- United States

- /

- Construction

- /

- NYSE:APG

How Strong Safety Services Growth and Upbeat Outlook at APi Group (APG) Has Changed Its Investment Story

Reviewed by Simply Wall St

- APi Group recently reported strong results, highlighted by robust organic revenue and adjusted EBITDA growth in its core Safety Services segment, alongside upward full-year earnings estimate revisions and increased institutional interest.

- This momentum underscores the impact of heightened safety regulations and expanding recurring revenue on the company's market enthusiasm and operational performance.

- Next, we’ll examine how the positive shift in earnings outlook may influence APi Group’s investment narrative and long-term prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

APi Group Investment Narrative Recap

Owning shares of APi Group means believing in ongoing demand for safety services, the strength of its recurring revenue model, and the company’s ability to manage costs and execute acquisitions effectively. While the recent surge in earnings estimates and strong institutional support reinforce APi Group’s positive momentum, these updates do not fundamentally change the key short-term catalyst: sustained regulatory-driven growth in inspection and service revenues. However, risks from material cost pressures and integration challenges remain material and warrant close attention.

The company’s July 2025 decision to raise full-year revenue guidance, now projected at between US$7,650 million and US$7,850 million, particularly stands out. This move comes after a robust second quarter, providing reassurance around recurring revenue catalysts but also raising questions about how resilient margins will be if cost inflation or acquisition headwinds intensify.

On the flip side, investors should be aware that sustained materials cost inflation could compress margins and impact future earnings if...

Read the full narrative on APi Group (it's free!)

APi Group's outlook anticipates $8.9 billion in revenue and $735.1 million in earnings by 2028. This scenario assumes annual revenue growth of 6.5% and a $594.1 million increase in earnings from the current $141.0 million level.

Uncover how APi Group's forecasts yield a $41.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

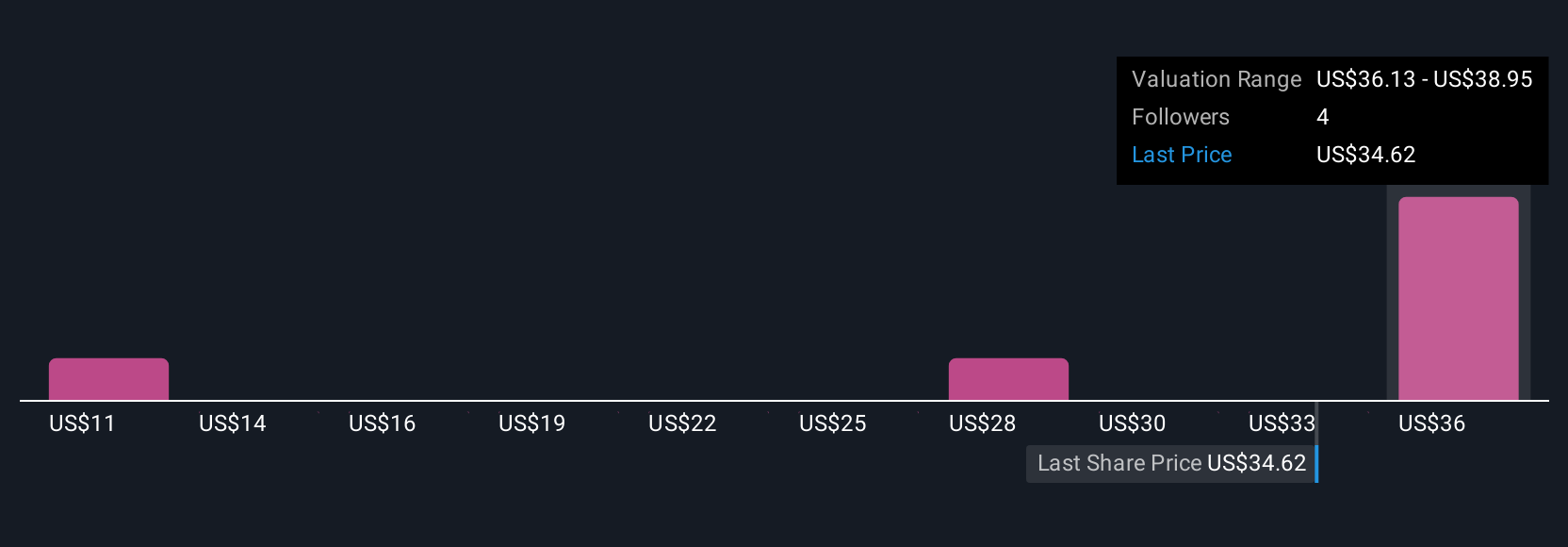

Simply Wall St Community members estimate APi Group’s fair value between US$10.74 and US$41, reflecting broad differences among four individual outlooks. Against a backdrop of persistent input cost risks, these varied perspectives showcase the importance of considering multiple viewpoints on the company’s long-term financial trajectory.

Explore 4 other fair value estimates on APi Group - why the stock might be worth as much as 16% more than the current price!

Build Your Own APi Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free APi Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate APi Group's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APG

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives