- United States

- /

- Electrical

- /

- NYSE:ATKR

Atkore (ATKR) Is Up 8.7% After Announcing Strategic Review Committee and Board Expansion

Reviewed by Sasha Jovanovic

- On November 21, 2025, Atkore Inc. announced it had reached a cooperation agreement with Irenic Capital Management, resulting in board expansion, the appointment of Franklin S. Edmonds as director, and the formation of a Strategic Review Committee exploring alternatives such as a sale or merger.

- This agreement highlights growing activist investor influence at Atkore and signals the company may pursue transformative actions to unlock shareholder value.

- We’ll consider how this newly-formed Strategic Review Committee, charged with evaluating potential company transactions, reshapes Atkore’s investment outlook and business trajectory.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Atkore Investment Narrative Recap

For investors to remain optimistic about Atkore, they need confidence in the company’s long-term ability to benefit from infrastructure spending, tariff protection, and a rebound in key construction markets, while actively managing supply chain challenges and volatile input costs. The recent cooperation agreement with Irenic Capital and the formation of a Strategic Review Committee introduces a possible catalyst, but for now, any immediate impact on the key short-term risks around margin compression from price declines and input cost volatility appears limited.

Among the latest announcements, Atkore’s fiscal 2026 net sales guidance of US$3.0 to US$3.1 billion is especially relevant as the Strategic Review Committee evaluates strategic alternatives. This outlook gives investors a near-term benchmark to measure if any future actions, such as a sale or merger, coincide with improving revenue stability or help address ongoing earnings volatility.

In contrast, one risk that investors should be especially mindful of lies in the company’s exposure to unpredictable swings in PVC and steel conduit selling prices, which…

Read the full narrative on Atkore (it's free!)

Atkore's outlook anticipates $2.9 billion in revenue and $217.1 million in earnings by 2028. This scenario assumes a 0.5% annual revenue decline and nearly doubles earnings from $111.4 million today, representing an increase of about $105.7 million.

Uncover how Atkore's forecasts yield a $63.60 fair value, a 5% downside to its current price.

Exploring Other Perspectives

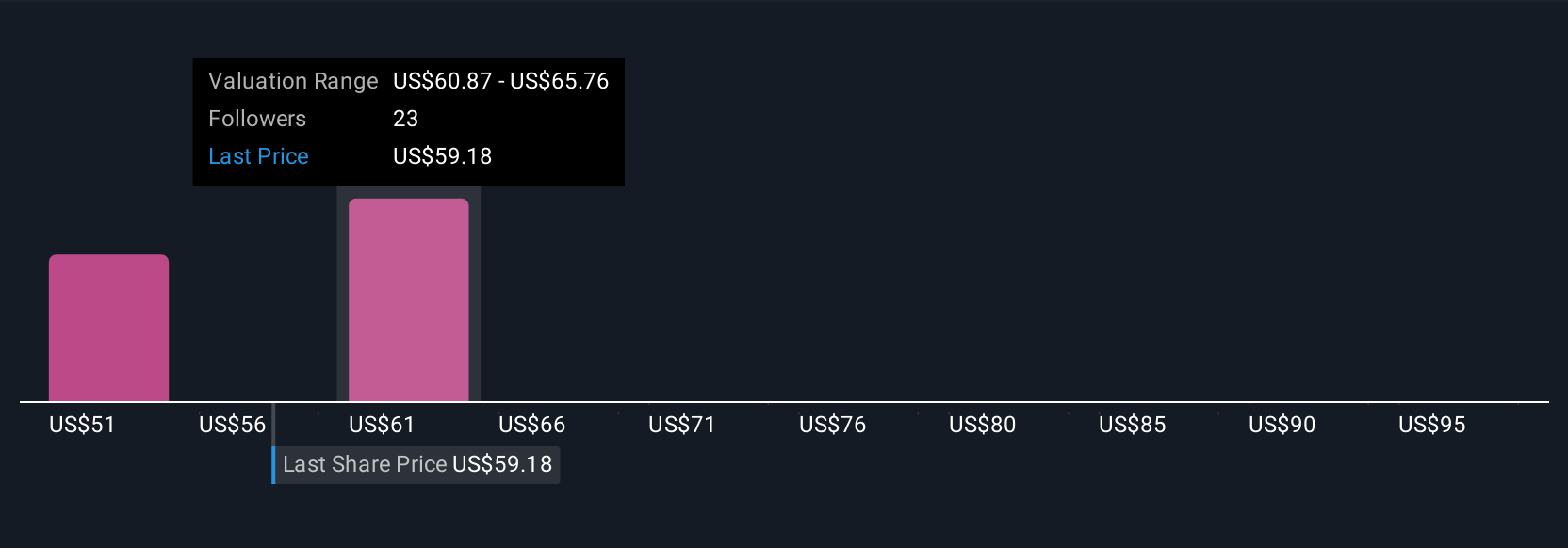

Simply Wall St Community members estimate Atkore’s fair value in a wide US$27.61 to US$74.36 range across three independent forecasts. With price declines in core conduit products threatening margins into 2026, you’ll find plenty of different perspectives on where the company might head next.

Explore 3 other fair value estimates on Atkore - why the stock might be worth less than half the current price!

Build Your Own Atkore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atkore research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atkore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atkore's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.