- United States

- /

- Building

- /

- NYSE:AWI

Armstrong World Industries (AWI): Unpacking the Valuation After Strong Year-to-Date Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Armstrong World Industries.

Armstrong World Industries has been on a clear upswing, with a 1-day share price gain of 1% and a stellar year-to-date share price return of nearly 44%. This strength has also benefited longer-term investors, with the company delivering an impressive 47% total shareholder return over the past year, along with even higher gains for those holding over three or five years. Recent momentum suggests renewed confidence in its growth story as investors respond to ongoing operational improvements as well as the broader market's appetite for quality industrials.

If Armstrong’s run has you thinking bigger, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares hitting new highs and recent gains closely tracking improved financials, investors are left to ponder if Armstrong World Industries remains undervalued or if the company’s strong prospects are already fully reflected in the stock price.

Most Popular Narrative: Fairly Valued

Armstrong World Industries closed at $201.22, almost matching the narrative fair value of $199.56. The result? An unusually narrow gap between price and projection, which hints at rare consensus in the market’s expectations. What really powers this close alignment?

Ongoing strategic acquisitions (e.g., 3form, Zahner) and successful integration are broadening Armstrong's addressable market to capture additional spaces within commercial buildings and accelerate cross-selling opportunities. This supports both revenue growth and improved net margins through scale and operational synergies.

Curious how bold bets on acquisitions and digital integration could reshape this company’s growth path? The secret drivers behind this valuation include sharply higher earnings estimates and a future profit multiple few would expect from an industrial stock. What’s really baked into these assumptions? Dive in to find out what makes this fair value tick.

Result: Fair Value of $199.56 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as prolonged weakness in commercial construction or margin pressures from rising costs. These factors could challenge Armstrong's current growth outlook.

Find out about the key risks to this Armstrong World Industries narrative.

Another View: Peer and Industry Ratios Paint A Different Picture

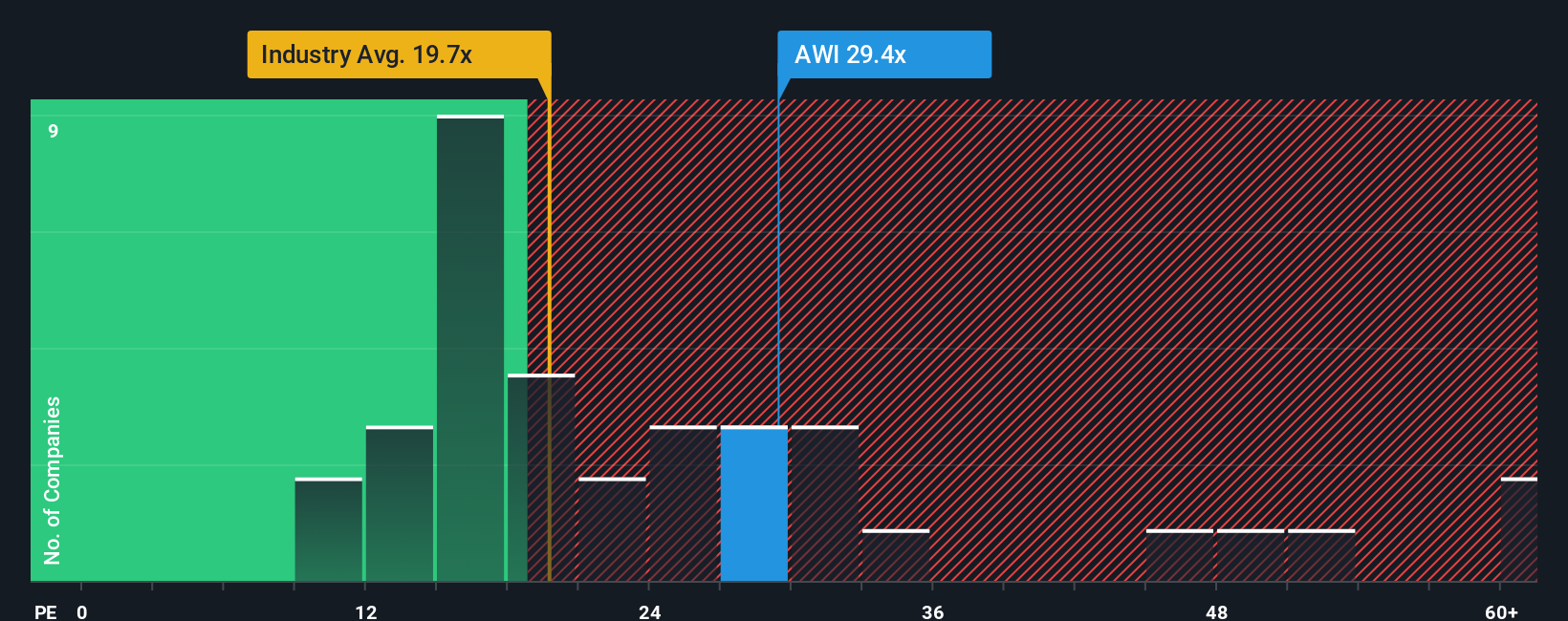

Looking at Armstrong World Industries through the lens of typical price-to-earnings ratios, things look less balanced. With shares trading at 29.4 times earnings, that is below the peer average of 37.6x, but well above both the US Building industry’s average of 20.5x and the fair ratio of 21.7x. This sizeable gap can signal optimism or extra risk if growth falters, so is the market too enthusiastic, or does Armstrong still have more upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Armstrong World Industries Narrative

If you see things differently or want to dig into the numbers your way, you can craft your own narrative in under three minutes. Do it your way

A great starting point for your Armstrong World Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead in today’s market. Use these powerful screeners to spot high-potential trends and hidden opportunities before others:

- Jump on the momentum of tech innovation with these 24 AI penny stocks, which are set to redefine industries and inspire the next investing wave.

- Target standout value by analyzing these 874 undervalued stocks based on cash flows, where quality businesses may be overlooked and priced below their true worth.

- Unlock stable, income-generating picks with these 17 dividend stocks with yields > 3%, earning yields over 3% and building compounding growth into your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWI

Armstrong World Industries

Engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives