- United States

- /

- Building

- /

- NYSE:ALLE

Allegion (ALLE) Valuation in Focus After Launch of Schlage Performance Series Locks for Commercial Real Estate

Reviewed by Kshitija Bhandaru

If you are thinking about what to do with Allegion (ALLE) after its latest product rollout, you are not alone. This week the company introduced its Schlage Performance Series Locks, a move aligned with heightened demand for cost-effective, secure solutions in commercial real estate and multifamily markets. As construction and operational budgets tighten, Allegion is betting on streamlined installation and priority delivery to meet customers where the need is greatest. For investors, the new offering signals the company’s ongoing effort to address both industry challenges and future growth opportunities.

This announcement fits into an eventful stretch for Allegion, which has also rolled out upgrades to its Overtur OnSite App this month. Momentum is clearly building, with the stock up 22% in the past three months and an impressive 23% over the year. Outperformance in recent years has been supported by consistent revenue and net income growth, and even some strong insider buying, further fueling market interest. The company’s ability to adapt with products that anticipate client needs continues to be a theme in its long-term performance.

So after a year marked by strong returns and bold product launches, is Allegion a bargain waiting to be discovered or has the market already accounted for its future growth?

Most Popular Narrative: Fairly Valued

According to the most widely followed analyst narrative, Allegion’s stock is currently trading in line with its fair value. This suggests that the market has largely priced in both its future earnings prospects and potential risks.

Strategic investments in electronic and software acquisitions (ELATEC, Gatewise, Waitwhile) are expected to drive new recurring revenue streams and margin accretion starting in 2026. This could enhance both top-line growth and the net margin profile as SaaS and high-margin hardware increase their share within the portfolio.

Can Allegion’s next leap in value come from these bold bets on recurring revenue? Discover which pivotal financial forecasts and assumptions have analysts holding steady on their price target. The narrative centers on revenue expansion and reimagined profit margins, but the real driver may surprise even the most seasoned investor. Interested in which growth levers define this fair value? The details make the story truly compelling.

Result: Fair Value of $174.64 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing challenges in Allegion’s international segment or a slowdown in nonresidential construction could quickly alter this otherwise balanced outlook.

Find out about the key risks to this Allegion narrative.Another View: Discounted Cash Flow Tells a Different Story

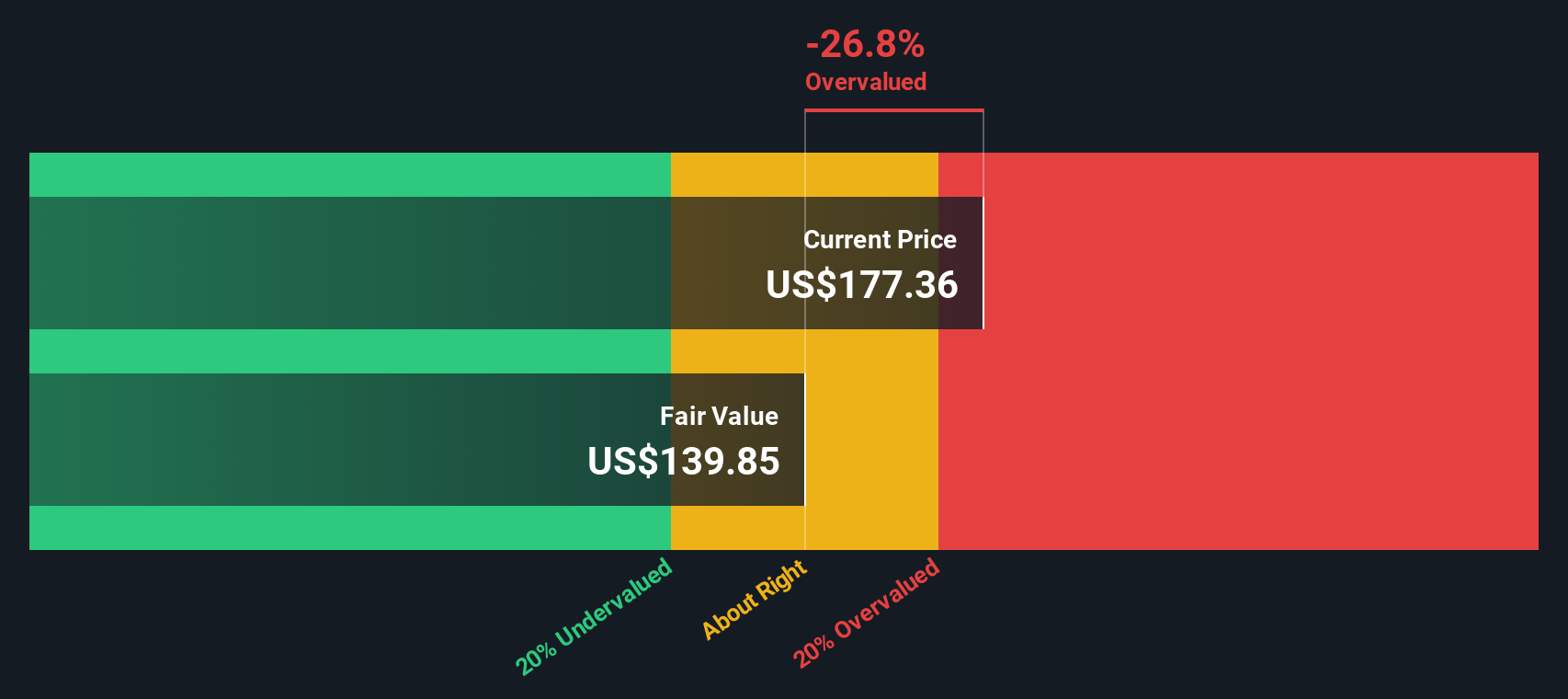

A look through the lens of our DCF model offers a more cautious perspective. While the analyst consensus suggests Allegion is fairly valued, the DCF method points to shares trading above what the company is fundamentally worth. Which view better captures reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Allegion Narrative

If this view does not fully capture your outlook, or if you want to dig into the details personally, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Allegion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss your opportunity to move ahead of the crowd. Use these tailored stock ideas to spot undervalued opportunities, trends transforming entire sectors, and companies redefining tomorrow’s technology.

- Accelerate your hunt for stocks trading below their true worth by checking out overlooked gems with undervalued stocks based on cash flows in high-potential industries.

- Tap into fast-growing healthcare firms on the cutting edge of artificial intelligence by reviewing the leaders poised for breakthroughs using healthcare AI stocks.

- Capture the momentum in digital payments, blockchain innovation, and crypto pioneers by exploring companies riding the future wave with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLE

Allegion

Engages in the provision of security products and solutions worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives