- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

Could ATI's Margin Strength and Free Cash Flow Shape Its Future Capital Allocation Strategy? (ATI)

Reviewed by Sasha Jovanovic

- Earlier in November 2025, KeyBanc analyst Philip Gibbs upgraded ATI, highlighting the company's robust performance in core EBITDA margins and anticipated growth in aerospace and defense sales.

- An interesting dimension is ATI's specialized materials portfolio, which may benefit from increased nuclear sector demand, while its strong free cash flow outlook could support renewed share buybacks.

- We'll explore how the analyst's recognition of margin strength and free cash flow potential could influence ATI's investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

ATI Investment Narrative Recap

To be a shareholder in ATI, you need confidence in the company’s ability to maintain its industry-leading margins and execute on growth opportunities in aerospace, defense, and next-generation materials. The recent analyst upgrade draws attention to these strengths but does not materially alter the primary near-term catalyst: the ramp in aerospace and defense sales, or the ongoing risk from sluggish, price-competitive non-aerospace markets and customer concentration.

Among recent announcements, ATI’s ongoing share repurchase program stands out. The analyst’s positive view on ATI’s free cash flow outlook ties directly to this buyback activity, which, if sustained, could provide incremental support for per-share metrics and shareholder value as long as the company’s cash generation remains robust.

On the other hand, investors should be aware that despite current margin strength, risks tied to ATI’s dependence on a few major aerospace customers could...

Read the full narrative on ATI (it's free!)

ATI's outlook anticipates $5.5 billion in revenue and $635.6 million in earnings by 2028. This scenario requires 6.7% annual revenue growth and a $218.1 million increase in earnings from the current $417.5 million.

Uncover how ATI's forecasts yield a $118.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

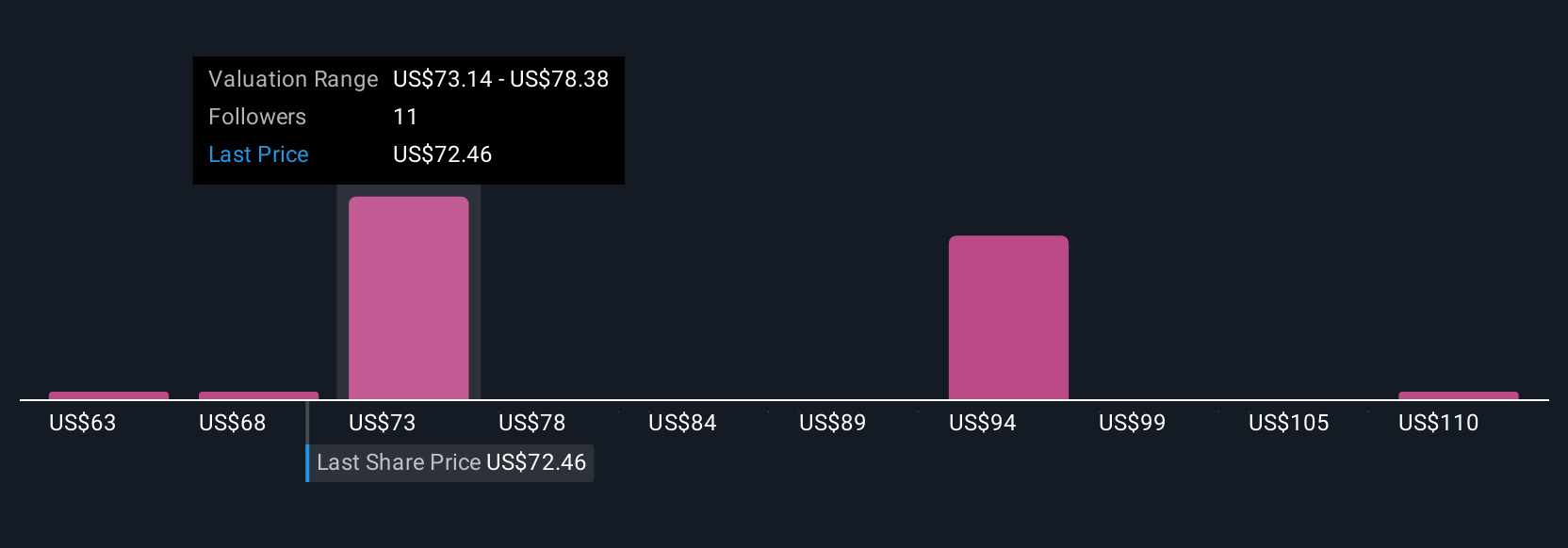

Simply Wall St Community members offered five fair value estimates for ATI, ranging from US$62.68 to US$118 per share. While these reflect a wide range of conclusions, the ongoing risk of weaker non-aerospace markets and reliance on key OEMs remains an important consideration for anyone reviewing the company’s performance and outlook.

Explore 5 other fair value estimates on ATI - why the stock might be worth 37% less than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives