- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore (ATKR) Margin Pressure Deepens With Q4 EPS Loss, Challenging Bullish Turnaround Narratives

Reviewed by Simply Wall St

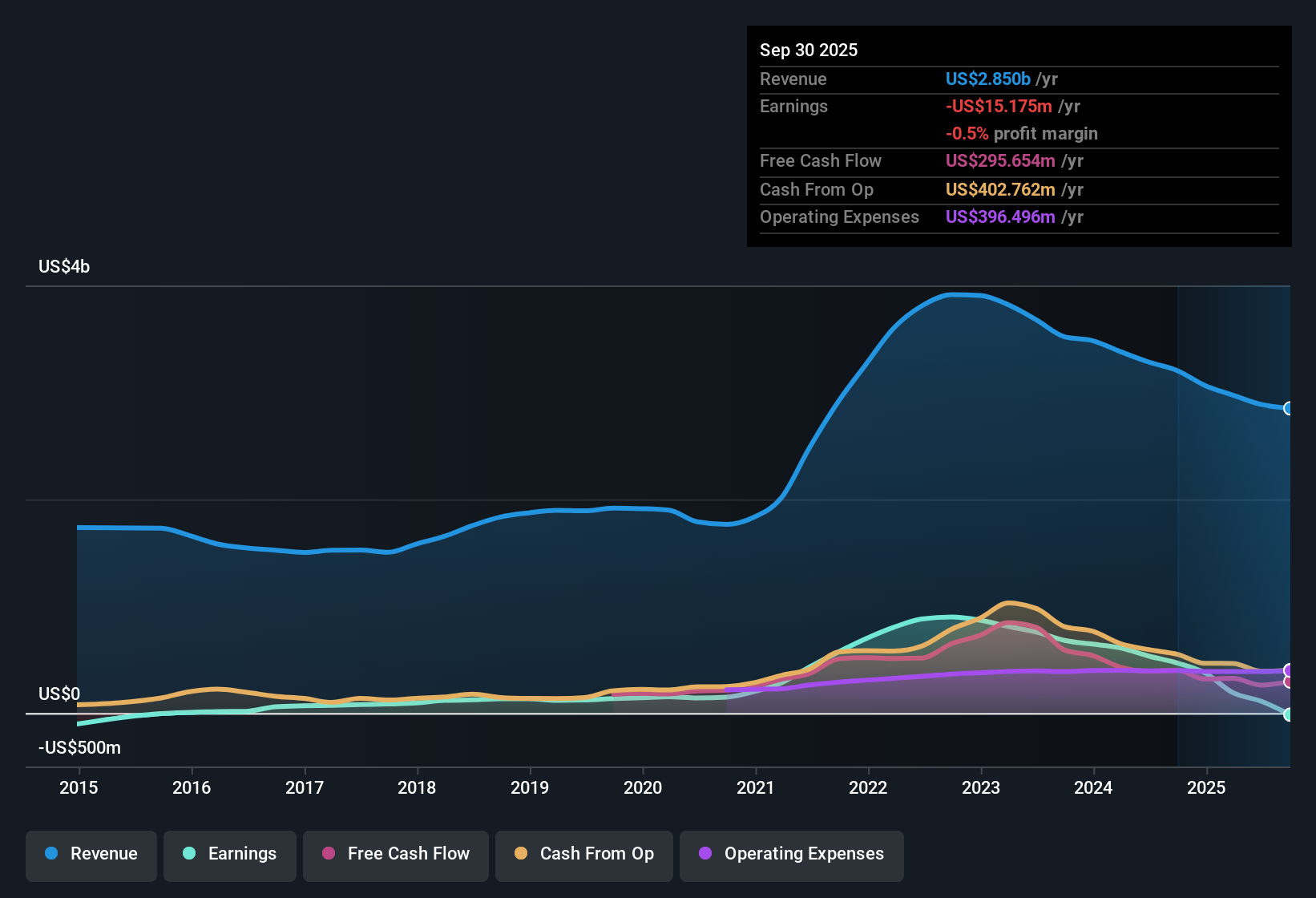

Atkore (ATKR) has released its latest financial results for FY 2025, reporting fourth quarter revenue of $752.0 million and a basic EPS of -$1.62. Looking back, the company has seen revenue move from $701.7 million in Q2 to $752.0 million in Q4, while EPS has fluctuated between -$1.47 and -$1.62 through the same period. Margins remain pressured, making profitability a key focus for investors digesting this release.

See our full analysis for Atkore.Next up, we will see how these results compare against the most talked-about narratives and where the numbers might challenge the prevailing sentiment.

See what the community is saying about Atkore

Profit Margins Remain Under Pressure

- Atkore's net income (excluding extraordinary items) dropped to -$54.3 million in Q4 2025, compared to -$50.1 million in Q2, reflecting continued losses despite rising revenues within the year.

- Consensus narrative highlights that, even as operational improvements and investment in innovation support future margin stability, declining prices for steel and PVC conduit products are creating ongoing headwinds for EBITDA and overall profitability.

- Significant year-over-year declines in average selling prices and volatile input costs are expected to create an approximately $50 million unmitigated headwind into FY '26.

- Bears emphasize that compressed margins make Atkore’s path to profitability and margin recovery a key risk, especially if market pricing power remains weak.

Valuation Attractive Versus Peers

- Atkore is currently trading at a price-to-sales ratio of 0.8x, which stands out as lower than both its direct peer group average of 4.3x and the industry norm of 1.9x.

- According to the consensus narrative, the favorable valuation multiples challenge the bearish view by suggesting the stock’s relative discount could attract investor interest, even as headline profitability lags.

- The current share price of $66.89 remains above the DCF fair value estimate of $27.68, indicating that deep value-oriented investors may remain skeptical until profitability improves meaningfully.

- Yet, consensus sees attractive price-to-sales metrics partially offsetting concerns about short-term losses and slow revenue growth.

Analysts See Rapid EPS Rebound

- Analyst forecasts call for annual earnings to grow at a striking 84.4% per year, with estimated annual profits reaching $217.1 million and an EPS of $7.15 by around September 2028.

- The consensus narrative notes this projected rebound heavily supports the bullish case for a turnaround, suggesting that if margin improvement and share buybacks can deliver as expected, the stock could close the gap with analyst price targets.

- Consensus expects profit margins to rise from 3.9% today to 7.4% within three years, even as revenue growth decelerates to just 4.1% annually.

- In order for analyst assumptions to play out, Atkore’s valuation would need to normalize to a forward PE of 11.7x, below industry averages, supporting a possible rerating if performance improves.

Despite operational pressure and slow revenue growth, analysts see potential for a swift turnaround if margin gains hold. Dive deeper into the consensus narrative for the full story. 📊 Read the full Atkore Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Atkore on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique take on the numbers? Sharpen your perspective now and create your own narrative in just a few minutes. Do it your way

A great starting point for your Atkore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Atkore’s earnings remain under pressure due to declining profit margins, volatile input costs, and continued losses, even though there have been recent gains in revenue.

If you’re seeking steadier results from businesses with greater predictability in their growth and margins, check out stable growth stocks screener (2075 results) that consistently outperform in tough markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.