- United States

- /

- Electrical

- /

- NYSE:AMPX

Does Amprius Technologies’ Recent 70% Rally Reflect Its True Value in 2025?

Reviewed by Bailey Pemberton

If you are sizing up Amprius Technologies, you are in good company. With a stellar 12.8% jump over the last week and a remarkable 70.6% surge in the past month, it is no wonder the stock has been catching investor attention. Year to date, Amprius has climbed 336.7%, and if you look back over the last year, the return is an impressive 1078.3%. These numbers are hard to ignore, signaling that something significant is happening with this company.

Behind these headline-grabbing moves are growing market developments, especially as demand accelerates for next-generation battery technology in electric vehicles and aerospace. These are sectors where Amprius is hoping to carve out a strong position. The company’s recent stock momentum seems to reflect shifting perceptions of risk and growth potential, as well as a broadening awareness of its technology among institutional investors. Yet, before you let FOMO take over, it is crucial to dig into how the market is valuing Amprius now.

When it comes to valuation, however, things look a little different. On a classic value score, where a company gets a point for each of six different ways it appears objectively undervalued, Amprius clocks in with a score of 0. That means by traditional metrics, the company is not undervalued in any of the main checks analysts typically use.

Of course, numbers never tell the whole story in isolation. Next, let us break down the different valuation approaches that investors often use to judge whether companies like Amprius offer true upside. At the end, there is also a look at an even more insightful way to think about valuation that many investors overlook.

Amprius Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amprius Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to today’s dollars. This method aims to answer what all those future cash profits could be worth right now to an investor.

For Amprius Technologies, the analysis starts with a current Free Cash Flow (FCF) of -$51.35 million, which is quite negative as the company is still ramping up operations and investing heavily in its growth. Forecasters anticipate that FCF will swing positive and expand significantly over the next decade. By 2026, analysts expect FCF to reach $9.20 million, and by 2027, $16.35 million. Beyond that, projections are extrapolated, with Simply Wall St estimating over $53 million in FCF by 2035, reflecting a robust growth trajectory. All values are calculated in USD.

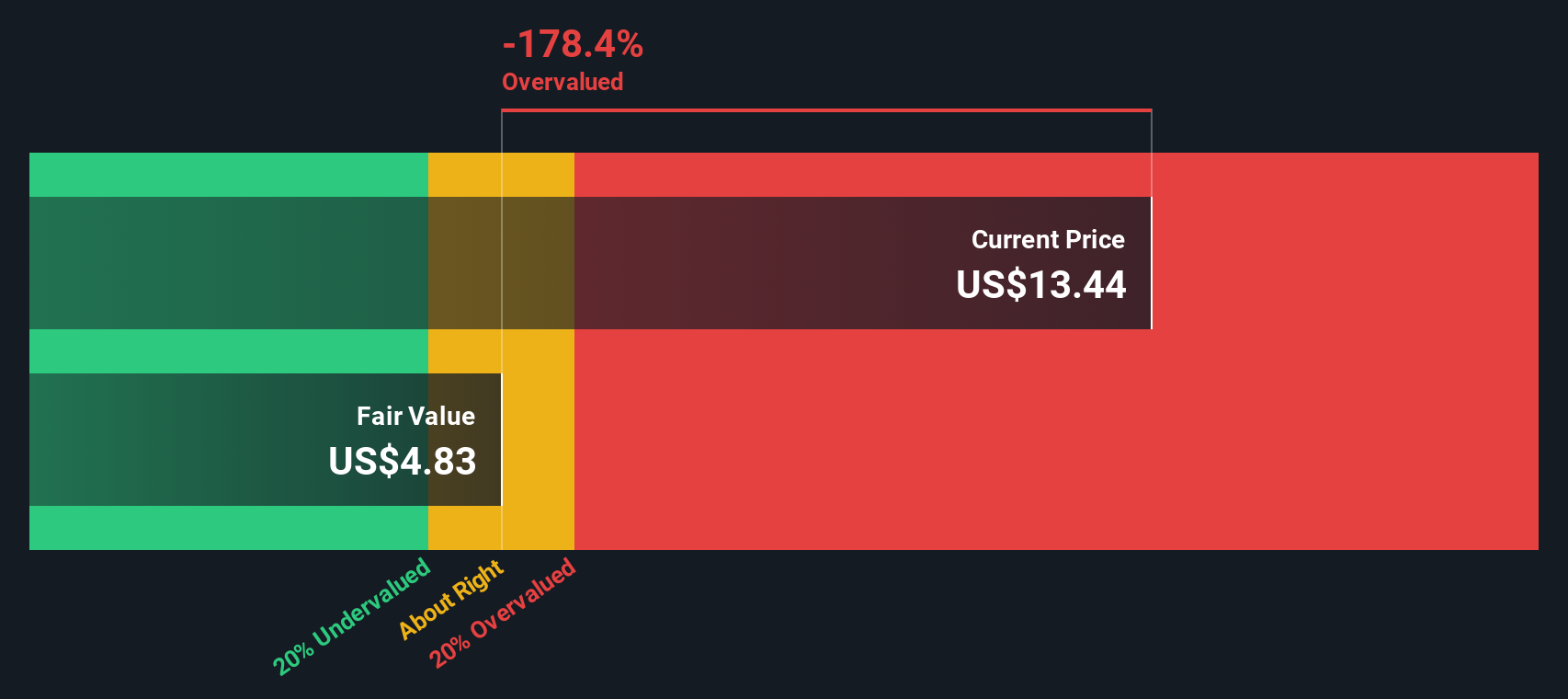

After discounting these future cash flows using a 2 Stage Free Cash Flow to Equity model, the DCF model sets Amprius Technologies’ estimated intrinsic value at $4.84 per share. With the current share price trading well above this, the implied discount is -158.3%, meaning the market is valuing the stock around two and a half times higher than what the DCF model suggests.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amprius Technologies may be overvalued by 158.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amprius Technologies Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation metric and is particularly useful for early-stage or high-growth companies that are not yet profitable. In these cases, traditional earnings measures can be skewed by upfront investment or negative earnings, so the P/S ratio offers a clearer window into how much investors are willing to pay for every dollar of revenue.

What counts as a “normal” P/S ratio is shaped by how much growth investors expect, how risky they perceive the company, and the company’s competitive edge. Higher growth prospects or proven advantages can justify higher ratios, while uncertainty or slowdowns usually pull them lower.

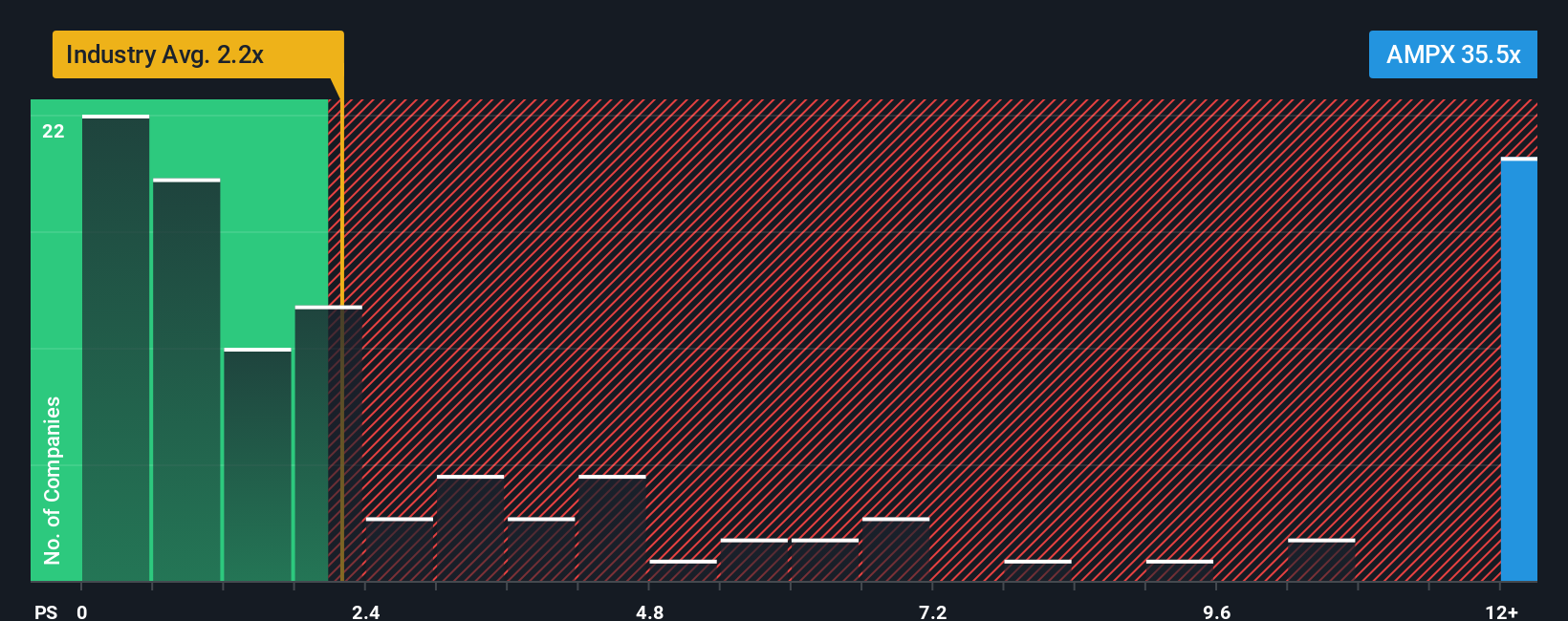

Amprius Technologies currently trades at a P/S ratio of 34.84x, which stands in stark contrast to the electrical industry’s average of 2.23x and the peer group average of 6.77x. This signals that investors have high expectations for future revenue growth or are betting on Amprius’ unique position in its market segment.

However, looking beyond simple benchmarks, Simply Wall St’s proprietary "Fair Ratio" estimates what a suitable P/S ratio should be for Amprius, given its specific growth outlook, profit margin, market size, and risk profile. This method is more insightful than just comparing to the industry or peers because it weighs the factors that genuinely drive company value.

For Amprius, the Fair Ratio is 1.51x, which is dramatically lower than the current market-priced multiple. This significant gap suggests that, even after accounting for upside, the stock is valued far above its risk-adjusted potential based on sales today.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amprius Technologies Narrative

Earlier, we hinted that there is a smarter way to understand a company’s true value. Enter Narratives. A Narrative goes beyond just numbers by letting you connect your own story or perspective on Amprius Technologies with your financial assumptions about where its revenue, profit margins, and fair value will head in the future.

Rather than relying solely on one-size-fits-all valuations, Narratives empower you to shape your expectations by linking the real-world story of Amprius, such as booming demand for advanced batteries or manufacturing risks, to your own scenario for financial growth or setbacks. On Simply Wall St’s Community page, millions of investors easily build, update, and share these Narratives, making investment decisions clearer and more personal.

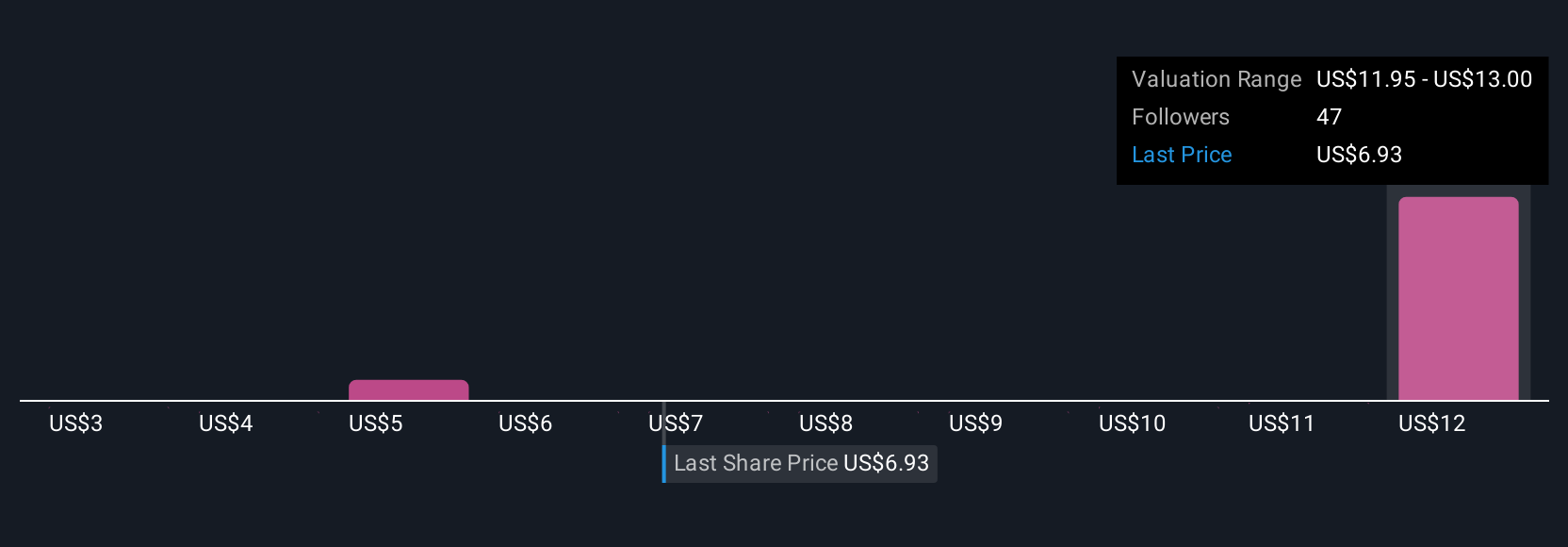

Narratives are not static. They update as soon as new earnings or news emerge, helping you react quickly and understand how events change fair value estimates versus the current share price. For example, one Narrative on Amprius might project aggressive global expansion and margin improvements, targeting a price as high as $18.00 if those assumptions play out. Another investor, more cautious, might focus on supply chain risks and stiff competition, resulting in a lower fair value near $10.00.

Do you think there's more to the story for Amprius Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives