steady pattern of dividend growth could influence its investment narrative and future outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Armstrong World Industries Investment Narrative Recap

To own Armstrong World Industries shares, you need to believe in ongoing demand for ceiling and wall products, with a focus on resilient commercial construction markets and effective innovation. The latest 10% dividend hike signals management’s confidence but is unlikely to shift the most important near-term catalyst, penetration and adoption of high-efficiency solutions like TEMPLOK. The biggest risk remains prolonged softness in core commercial construction, especially in discretionary projects; on balance, the dividend move doesn’t materially affect this exposure.

Of the recent announcements, Armstrong’s quarterly earnings update scheduled for October 28, 2025, stands out. As investors watch for evidence of continued sales and margin growth, this event is highly relevant given the company’s emphasis on innovation-driven revenue and margin catalysts in the Architectural Specialties segment.

However, investors should not overlook that persistent weakness in project bidding activity could still impact...

Read the full narrative on Armstrong World Industries (it's free!)

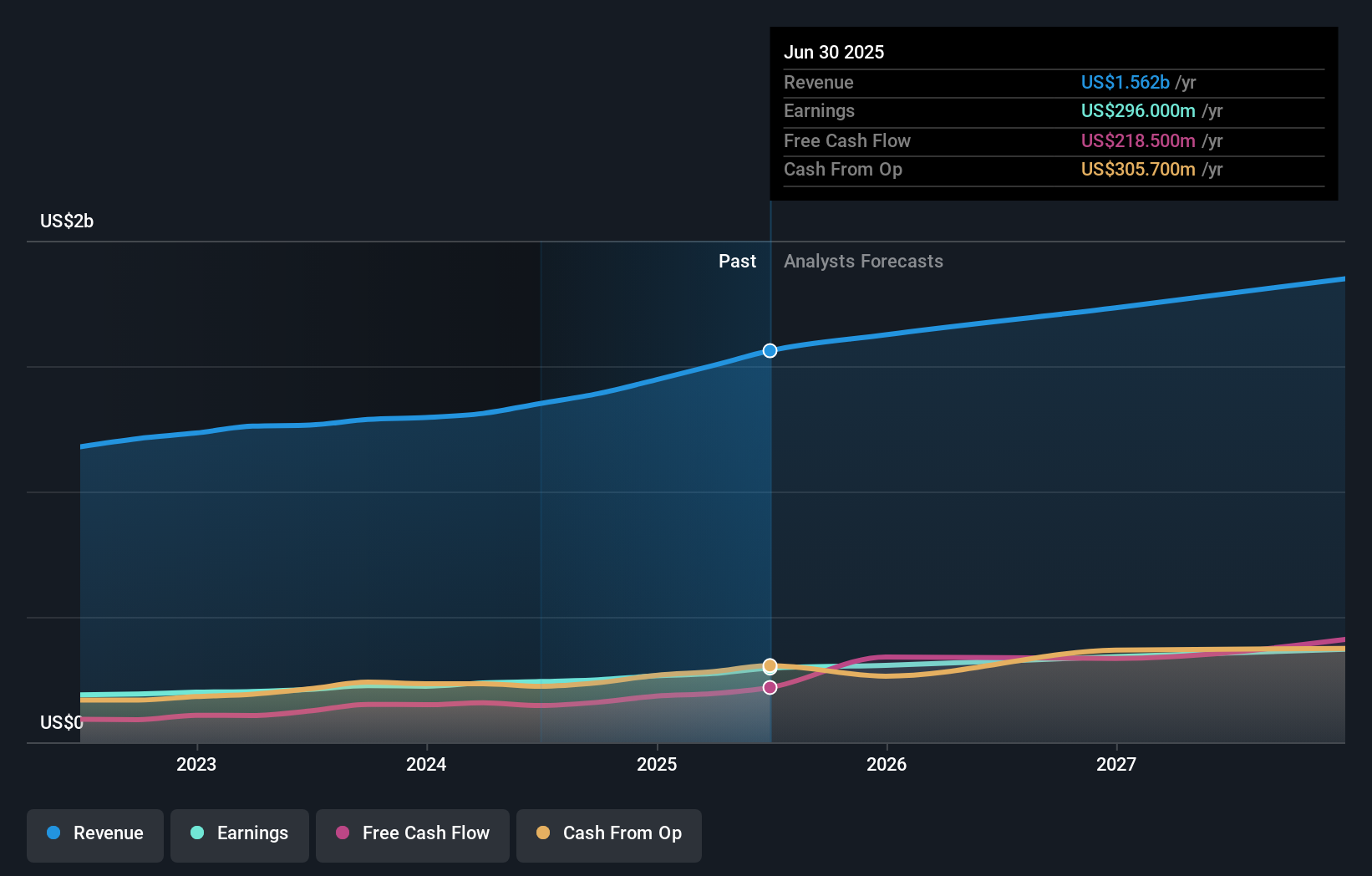

Armstrong World Industries' narrative projects $1.9 billion in revenue and $389.4 million in earnings by 2028. This requires 6.9% yearly revenue growth and an increase of $93.4 million in earnings from the current $296.0 million.

Uncover how Armstrong World Industries' forecasts yield a $199.56 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Armstrong, ranging from US$158.35 to US$199.56 per share. With opinions varying this widely amid uncertain commercial construction volumes, it’s important to compare several viewpoints before making decisions about the company’s future.

Explore 3 other fair value estimates on Armstrong World Industries - why the stock might be worth 21% less than the current price!

Build Your Own Armstrong World Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Armstrong World Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Armstrong World Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Armstrong World Industries' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives