- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore's (ATKR) Debt Refinancing Could Be a Game Changer for Its Growth Strategy

Reviewed by Sasha Jovanovic

- Atkore Inc. recently completed the refinancing of its senior secured term loan facility, securing a new US$373 million loan maturing as late as September 2032 at revised interest rates, with proceeds used to repay existing debt and cover related expenses.

- This refinancing extends Atkore’s debt maturities and may provide greater financial flexibility, aligning the company’s capital structure with its long-term growth initiatives.

- We’ll explore how Atkore’s successful debt refinancing could influence its investment narrative and support ongoing infrastructure market opportunities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Atkore Investment Narrative Recap

Atkore’s appeal for investors rests on the belief that U.S.-based manufacturing and infrastructure projects will drive steady demand for steel and PVC conduit, supported by ongoing tariff protections. The recent debt refinancing marks a positive administrative step, extending maturities and increasing flexibility, but the most pressing catalyst, higher market share from reduced imports, remains rooted in government policy. The biggest short-term risk continues to be unpredictable input costs, which the refinancing does not directly address.

Among recent announcements, the CEO’s retirement plan is particularly relevant, as leadership transitions can create uncertainty during periods of financial market and pricing volatility. While the debt refinancing shores up financial footing, execution risk tied to management changes may still affect the company's ability to respond swiftly to the ongoing catalyst of domestic infrastructure growth.

In contrast, investors should also be aware of the implications of a new CEO at a time when...

Read the full narrative on Atkore (it's free!)

Atkore's outlook anticipates $2.9 billion in revenue and $217.1 million in earnings by 2028. This scenario assumes a 0.5% annual revenue decline and an earnings increase of $105.7 million from the current $111.4 million.

Uncover how Atkore's forecasts yield a $63.60 fair value, in line with its current price.

Exploring Other Perspectives

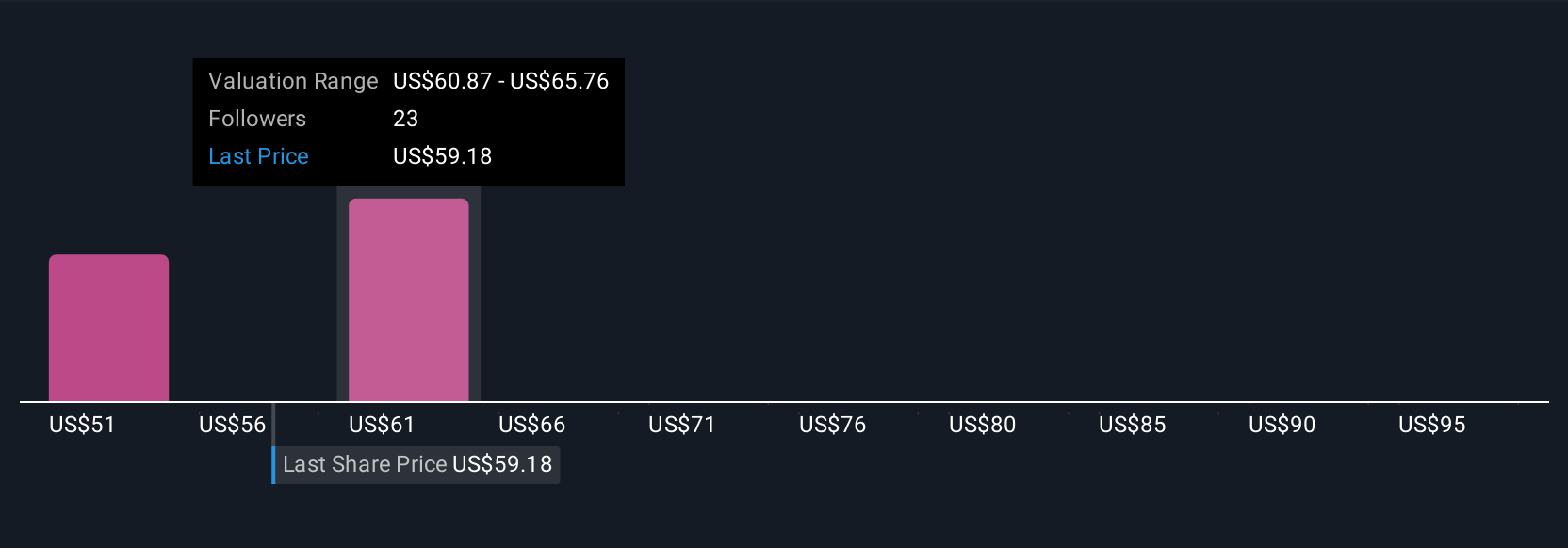

Five fair value estimates from the Simply Wall St Community span a wide US$49.87 to US$100 per share. While some see significant upside or caution, investors face persistent input cost risks impacting current results, explore a range of opinions to better inform your decisions.

Explore 5 other fair value estimates on Atkore - why the stock might be worth 21% less than the current price!

Build Your Own Atkore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atkore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atkore's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives