- United States

- /

- Electrical

- /

- NYSE:AMPX

A Fresh Look at Amprius Technologies (AMPX) Valuation Following S&P Global BMI Index Addition

Reviewed by Kshitija Bhandaru

Amprius Technologies (AMPX) was recently added to the S&P Global BMI Index, a move that tends to draw more attention from investors and index funds tracking the benchmark. The addition could influence trading activity and the stock’s profile in the coming months.

See our latest analysis for Amprius Technologies.

Momentum around Amprius Technologies has been building, with the recent S&P Global BMI Index addition drawing new attention as the company continues to make headlines at industry events. While the 1-year total shareholder return stands at a respectable 9.4%, recent share price movement suggests investors are increasingly optimistic about where the company is heading.

If the bump in visibility for Amprius has you interested in what other fast-moving companies insiders are backing, consider broadening your view and discover fast growing stocks with high insider ownership

Given the recent upswing in attention and the company’s forward-looking metrics, investors now face a key question: Is Amprius Technologies currently trading below its true value, or has the market already priced in the company’s growth potential?

Most Popular Narrative: 2% Undervalued

With the most popular narrative placing Amprius Technologies’ fair value just above its last close, there is little room for error in the current optimism. Investors are focusing on the business model’s potential to scale, looking for solid catalysts to support further upside.

Ongoing investment in automation and manufacturing capacity (supported by government contracts like the $10.5M Defense Innovation Unit award) positions Amprius to capture a larger share of future high-margin opportunities in defense and critical infrastructure. This enhances both revenue visibility and earnings stability.

Curious what mix of growth assumptions back this valuation? The narrative hints at profit transformation, significant revenue increases, and a price multiple that stands out even among fast-growing tech names. If you want to see exactly which forecasts and bold predictions underpin the current fair value, this is a deep dive you do not want to miss.

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including heavy reliance on the drone sector and challenges in scaling up new battery technologies, which could disrupt expected growth.

Find out about the key risks to this Amprius Technologies narrative.

Another View: What the Price-to-Sales Ratio Tells Us

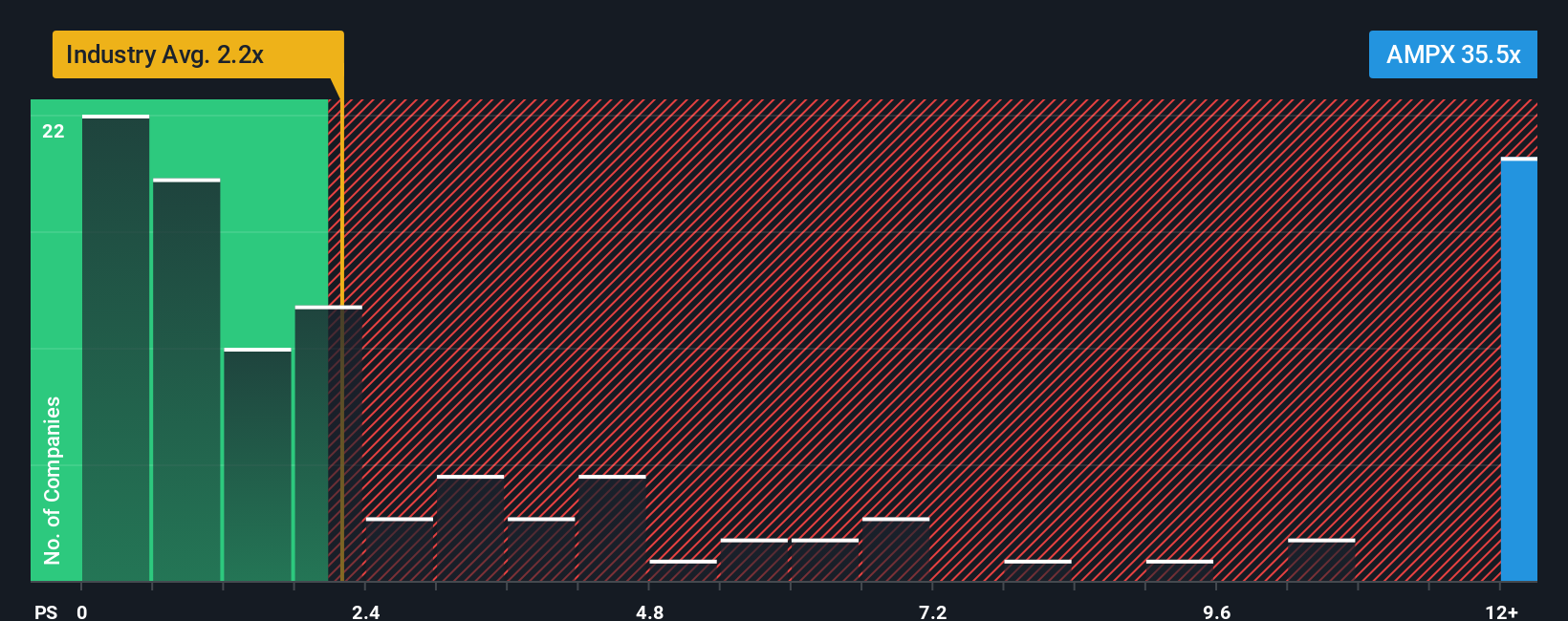

Looking through a different lens, Amprius Technologies trades at a price-to-sales ratio of 35.5x. That is significantly higher than both the US Electrical industry average of 2.2x and the peer average of 6.8x, and even further above the fair ratio of 1.5x. This premium means investors are banking on exceptional future growth, but it also introduces greater risk if expectations are not met. Is the market being too optimistic, or could the business outperform these high benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you think there’s more to the story or want a closer look at the numbers, you can easily construct your own view in just a few minutes: Do it your way

A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Serious about building wealth? Don’t miss out on stocks making waves in tech, healthcare, and the market’s biggest opportunities. Now is the time to power up your strategy.

- Tap into growth by scanning these 24 AI penny stocks that are fueling the next era of artificial intelligence innovation and breakthroughs.

- Unlock steady income and minimize market shocks with these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Ride the early momentum from these 78 cryptocurrency and blockchain stocks shaping the blockchain and cryptocurrency revolution before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMPX

Amprius Technologies

Develops, manufactures, and markets lithium-ion batteries for mobility applications.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives