- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

ATI (ATI) Margin Expansion Reinforces Bullish Narrative Despite Slowing Earnings Growth

Reviewed by Simply Wall St

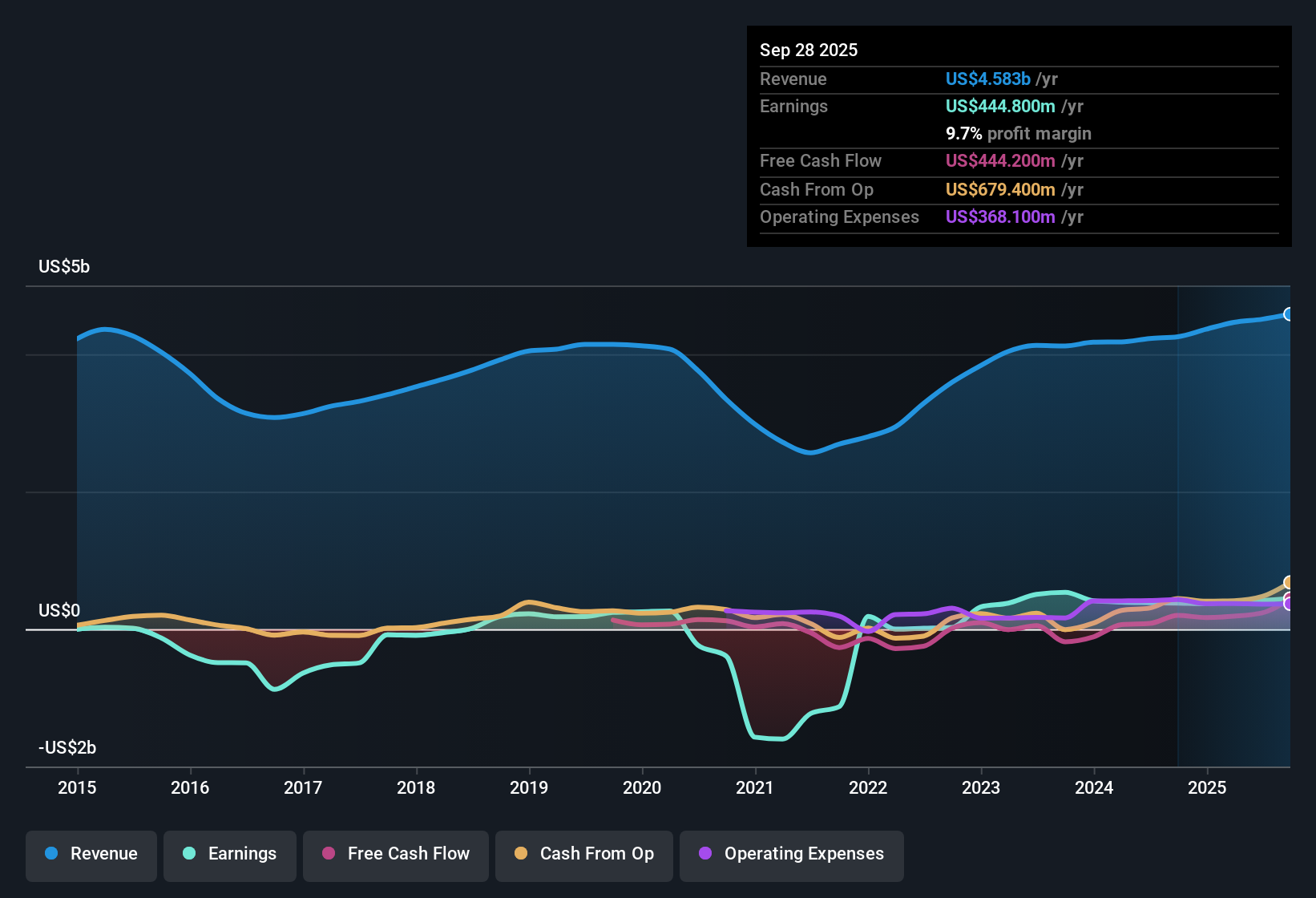

ATI (ATI) posted net profit margins of 9.7%, up from 8.9% the previous year. This marks another year of improved profitability as the company continues its multi-year turnaround. Over the past five years, earnings have grown at an annual rate of 66.5%. This year’s annual earnings growth stands at 18.1%, which is lower than the five-year average. Looking ahead, earnings are projected to rise by 14.86% per year. Revenue growth is expected at 6.5% per year, which is slower than the broader US market’s expected pace of 10.2%.

See our full analysis for ATI.Next, we consider these new earnings figures in the context of current market and community narratives to highlight where consensus aligns with reality and where new developments may emerge.

See what the community is saying about ATI

Margin Expansion Drives Industry-Leading Segment

- ATI's High Performance Materials & Components margins topped 24%, far outpacing peer averages in the aerospace and defense industry.

- According to analysts' consensus view, ATI’s focus on long-term contracts with Boeing and Airbus, along with investments to expand titanium and nickel alloy production, is fueling high-margin segment growth and protecting cash flow, even as industrial and medical demand remains weak.

- Consensus narrative notes these contracts feature inflation pass-throughs and minimum volume guarantees, supporting higher-margin revenue streams.

- Analysts highlight ATI’s efficiency gains and diversified customer base as key levers supporting margin resilience and improved free cash flow generation.

- See why analysts think ATI’s segment leadership could be the start of a multi-year growth run. 📊 Read the full ATI Consensus Narrative.

Valuation Gap Versus Fair Value and Industry

- Shares trade at $103, which is 19% above the estimated DCF fair value of $86.48 and exceeds the peer average P/E of 29.8x, though still lower than the industry average of 40.6x.

- Consensus narrative points out that the market seems to be assigning a premium due to ATI's earnings quality and durable contract-driven growth, but some analysts caution that further price upside may hinge on delivering the projected rise in profit margins to 11.6% over the next three years.

- Consensus acknowledges ongoing investments and sector tailwinds, yet the current multiple requires continued margin and cash flow expansion to stay justified.

- Some analysts flag risk if key customer contract volumes or sector demand underperform, given ATI’s share price already reflects significant margin improvement.

Limited Near-Term Risks but Concentration Remains

- ATI’s risk profile remains limited according to current disclosures, with only a minor note regarding its financial position, though exposure to a few large aerospace customers remains a key watchpoint.

- Consensus narrative draws attention to ATI’s relatively low risk flagging and high contract stability, but analysts are monitoring for potential volatility should major OEM customers like Boeing or Airbus reduce orders or if global trade barriers intensify.

- Analysts note these contracts work both ways. While they underpin steady revenue, they also increase reliance on a concentrated client base.

- Consensus commentary warns that macroeconomic softness and sector-specific slowdowns could still impact non-aerospace revenues and margins.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ATI on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the numbers your way? Share your own take and shape a personal narrative of ATI’s future in just a few minutes. Do it your way.

A great starting point for your ATI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

ATI’s premium valuation and reliance on continued margin expansion mean the stock could struggle if contract or sector growth slows.

If you want stocks with more attractive upside, see these 853 undervalued stocks based on cash flows that combine quality with compelling valuations and discover better value opportunities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives