- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI) Valuation in Focus After Analyst Upgrade and Strong Aerospace, Defense Momentum

Reviewed by Simply Wall St

See our latest analysis for ATI.

ATI’s upgraded outlook has added to the stock’s momentum, with a recent surge bringing the 30-day share price return to 23.7 percent and year-to-date gains above 80 percent. Investors taking the long view have seen a 75 percent total shareholder return over the past year, underscoring both short-term excitement and the company’s broader turnaround story.

If today’s strong momentum in aerospace and defense stocks interests you, explore more opportunities with our curated list in the See the full list for free..

With such outsized gains and analyst upgrades fueling the rally, is ATI still trading at an attractive value? Or is all of the company’s future growth already reflected in today’s soaring share price?

Most Popular Narrative: 15.8% Undervalued

ATI's most closely followed narrative currently places its fair value at $118, which is well above the most recent close of $99.37. This positions ATI as an opportunity that could surprise those betting against it, given strong margin expansion and increased analyst confidence in the business trajectory.

Recent long-term contract expansions with both Boeing and Airbus, including new titanium alloy sheet supply and broader product offerings, lock in higher volumes and minimums, expand ATI's share, and feature inflation pass-through and attractive pricing. These factors directly support reliable, higher-margin revenue growth and a structurally improved earnings base through the decade.

Curious why the market’s favorite narrative points to future outperformance? The secret sauce lies in bolder earnings expansion, contract-driven stability, and a profitability target that rivals industry icons. What numbers fuel such an aggressive upside? See inside for the real story behind these projections.

Result: Fair Value of $118 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ATI’s heavy reliance on a few major aerospace customers and vulnerability to global trade barriers could challenge these upbeat projections if conditions change.

Find out about the key risks to this ATI narrative.

Another View: Market Ratios Offer a Check

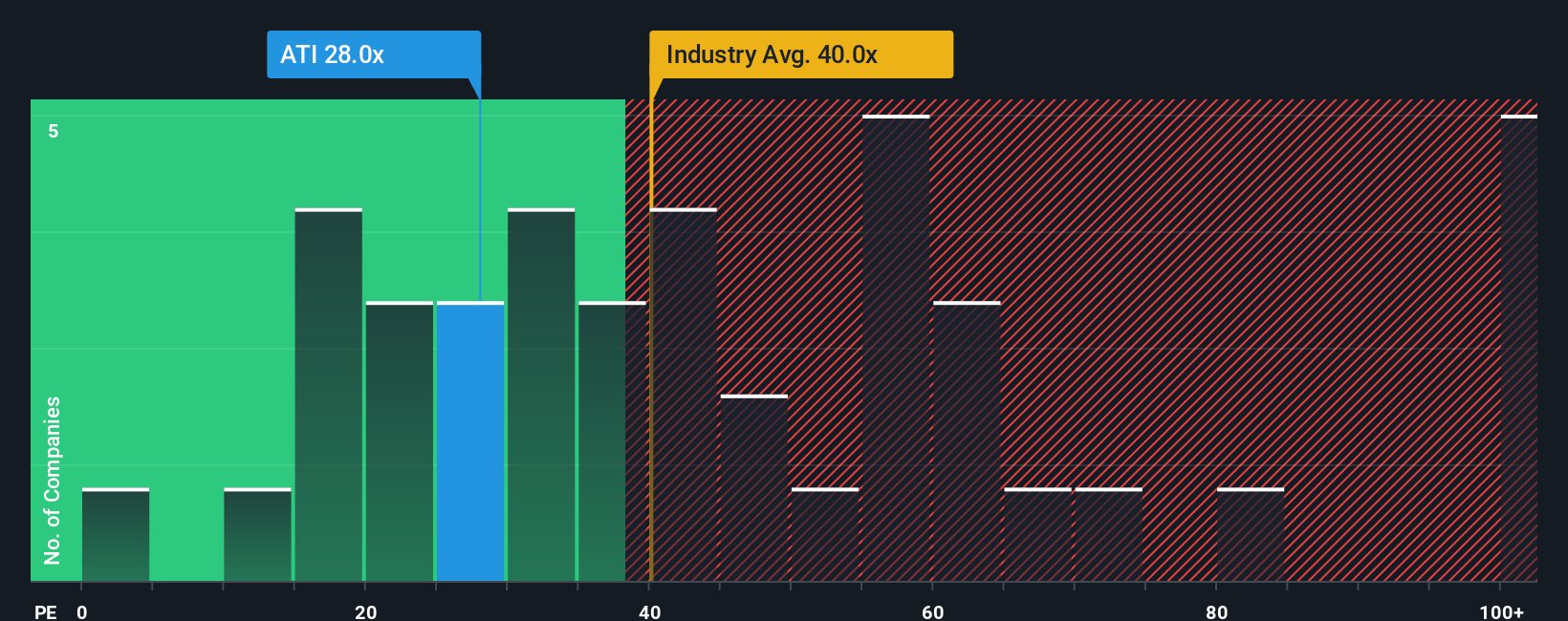

While the current outlook leans bullish, looking at ATI's price-to-earnings ratio provides another perspective. ATI trades at 30.4x earnings, which is below the industry average of 38.5x and slightly under the peer average of 32.9x. The fair ratio stands at 32.5x, suggesting ATI is valued attractively compared to both its competitors and the broader market.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ATI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ATI Narrative

If your take on ATI's story differs or you prefer to follow your own research trail, the platform lets you shape your perspective in just minutes. Do it your way.

A great starting point for your ATI research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great opportunities never wait around. Stay a step ahead by scouting promising stocks beyond ATI. Smart investors constantly refresh their watchlists with emerging themes.

- Capture long-term income potential by searching for strong yields with these 16 dividend stocks with yields > 3% delivering over 3 percent.

- Tap into the future of medicine with these 32 healthcare AI stocks powering the next wave of healthcare breakthroughs.

- Spot untapped value where the market has overlooked growth, thanks to these 897 undervalued stocks based on cash flows based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives