- United States

- /

- Electrical

- /

- NYSE:ATKR

A Fresh Look at Atkore (ATKR) Valuation Following Recent Share Movement

Reviewed by Kshitija Bhandaru

Atkore (ATKR) may not be making waves with a major announcement today, but recent market performance has caught the eye of investors. Shares have been moving as traders reevaluate the stock in light of a mix of short-term gains and longer-term declines.

See our latest analysis for Atkore.

Atkore’s share price has seen a swift 8% rise over the past month even as momentum has faded year to date, with the 12-month total shareholder return still down around 24%. The mixed results reflect traders weighing near-term optimism against a longer-term reset in growth expectations and risk.

If you are looking to spot market opportunities beyond just one industry, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near analyst targets and long-term returns still deeply negative, the question remains: does Atkore have room to rebound, or is the market already accounting for all foreseeable growth ahead?

Most Popular Narrative: 2.5% Overvalued

With Atkore closing at $65.20 while the widely followed fair value stands at $63.60, the stock is trading just above narrative-based estimates. Investors are faced with a close call, as the market price and intrinsic valuation nearly align at current levels.

High tariffs on imported steel and PVC conduit are reducing foreign competition and leading to significantly lower import volumes. This positions Atkore to recapture market share in domestically sourced steel conduit over time, supporting increased revenue potential and sustained or improved net margins.

Curious how tariff changes could set off a chain reaction for Atkore’s revenue growth and profit trajectory? The narrative models out bold assumptions about future margins, product demand, and long-term earnings power. The real numbers that drive this premium are hidden until you dive in—find out the surprising levers behind analyst conviction.

Result: Fair Value of $63.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in average selling prices and unpredictable input costs could quickly erode Atkore’s margin gains and challenge the positive outlook.

Find out about the key risks to this Atkore narrative.

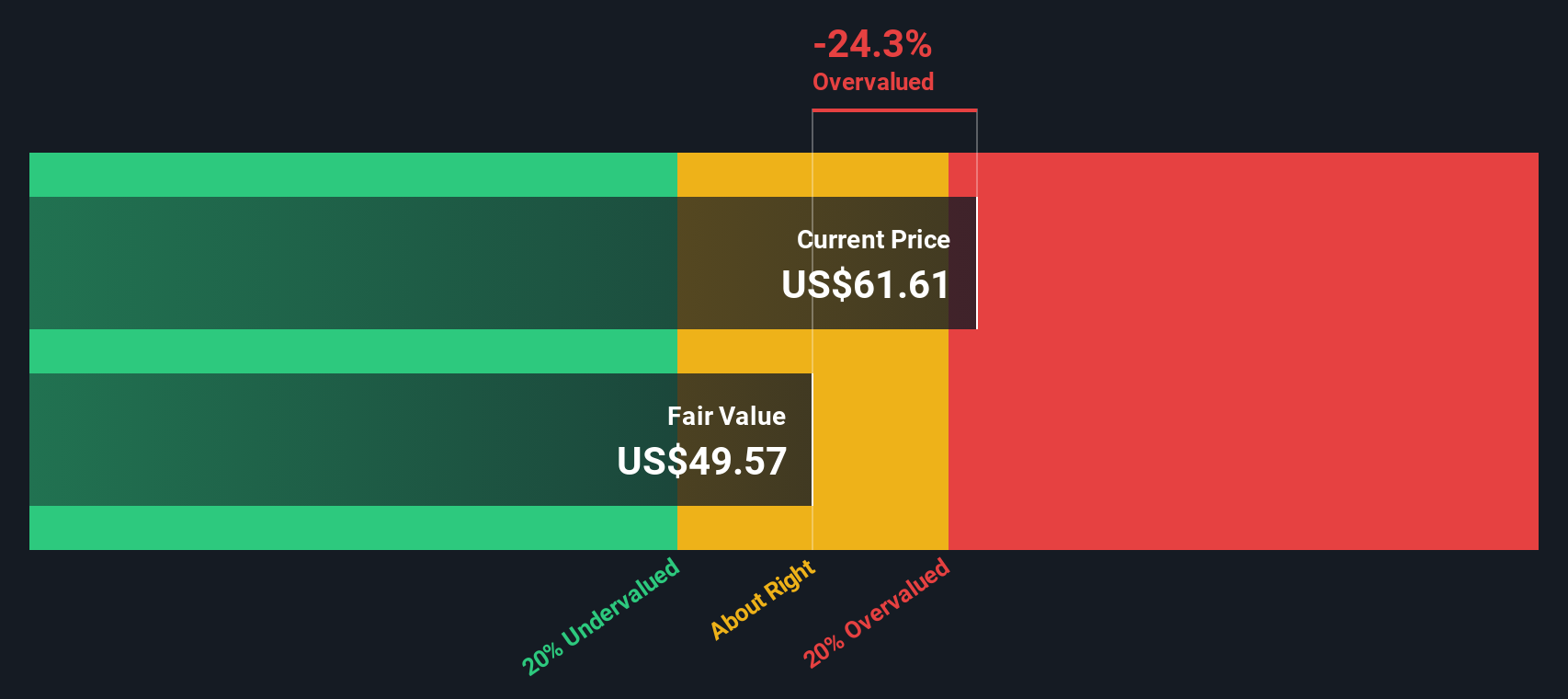

Another View: Our DCF Model Says Overvalued

Looking through the lens of our SWS DCF model, Atkore’s current price appears even less attractive. The DCF model places fair value at just $49.38, well below the market price of $65.20. This suggests potential downside if market sentiment shifts. Which narrative will the market trust next?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atkore Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own narrative and reach your own conclusions in just a few minutes with Do it your way.

A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize fresh opportunities in today’s market. If you want to stay ahead, you need to see the stocks changing the game right now. Don’t let them pass you by.

- Boost your returns with steady income; check out these 18 dividend stocks with yields > 3% that deliver reliable yields above 3%.

- Ride the growth wave by investigating these 24 AI penny stocks, which are leading innovations in artificial intelligence and automation.

- Tap into the future of finance with these 79 cryptocurrency and blockchain stocks, featuring companies revolutionizing payments and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATKR

Atkore

Engages in the manufacture and sale of electrical, mechanical, safety, and infrastructure products and solutions in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives