- United States

- /

- Electrical

- /

- NYSE:AME

A Look at AMETEK's (AME) Valuation as Q3 2025 Earnings Expectations Drive Investor Optimism

Reviewed by Kshitija Bhandaru

AMETEK (NYSE:AME) is preparing to report its third-quarter 2025 earnings, and there is growing anticipation among investors. With expectations for a profit increase and a history of beating estimates, interest is running high.

See our latest analysis for AMETEK.

AMETEK’s latest share price of $184.49 reflects steady optimism, with a 3.45% share price return year-to-date and a robust 9.45% total shareholder return over the past year. Momentum has been building thanks to consistent earnings beats and sustained long-term growth. The company has delivered a 63.47% total return over three years and 78.11% over five years, even as it navigates modest top-line expansion and positions for potential strategic moves.

If you’re keen to spot the next set of promising industrial leaders, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near all-time highs and analysts forecasting more gains, investors must decide whether AMETEK’s potential is still underestimated or if the market has already factored in its future growth prospects.

Most Popular Narrative: 10.4% Undervalued

With AMETEK closing at $184.49 and the most closely followed narrative calling fair value at $205.94, sentiment tilts toward hidden value still waiting to be unlocked. Investors are watching whether earnings momentum and strategic deals are enough to validate these projections.

Adoption of digital reality, automation, and advanced metrology solutions is accelerating across key end markets such as aerospace, defense, and architecture. This trend was recently reinforced by the FARO Technologies acquisition, which expands AMETEK's addressable market and supports both revenue and margin growth through higher value, software-enabled recurring revenue streams.

Want to know why margin expansion and automation could change everything for AMETEK? One financial lever in these projections will surprise you. What’s the full story behind these bold expectations? You’ll want to see the numbers driving this fair value call.

Result: Fair Value of $205.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in process and analytical segments, or delays in global trade, could limit AMETEK’s revenue growth and present challenges for margin expansion.

Find out about the key risks to this AMETEK narrative.

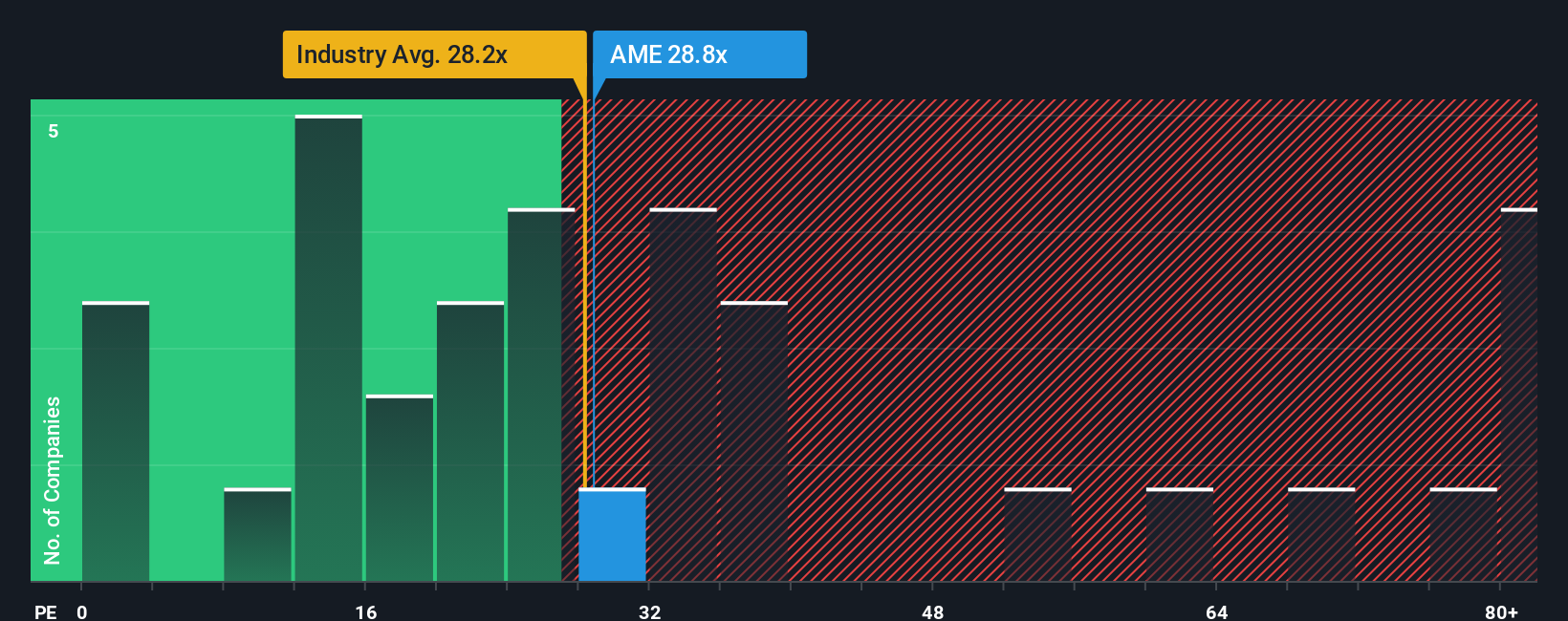

Another Perspective: Multiples Paint a Different Picture

While analysts see AMETEK’s fair value above the current price, its price-to-earnings ratio (29.6x) is already below both the industry average (30.5x) and peers (46.1x). However, compared with a fair ratio of 24.3x, shares could be considered expensive if the market shifts toward this benchmark. Is there more risk at these elevated multiples than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AMETEK for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AMETEK Narrative

If you think these numbers only tell part of the story or want to dig into the details yourself, you can shape your own narrative in just a few minutes, and even share your perspective. Do it your way

A great starting point for your AMETEK research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never rest on one opportunity. Uncover fresh ways to strengthen your portfolio and stay ahead of trends with these handpicked ideas waiting for you.

- Seize high yield opportunities by reviewing these 20 dividend stocks with yields > 3%, which regularly deliver strong income potential in different market conditions.

- Ride the next tech revolution by tapping into these 24 AI penny stocks, featuring rapid growth prospects at the heart of artificial intelligence innovation.

- Spot market deals that others might miss and focus on these 874 undervalued stocks based on cash flows, which may offer attractive upside based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AME

AMETEK

Manufactures and sells electronic instruments (EIG) and electromechanical (EMG) devices in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives