- United States

- /

- Electrical

- /

- NYSE:ATKR

Is Atkore (ATKR) Sharpening Its Focus to Unlock Greater Value for Shareholders?

Reviewed by Sasha Jovanovic

- Earlier this month, Atkore Inc. announced it has begun an asset review that could lead to the sale of its high density polyethylene pipe and conduit business serving the telecommunications sector, with no set timetable for completion and no assurance of any specific outcome.

- This move highlights Atkore's intent to sharpen its portfolio focus around core electrical infrastructure markets as it evaluates ways to increase shareholder value following the retirement of its president and CEO.

- We'll now examine how a possible divestiture of the telecommunications pipe business may impact Atkore's long-term growth and margin outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Atkore Investment Narrative Recap

If you're considering Atkore as an investment, the core thesis rests on its ability to sharpen its portfolio around electrical infrastructure markets and execute operational improvements, while managing significant pricing and input cost pressures. The newly announced review of its telecommunications pipe business does not materially change the immediate catalyst, ongoing US tariff protection and industrial spending, but it does highlight the main risk: margin compression from volatile pricing, especially for core steel and PVC products, remains front and center. A relevant development stemming from this shift in focus is Atkore's recent refinancing of its senior secured term loan, which extends debt maturities and supports financial flexibility as it potentially reshapes its business mix. This move underscores the company’s intent to maintain stability even as end markets face swings in demand and costs. Still, despite management's portfolio realignment, investors should keep in mind that margin pressure isn't just a minor headwind...

Read the full narrative on Atkore (it's free!)

Atkore's narrative projects $2.9 billion revenue and $217.1 million earnings by 2028. This requires a 0.5% annual revenue decline and an increase in earnings of $105.7 million from $111.4 million currently.

Uncover how Atkore's forecasts yield a $63.60 fair value, in line with its current price.

Exploring Other Perspectives

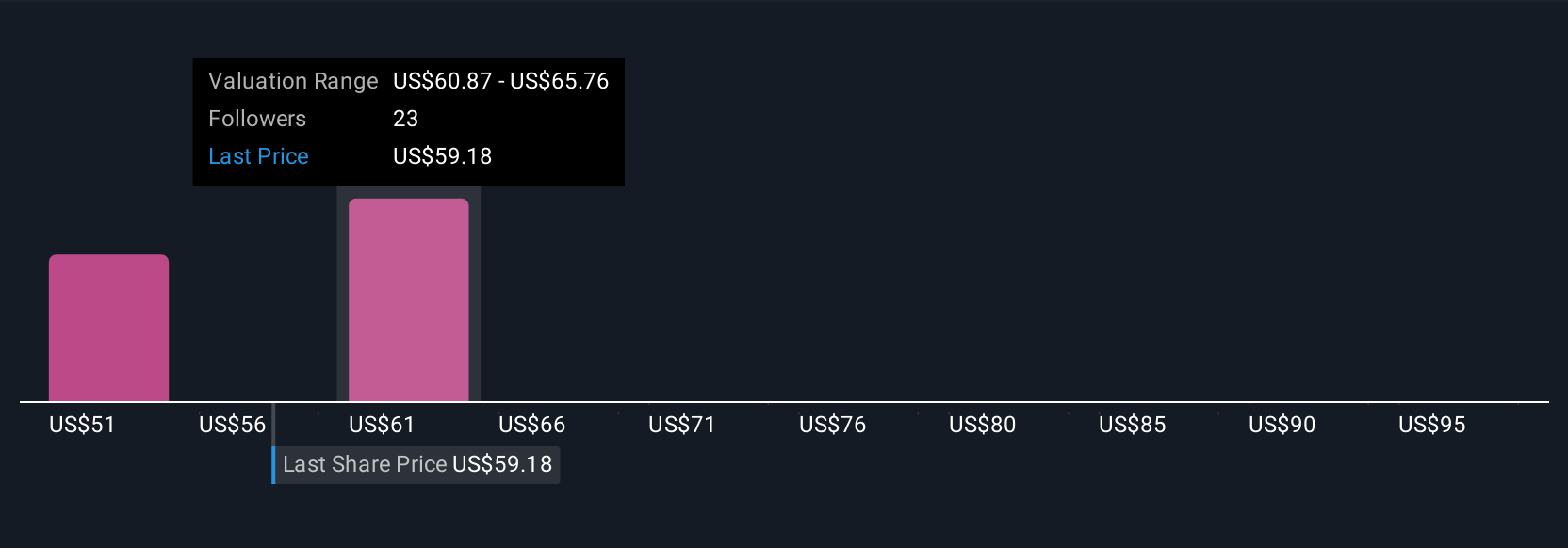

Five Simply Wall St Community estimates show fair values for Atkore ranging from US$49.37 to US$100 per share. With ongoing uncertainty around selling prices for key conduit products, you’ll find several sharply contrasting viewpoints on future margin resilience and business value among these contributors.

Explore 5 other fair value estimates on Atkore - why the stock might be worth 24% less than the current price!

Build Your Own Atkore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atkore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atkore's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives