- United States

- /

- Electrical

- /

- NYSE:AME

AMETEK (NYSE:AME) Declares US$0.31 Quarterly Dividend for June 2025

Reviewed by Simply Wall St

AMETEK (NYSE:AME) has recently affirmed a quarterly dividend of $0.31 per share, set to be paid on June 30, 2025, following its strong earnings report on May 1, 2025, which highlighted an increase in net income despite a slight dip in sales. The company is actively pursuing acquisitions, supported by a solid cash flow and repurchase authorization. During the previous month, AMETEK’s share price rose 11%, in line with a broader market uplift driven by a new trade agreement between the U.S. and the U.K. These corporate actions likely supported the stock's performance against the backdrop of an improving market.

Buy, Hold or Sell AMETEK? View our complete analysis and fair value estimate and you decide.

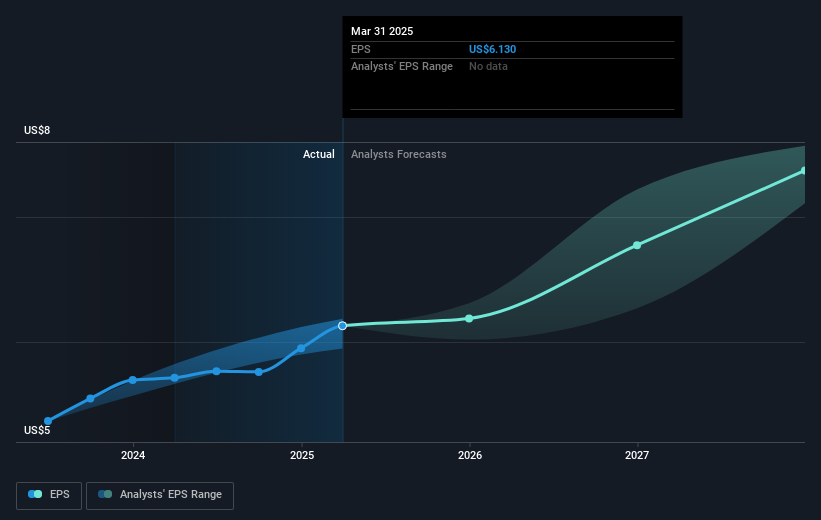

The recent affirmation of a dividend, alongside AMETEK's solid earnings report, potentially supports its strategic investments and acquisition plans. These actions align with AMETEK's narrative of leveraging strong cash flows for growth. While recent share price movements show an 11% rise over the past month, driven by macroeconomic factors like the U.S.-U.K. trade agreement, it's essential to consider the longer-term performance. Over the past five years, AMETEK’s stock, including dividends, delivered an impressive return of 124.96%. However, it underperformed against the broader U.S. market’s 7.2% return over the past year.

The affirmation of the dividend suggests confidence in future cash flows, which could further support revenue and earnings forecasts. However, potential risks such as trade policy uncertainties and dependency on acquisitions for growth remain. With analysts projecting a revenue growth rate of 5.6% annually until 2028, alongside increasing profit margins, the company's focus on diversification and technology investment appears poised to withstand various challenges. Current share price movements, while upward, exist within a broader analyst consensus price target of $190.91, representing a 12.1% potential increase from the prevailing share price of $167.85.

Upon reviewing our latest valuation report, AMETEK's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives