- United States

- /

- Electrical

- /

- NYSE:AMPX

Should You Rethink Amprius After Its Stock Surged Over 340% in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Amprius Technologies stock? You are not alone. Investors have been closely watching the company, especially given its wild share-price ride over the last year. Just this past month, Amprius soared nearly 40%, and since the start of the year, it is up an eye-popping 346.9%. If you zoom out even further, Amprius has delivered an astonishing 883.1% return over the past twelve months. That kind of performance instantly puts the stock on a lot of watchlists, but it also raises the big question: is all that growth justified?

A surge like this cannot just be chalked up to market noise. Much of the excitement centers on growing optimism around the next wave of battery technology, with Amprius positioned as a potential leader. Industry headlines have amplified expectations, and there is a subtle but noticeable shift in how investors now calculate risk and reward here. Despite some minor setbacks, such as a small 0.2% dip this week, the longer-term returns have more than compensated for short-term jitters.

But here is the thing: when we turn to traditional valuation metrics, the numbers paint a different picture. The company scores a 0 out of 6 on our valuation checks, hinting that by the usual standards, it might not be undervalued at all.

Let’s dig into those valuation methods one by one to see what’s driving that score, and stick around because after that, we will explore a smarter way to think about what Amprius might really be worth.

Amprius Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amprius Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that tries to estimate a company’s true worth by forecasting its future cash flows and then discounting those back to today’s dollars. In plain terms, it asks: if you owned the company and could collect all its future cash, what would those be worth right now?

For Amprius Technologies, current Free Cash Flow is deeply negative at $-51.35 Million. Analyst forecasts predict a dramatic turnaround. By 2027, Free Cash Flow is projected to rise to $16.35 Million, with models extrapolating further strong growth in the years that follow. In fact, if we look out ten years, the forecasted Free Cash Flow ramps up each year, reaching over $53.5 Million by 2035. All projections are in US Dollars ($), and it is worth noting that only the next five years use direct analyst estimates, while the rest rely on growth extrapolations by Simply Wall St.

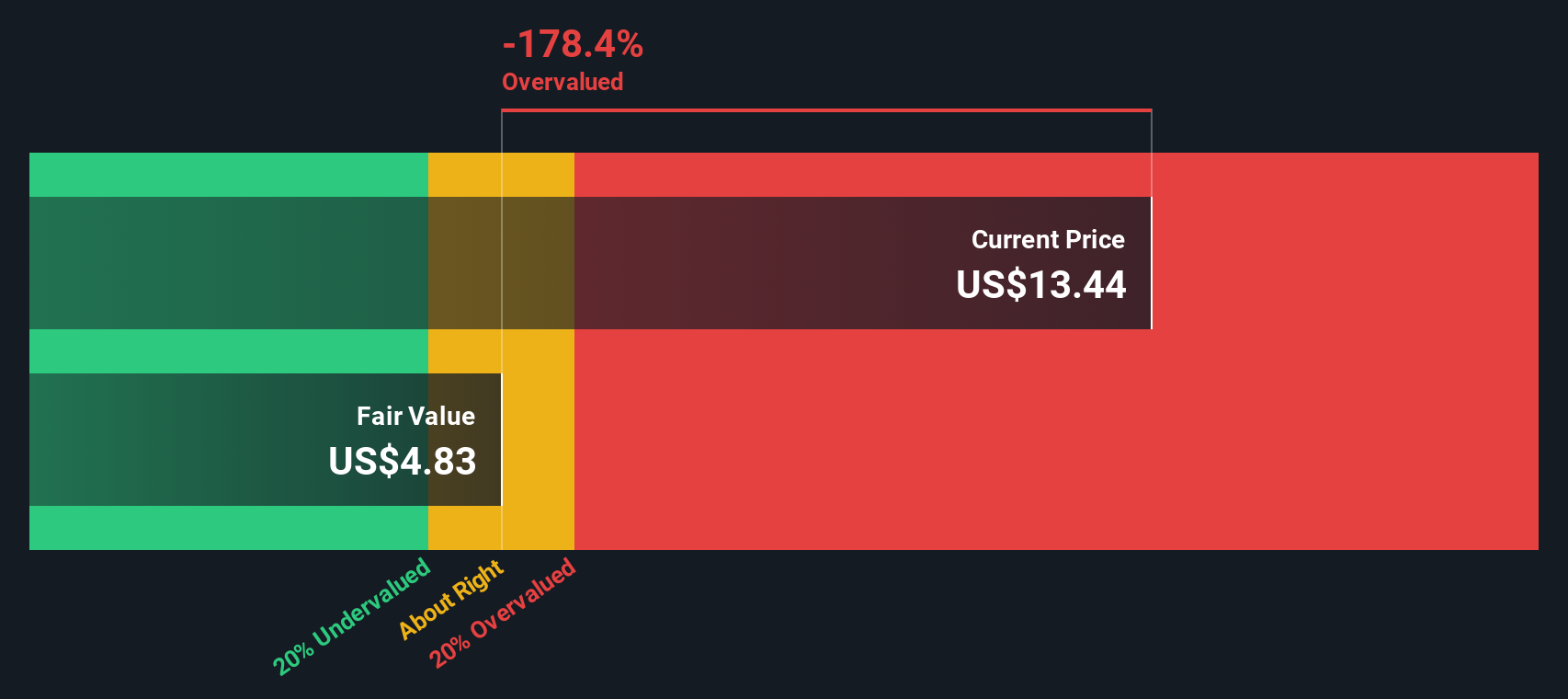

Based on this DCF analysis, the estimated intrinsic value per share is $4.72. With Amprius trading far above that today, the implied discount is -171.0%, making the stock appear significantly overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amprius Technologies may be overvalued by 171.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amprius Technologies Price vs Sales

The Price-to-Sales (P/S) multiple is a widely used valuation metric for companies that are not yet profitable or are in their high-growth phase, like Amprius Technologies. Since Amprius is still early in its commercialization journey and reinvesting for future growth, focusing on sales rather than profits provides a more meaningful comparison with similar firms.

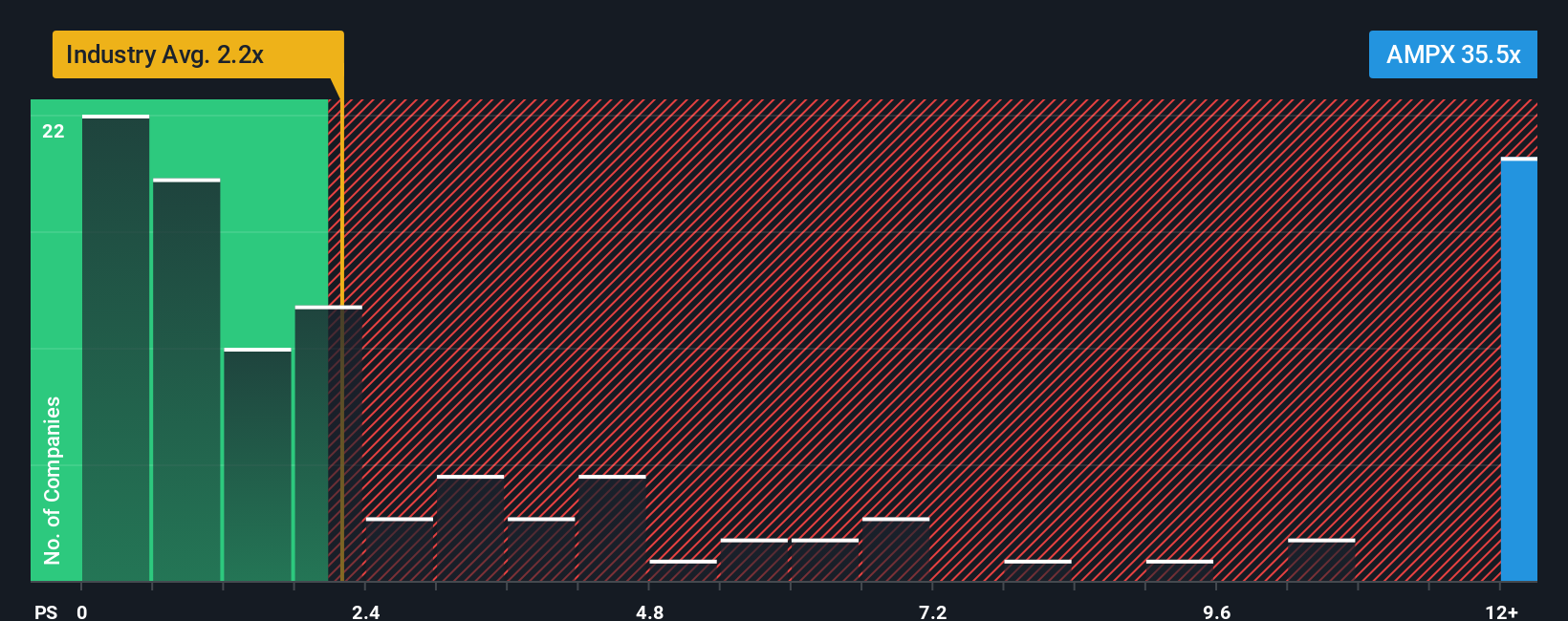

When looking at P/S ratios, investors often consider industry trends and growth expectations. Higher growth companies usually command a higher P/S multiple, but this also comes with higher risks. For Amprius, the current P/S multiple stands at 35.65x, which is significantly above both the industry average of 2.47x and the peer average of 6.89x in the Electrical sector.

To get a truer sense of value, we turn to Simply Wall St’s proprietary “Fair Ratio.” This benchmark considers not just the company’s sector, but also factors in its sales growth outlook, risk profile, profit margins, and market capitalization. As a result, it serves as a more holistic and tailored measure compared to relying on industry averages or peer group multiples.

Simply Wall St calculates Amprius’ Fair Ratio at 1.58x, much lower than its current P/S of 35.65x. This large gap suggests the stock is trading at a substantial premium to what would normally be justified given its sales growth and risk profile.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amprius Technologies Narrative

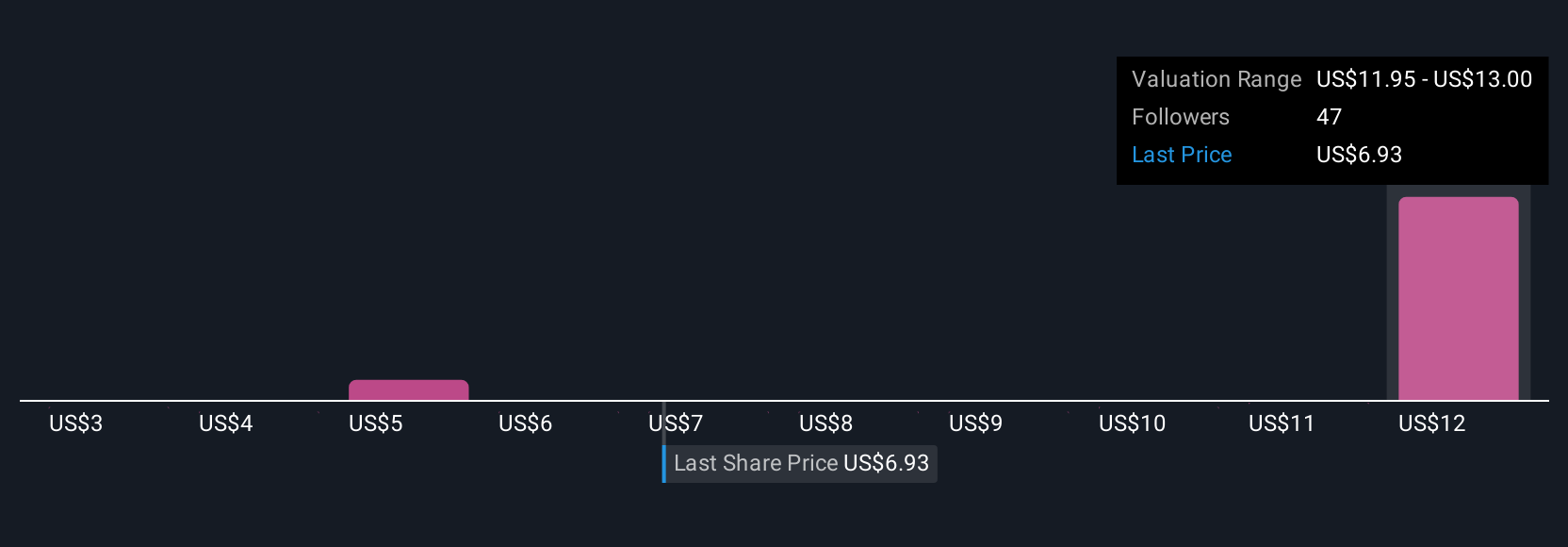

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a clear, user-driven story that connects your unique perspective on a company, such as your expectations for Amprius’ future revenue, margins, and risks, to a financial forecast and, ultimately, a personalized fair value. Far more than just crunching numbers, Narratives let investors blend what they see and believe about a business with real financial outcomes, making investing more intuitive and actionable.

Narratives are available to all users on the Community page at Simply Wall St, where millions share, discuss, and refine their views. They help you decide when to buy, hold, or sell by continuously comparing your Narrative’s fair value calculation to the current share price. Because Narratives are dynamic, they automatically update when important news or earnings are released, so your thesis always reflects the latest facts.

For example, some Amprius Narratives are highly bullish, forecasting rapid scaling, margin expansion, and a fair value over $18 per share. Others are more cautious, reflecting technology, market, or scaling risks and a fair value closer to $10. Narratives let you see the real stories behind the market and choose (or create) one that matches your convictions.

Do you think there's more to the story for Amprius Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives