- United States

- /

- Machinery

- /

- NYSE:ALSN

How Do Allison Transmission’s Expanded Electric Partnerships Impact Its 2025 Valuation?

Reviewed by Bailey Pemberton

So, you are wondering what to do with Allison Transmission Holdings stock. Maybe you have watched it climb over the years and are debating whether it still has room to run, or perhaps the recent slips have you second-guessing your move. Either way, you are not alone. This industrial heavyweight has delivered impressive long-term gains, with a 3-year return over 100% and a staggering 5-year return of 136%. But fast forward to today and, at $82.11 per share, the stock is sitting on a year-to-date loss of 23.7%, with the past month alone down 4.2% and a slight 0.5% dip just this last week.

Why the rollercoaster? The latest news swirling around Allison Transmission Holdings has revolved around expanded partnerships in electric and hybrid vehicle systems, as well as continued investments in its global manufacturing footprint. These strategic moves hint at long-term opportunities but may also amplify investor uncertainty in the near term as the market figures out how to value these evolving bets. As sentiment has shifted, so has the risk profile, which you can clearly see in the short-term pullbacks since the start of the year, even as the fundamentals remain steady.

Now, here is where it gets interesting: on a pure numbers basis, Allison scores a 5 out of 6 in our value checklist, an impressive feat that signals undervaluation on almost every key metric we track. Next, let us break down these valuation approaches in more detail and discuss what they really tell us about the company’s potential. But stick around, because there is a twist that makes understanding Allison’s true value even more compelling.

Why Allison Transmission Holdings is lagging behind its peers

Approach 1: Allison Transmission Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental tool for estimating the intrinsic value of a company by projecting its future cash flows and then discounting those amounts back to today's dollars. Simply put, it tries to predict what the business is truly worth right now, based on the money it is expected to generate over the coming years.

For Allison Transmission Holdings, the current Free Cash Flow (FCF) sits at $672.2 million. Analyst forecasts provide projections for the next several years, with FCF expected to steadily grow, reaching $1.20 billion in 2029 according to available estimates and further extrapolation. This pattern reflects a blend of analyst opinion and moderated growth assumptions, projecting an ongoing rise in the company’s cash-generating potential.

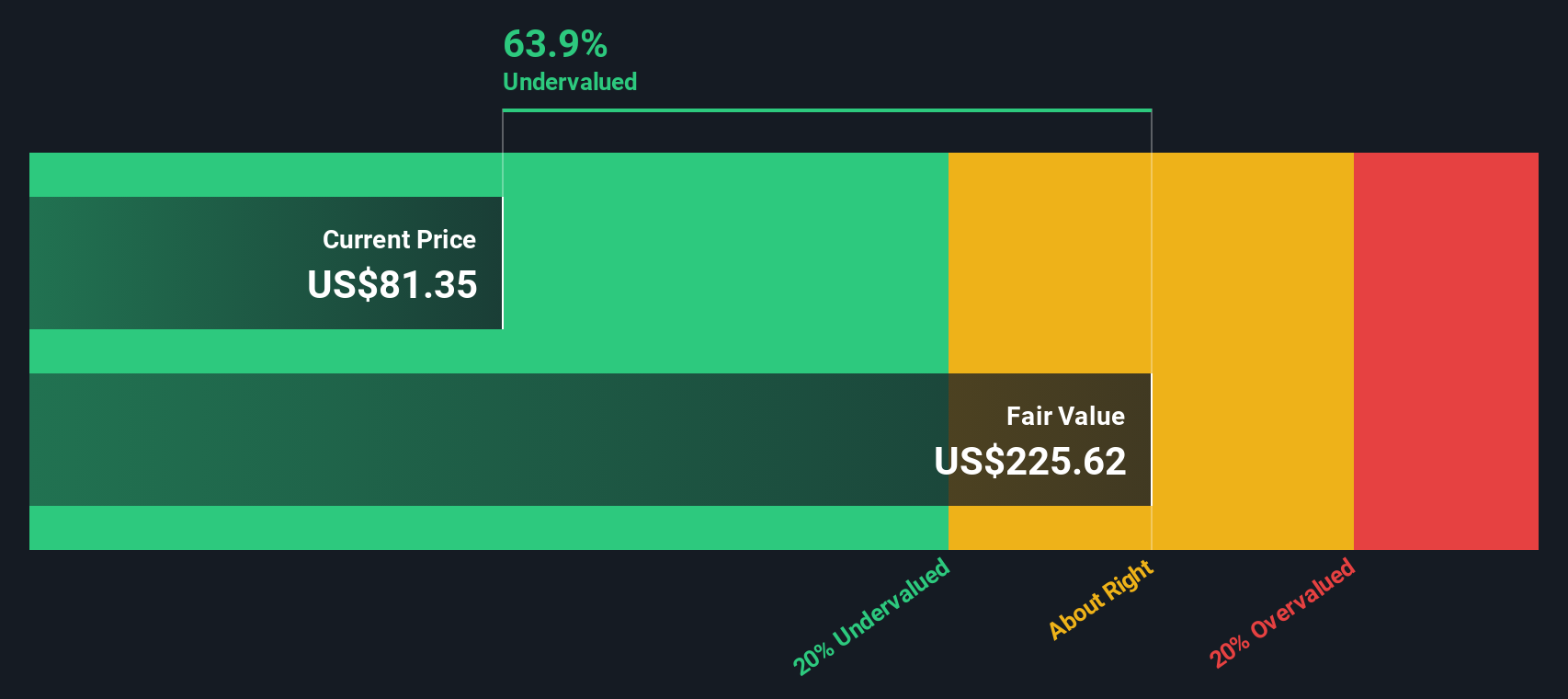

Using this two-stage Free Cash Flow to Equity model, Allison's intrinsic value is estimated at $243.92 per share. With the stock currently trading at $82.11, the model suggests the shares are trading at a 66.3% discount to fair value. In other words, the stock appears undervalued when measured by its long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Allison Transmission Holdings is undervalued by 66.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Allison Transmission Holdings Price vs Earnings

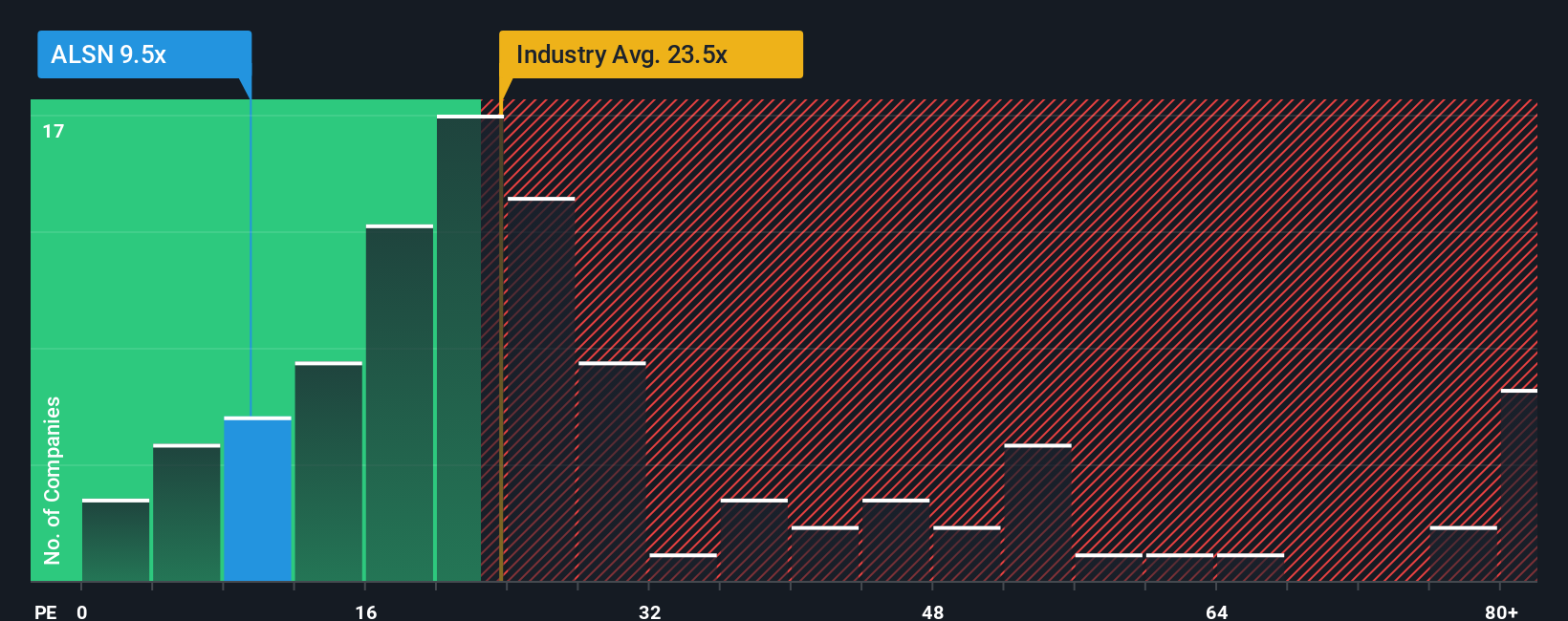

For established, profitable companies like Allison Transmission Holdings, the Price-to-Earnings (PE) ratio serves as a tried-and-true way to assess market valuation. The PE ratio effectively shows how much investors are willing to pay today for each dollar of a company’s earnings, making it a reliable yardstick for comparing profitability and expected growth within similar businesses.

It is important to remember that what counts as a reasonable or “fair” PE ratio depends on several factors, especially the company's growth outlook and risk. Fast-growing or lower-risk companies often command higher PE multiples, while more mature or riskier ones tend to trade at lower levels. These considerations help set the standard for what investors should expect from a company like Allison.

Currently, Allison Transmission Holdings trades at a PE ratio of 9.01x. This is significantly below the Machinery industry average of 24.50x and the peer average of 22.20x. At first glance, that discount might suggest an opportunity, but numbers alone do not tell the whole story. This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for Allison is calculated at 21.55x, taking into account nuanced factors like the company’s specific earnings growth potential, industry conditions, profit margins, market cap, and overall risk profile.

Unlike a simple peer or industry comparison, the Fair Ratio provides a much more tailored benchmark. By adjusting for the context of Allison’s performance and risks, it gives a more accurate sense of how the market should value the stock.

Comparing Allison's current PE ratio of 9.01x with its Fair Ratio of 21.55x, the stock stands out as significantly undervalued on this measure. In short, while standard metrics already show a discount, the proprietary Fair Ratio highlights how much room there could be for this stock to rerate higher if market sentiment or company performance improves.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Allison Transmission Holdings Narrative

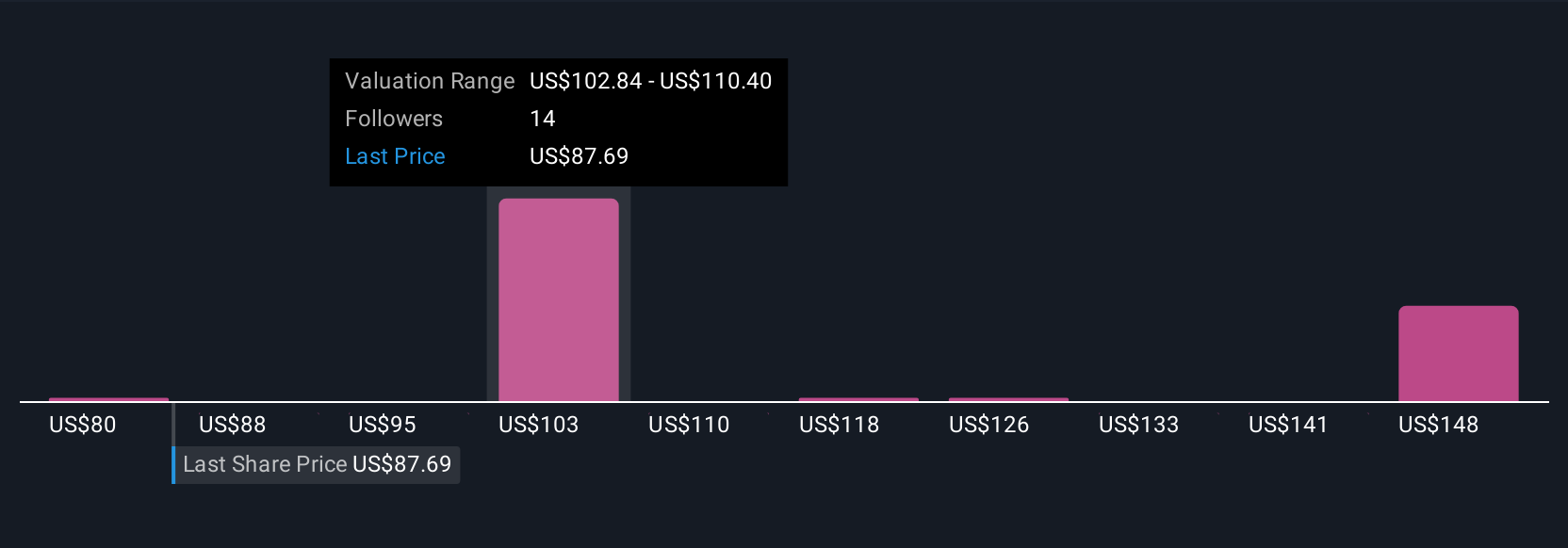

Earlier, we hinted at a more effective way to decode a stock’s value, so let’s introduce you to Narratives. A Narrative is simply your story—your perspective on how a company’s future will play out, grounded in your own assumptions for its revenue, profit margins, and growth. Instead of relying solely on numbers, a Narrative connects the company’s fundamental story, your financial forecast, and a calculated fair value all in one clear picture.

On the Simply Wall St platform's Community page, Narratives make this easy and accessible for everyone, allowing millions of investors to transparently map out why they believe a company is a buy, hold, or sell. They help you decide by directly comparing each Narrative's Fair Value to today’s share price, updating instantly as news and results emerge. This means your understanding evolves as the company does.

For Allison Transmission Holdings, one investor might see surging demand for electrified drivetrains and global expansion as reasons to set a Fair Value near $129, while another may focus on integration risks and slowing growth and place theirs around $84. Both can refine those views as new information arrives.

Do you think there's more to the story for Allison Transmission Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALSN

Allison Transmission Holdings

Designs, manufactures, and sells fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives