- United States

- /

- Construction

- /

- NYSE:AMRC

Can Ameresco’s (AMRC) Arizona Battery Project Reveal Its Edge in Industrial Clean Energy Solutions?

Reviewed by Sasha Jovanovic

- Ameresco, Inc. recently announced the commercial operation of a 50MW/200MWh battery energy storage system in Kingman, Arizona, marking it as the largest behind-the-meter project in the state, developed for Nucor’s expanding bar mill.

- This project not only highlights Ameresco’s role in advancing large-scale clean energy solutions for major industrial clients but also features a 20-year Storage Services Agreement using Tesla Megapack units and plans for a future 25MW solar asset.

- We'll explore how the launch of Arizona's largest battery energy storage system for Nucor could reshape Ameresco's long-term growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Ameresco Investment Narrative Recap

Ameresco appeals to investors who see opportunity in the transition to clean energy infrastructure, particularly as demand for large-scale battery storage and integrated solutions accelerates. The launch of the largest behind-the-meter battery system in Arizona should reinforce Ameresco’s credibility with industrial clients and support its project backlog, although ongoing supply chain and regulatory risks remain the most prominent shorter-term considerations, particularly around battery availability and policy incentives.

Among recent announcements, the US$197 million ESPC project with the U.S. Navy stands out, highlighting Ameresco’s strong public sector relationships and experience with resilient energy infrastructure. This capability is relevant given that utility and industrial clients are prioritizing reliability, but supply chain constraints, especially for batteries, continue to present a tangible source of execution risk for such large projects.

However, in contrast, investors should be aware of how persistent supply chain and equipment lead time risks could affect...

Read the full narrative on Ameresco (it's free!)

Ameresco's outlook projects $2.4 billion in revenue and $87.4 million in earnings by 2028. This is based on an expected 8.8% annual revenue growth and a $25.4 million increase in earnings from the current $62.0 million.

Uncover how Ameresco's forecasts yield a $35.67 fair value, a 7% downside to its current price.

Exploring Other Perspectives

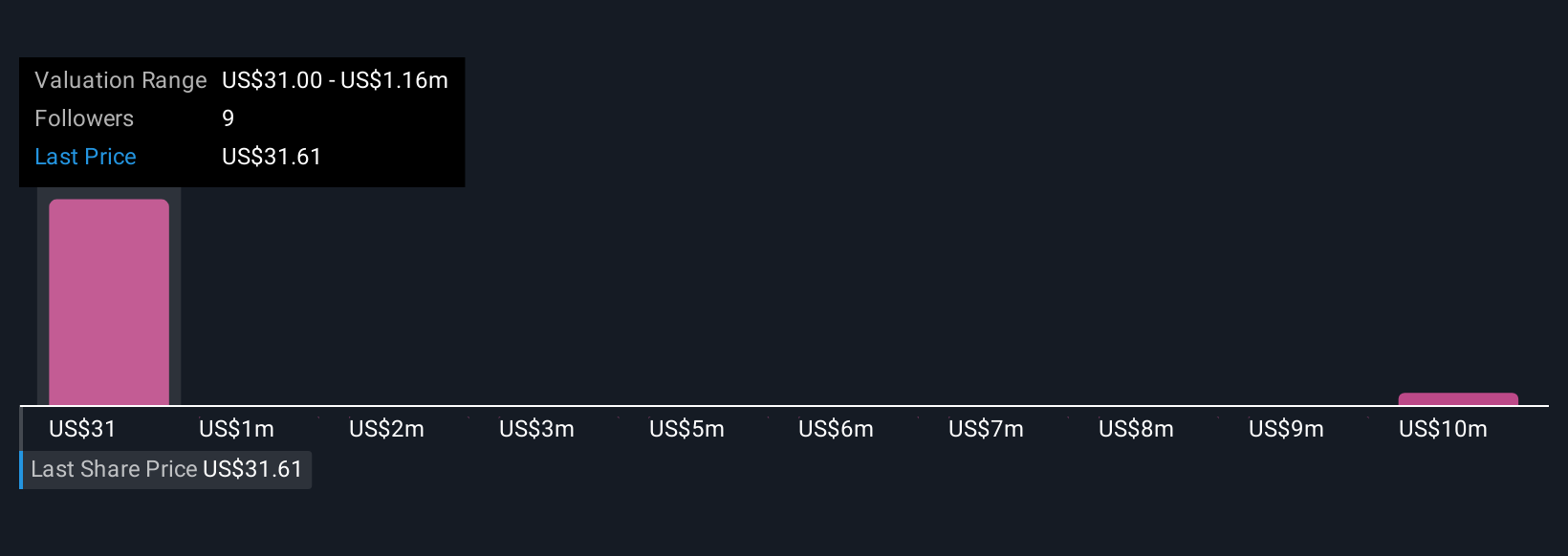

Three distinct Simply Wall St Community fair value estimates for Ameresco range tightly from US$35.67 to US$38.66 per share. While many see growth opportunities from projects like Arizona’s BESS, supply chain disruptions may significantly alter the company’s ability to meet timelines and margin goals, so consider how varied opinion can be in forming your own outlook.

Explore 3 other fair value estimates on Ameresco - why the stock might be worth as much as $38.66!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

No Opportunity In Ameresco?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives