- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC) Valuation in Focus Following Strong Share Price Rally

Reviewed by Kshitija Bhandaru

Ameresco (AMRC) shares have shown strong momentum recently, climbing nearly 30% over the past month and more than doubling over the past 3 months. This performance is drawing attention to how the market is valuing the company’s growth story and potential in the clean energy sector.

See our latest analysis for Ameresco.

Ameresco’s share price has snapped back sharply after last year’s losses, with recent momentum building. Its 30-day share price return sits at nearly 30%, and it’s up 58.8% year-to-date. Despite a strong 12-month total shareholder return, longer-term gains have been more subdued. This suggests that the recent rally reflects renewed confidence in the company’s growth prospects and a shift in sentiment within the clean energy space.

If Ameresco’s rapid turnaround has you wondering what else the market is rewarding, it’s a great time to discover fast growing stocks with high insider ownership

The recent surge has sparked debate, as Ameresco now trades close to analyst targets and is only slightly discounted on intrinsic value. Some investors are questioning whether this upward momentum signals more gains ahead or if future growth is already reflected in the current price.

Most Popular Narrative: 12% Overvalued

Ameresco’s most widely followed narrative suggests its fair value is $35.67, while the last close stood at $39.93. This signals that recent gains have pushed the stock beyond what is justified by underlying assumptions. Attention is turning to whether forward growth can support this stretch.

“Sharply rising utility rates and escalating grid instability are prompting more public and private clients to pursue long-term energy infrastructure, distributed generation, and microgrid projects. These are areas where Ameresco's project backlog and pipeline are rapidly growing, indicating upside for future revenues and gross margins as these higher-value projects convert. Expanded government incentives for clean energy and storage (including ITCs and the Inflation Reduction Act) have allowed Ameresco to monetize new projects more quickly and enhance project economics, improving both revenue predictability and net margins via increased operating leverage.”

Curious what supports that valuation? The narrative hints at a future profit surge and expanded margins fueled by hefty government incentives and grid opportunities. But there is a sharp twist in the quantitative forecasts that only the full narrative reveals. Don’t miss the details that shape the bullish case.

Result: Fair Value of $35.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain hurdles or renewed regulatory uncertainty could quickly test the bullish case and challenge both revenue growth and margin expectations ahead.

Find out about the key risks to this Ameresco narrative.

Another View: What Do the Ratios Say?

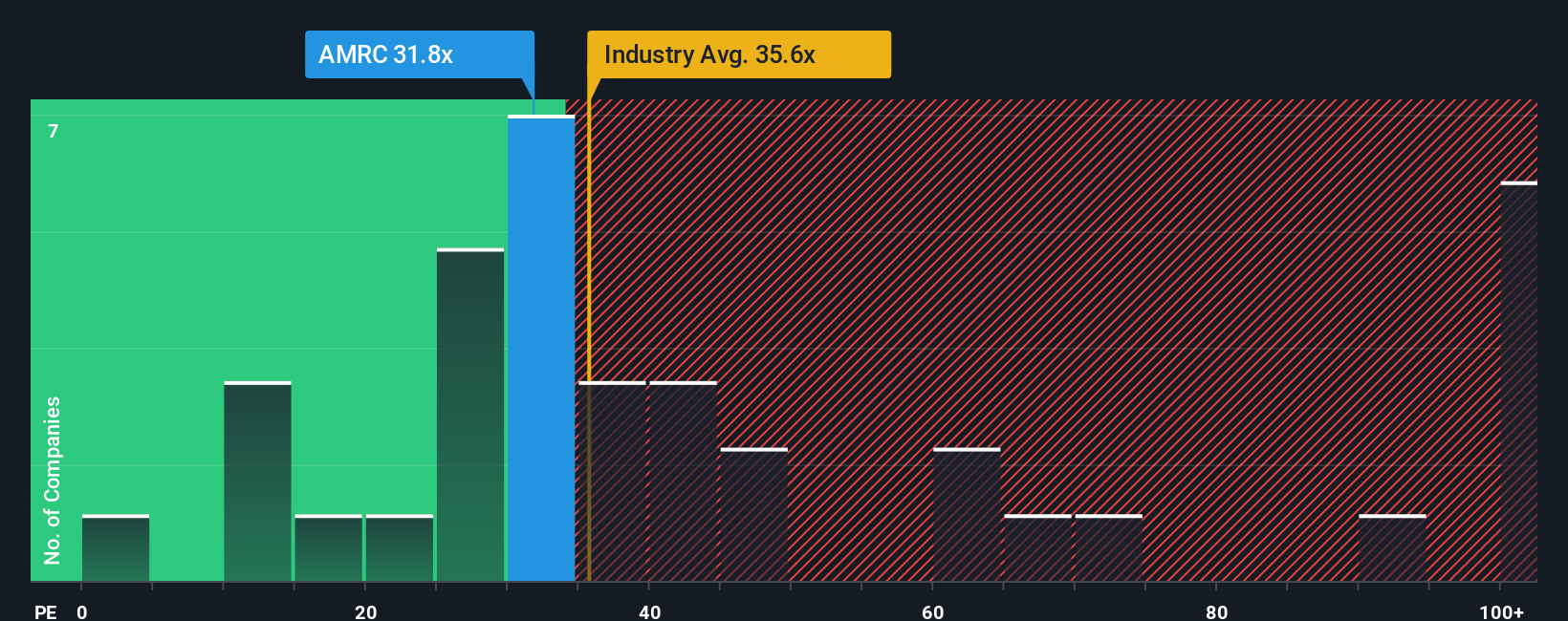

Looking beyond the recent rally and analyst targets, Ameresco's price-to-earnings ratio of 34x closely tracks the US Construction industry average of 35.9x but stands above the peer average of 33.7x. However, it remains well below the fair ratio of 49.8x, suggesting the market could still push the valuation higher. Does this mean investors are overlooking further upside, or is caution still the best approach as sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameresco Narrative

If you see the story differently or want to test your own insights, you can craft a personal view by building your narrative in just minutes with Do it your way.

A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Take your investing game up a notch by jumping on these unique stock themes before the crowd does.

- Boost your portfolio’s income potential by targeting attractive yields through these 18 dividend stocks with yields > 3% delivering above-average returns from established companies.

- Unlock the growth story of tomorrow’s tech breakthroughs by scanning these 24 AI penny stocks powering advancements in automation, data science, and smart innovation.

- Capitalize on pure value plays with these 877 undervalued stocks based on cash flows, finding companies that the market has overlooked, so you stay ahead of the pack.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives