- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI): Valuation in Focus After SBA Suspension and Fraud Probe Spurs Investor Reassessment

Reviewed by Simply Wall St

The Small Business Administration has suspended ATI (ATI) Government Solutions and its majority owner from new federal business after launching a probe into alleged fraud within the 8(a) Business Development Program. This regulatory move is likely causing investors to reassess ATI's outlook and risks.

See our latest analysis for ATI.

ATI’s share price has proven resilient, with a year-to-date gain of 62.18% and a 1-year total shareholder return of 45.41%, even as the latest regulatory setback weighs on sentiment. This momentum highlights how quickly risk perception can shift when events unfold, even for stocks with a big long-term run.

If news-driven volatility has you thinking about broader opportunities, it might be the perfect moment to discover fast growing stocks with high insider ownership

With ATI’s stock still trading below analyst targets despite recent gains, investors now face a fundamental question: is this a chance to buy ahead of a rebound, or has the market already priced in its future growth?

Most Popular Narrative: 14% Undervalued

ATI closed at $89.25 per share, while the most followed narrative places its fair value at $103.86, indicating a substantial potential upside. The stage is set as investors weigh whether the analysts’ bold financial forecast is justified by ATI’s recent contract wins and performance streak.

Recent long-term contract expansions with both Boeing and Airbus, including new titanium alloy sheet supply and broader product offerings, lock in higher volumes and minimums, expand ATI's share, and feature inflation pass-through and attractive pricing. These deals directly support reliable, higher-margin revenue growth and a structurally improved earnings base through the decade.

Want to uncover what drives that high conviction target? Beneath the headlines lie game-changing commercial deals, margin-boosting upgrades, and aggressive profit forecasts. Find out which financial levers might propel ATI much higher if real-world performance keeps pace with narrative optimism.

Result: Fair Value of $103.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish demand in industrial markets and ATI’s large exposure to a small group of aerospace customers could quickly challenge even the most optimistic forecasts.

Find out about the key risks to this ATI narrative.

Another View: What Does the SWS DCF Model Say?

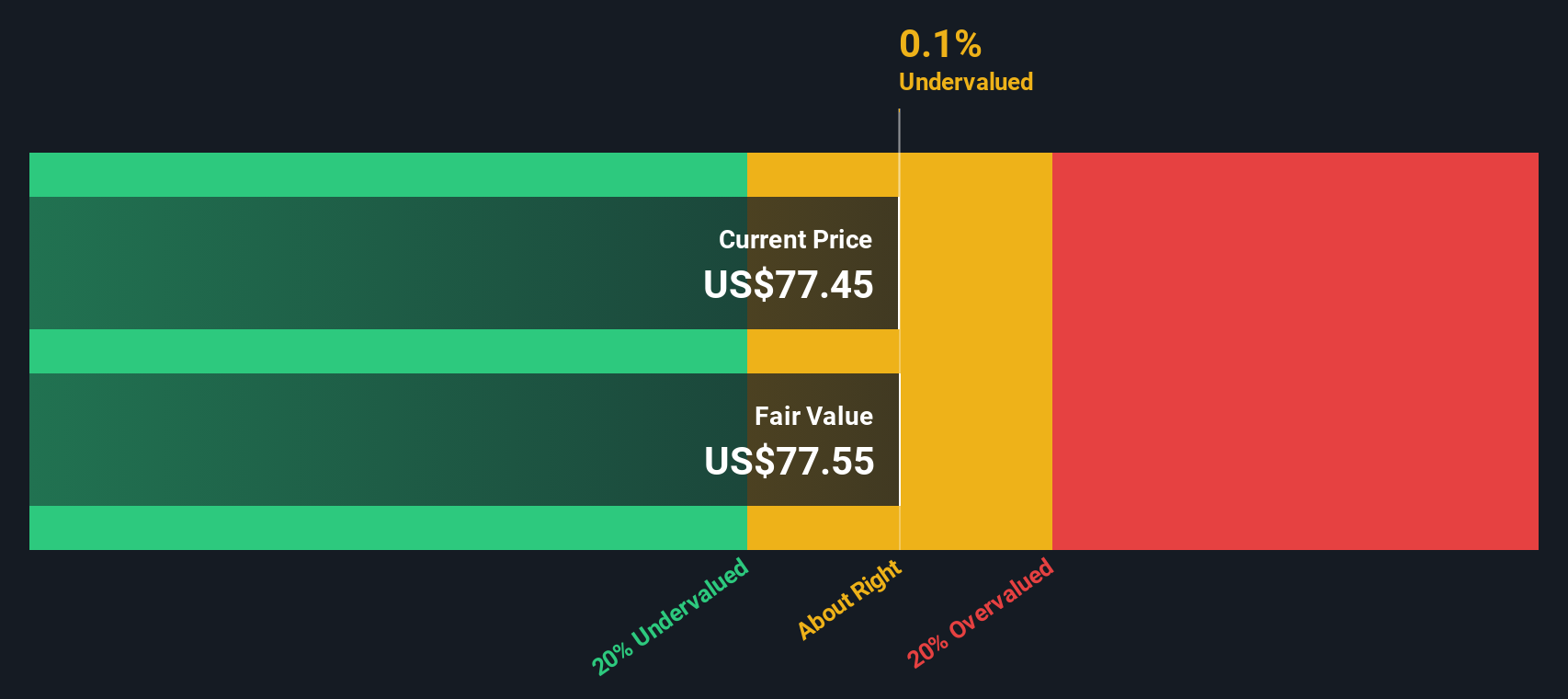

While analysts see ATI's fair value above the current share price, the SWS DCF model questions that optimism. According to our DCF model, ATI trades above its estimated fair value of $78.12. This suggests some downside risk and calls for a closer look at whether market expectations are outpacing fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If you see things differently or enjoy diving into the data yourself, crafting your own investment story is quick and straightforward in just a few minutes. Do it your way

A great starting point for your ATI research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep options open. Make your next move count with these powerful stock ideas that could shape your portfolio’s future.

- Tap into long-term potential with companies offering strong yields and reliable income by using these 17 dividend stocks with yields > 3%.

- Uncover undervalued gems that the market may have overlooked by checking out these 877 undervalued stocks based on cash flows.

- Stay ahead as artificial intelligence transforms industries with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives