- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

Will ATI’s New CFO Shape a Different Balance Between Growth and Discipline for ATI (ATI)?

Reviewed by Sasha Jovanovic

- Earlier this month, ATI Inc. announced that longtime finance leader James Robert "Rob" Foster will become Senior Vice President, Finance and Chief Financial Officer on January 1, 2026, succeeding current CFO Don Newman, who will transition to a strategic advisory role before his planned retirement in March 2026.

- Foster’s blend of deep operational experience in specialty alloys and prior leadership of ATI’s global finance, capital deployment, and supply chain functions positions him to directly influence how the company balances growth investments with financial discipline.

- We’ll now examine how Foster’s combination of operational and finance experience may influence ATI’s investment narrative and forward-looking risk-reward profile.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

ATI Investment Narrative Recap

To own ATI, you generally need to believe in its role as a key supplier of advanced alloys to commercial aerospace, defense, and energy, while managing capital intensive growth and concentrated OEM exposure. The Rob Foster CFO appointment looks incremental rather than transformational in the short term, so it does not materially change the near term focus on executing long term aerospace contracts versus the ongoing risk of heavy capex and balance sheet pressure.

Among recent developments, ATI’s June 2025 refinancing that put a US$200,000,000 term loan and US$600,000,000 revolving facility in place stands out in light of Foster’s new role. His background overseeing capital projects and supply chain ties directly into how ATI uses this expanded liquidity to fund capacity investments and efficiency gains, which feeds back into both its growth catalysts in aerospace and the risk of elevated leverage if returns on these projects fall short.

But against that backdrop of strong aerospace demand, investors should still be alert to how ATI’s ongoing capital expenditure needs could...

Read the full narrative on ATI (it's free!)

ATI's narrative projects $5.5 billion revenue and $635.6 million earnings by 2028.

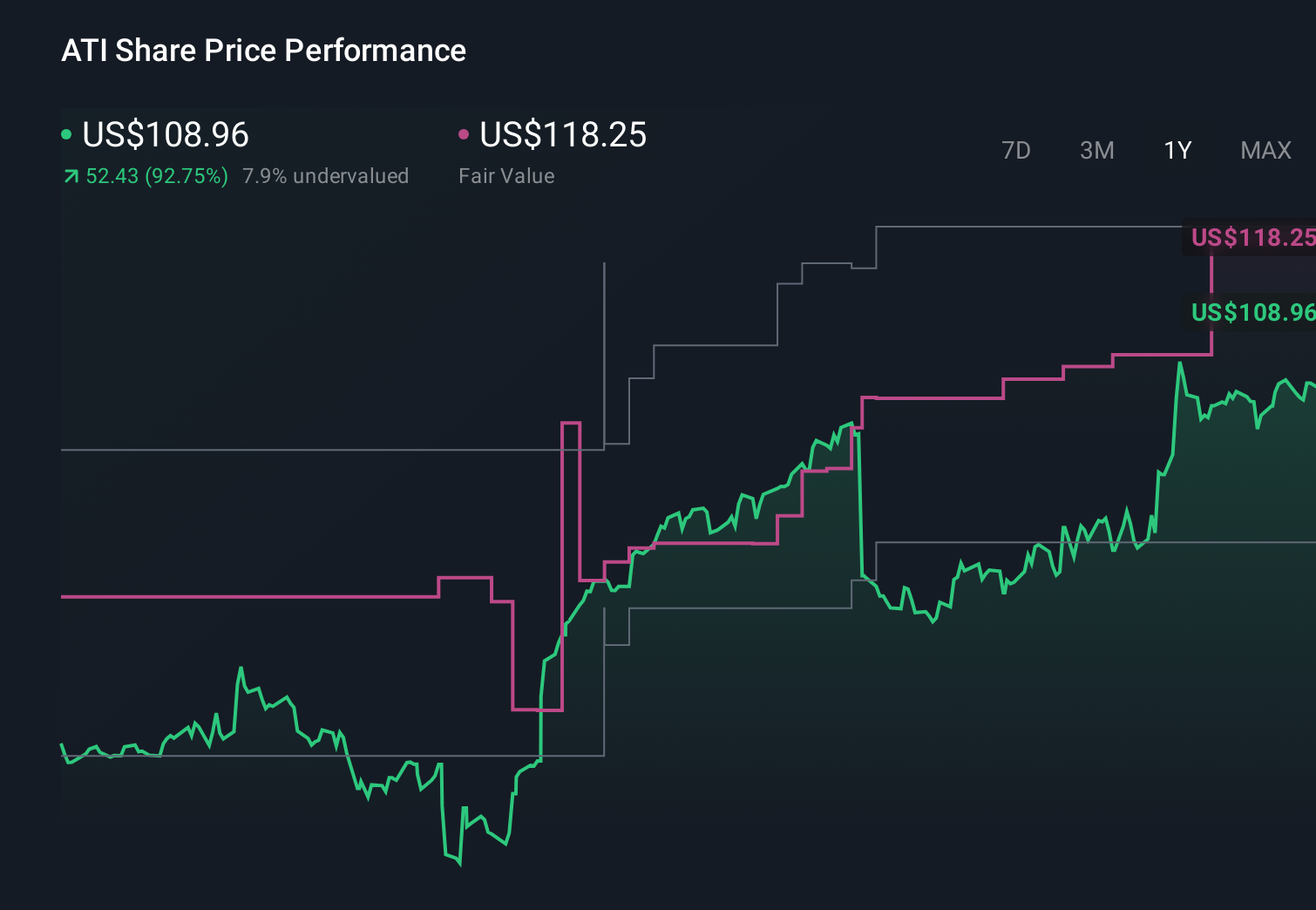

Uncover how ATI's forecasts yield a $118.25 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently value ATI between US$62.68 and US$118.25 per share, reflecting a wide spread of expectations. When you weigh those views against ATI’s dependence on large aerospace OEMs and capital heavy growth, it becomes clear why examining several alternative viewpoints on the company’s prospects is so important.

Explore 5 other fair value estimates on ATI - why the stock might be worth as much as $118.25!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion