- United States

- /

- Machinery

- /

- NYSE:ALG

Alamo Group (ALG): Assessing Valuation After 15% Dividend Increase and Ongoing Growth Strategy

Reviewed by Kshitija Bhandaru

Alamo Group (ALG) just announced a 15% increase to its quarterly dividend, raising it to $0.30 per share. This marks its 33rd consecutive year of growing payments and highlights a steady approach to shareholder returns.

See our latest analysis for Alamo Group.

Alamo Group’s share price has seen some ups and downs this year, with recent trades hovering near $192 and fluctuating between highs of $232 and lows of $189. Yet, momentum remains positive as its total shareholder return over the past year is just under 10%, and long-term investors have enjoyed nearly 67% gains over five years. Recent moves like the dividend hike and ongoing acquisitions point to sustained growth potential, supporting a confident outlook even as the broader machinery sector faces cyclical headwinds.

If you’re searching for your next opportunity beyond Alamo Group, it’s a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock now trading above its intrinsic value and expectations for double-digit earnings growth, investors have to decide whether Alamo Group is a hidden bargain amid sector volatility or if future growth is already priced in.

Most Popular Narrative: 21.5% Undervalued

With the current fair value estimate set at $244.25, Alamo Group’s last close of $191.66 signals strong upside in the eyes of the most-followed market narrative. This positions the share price well below future growth expectations as projected by leading consensus forecasts.

“Robust organic growth in the Industrial Equipment division, evidenced by record sales (+17.6% YoY), soaring backlog (~$510 million), and strong order bookings (+21% YoY in Q2), is directly tied to rising infrastructure investments and government spending, conditions expected to persist globally. These factors support continued revenue expansion and earnings growth.”

Want to know what’s fueling this optimism? One assumption dominates the calculation: the company’s aggressive profit margin expansion, paired with growth rates that defy industry slowdowns. Curious how confident the narrative is in these projections? Find out what financial leap is forecast over the next few years and dive into the underlying logic to see what is really driving that bullish price target.

Result: Fair Value of $244.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in key segments and uncertainty around the CEO transition could challenge the bullish growth story if these issues persist.

Find out about the key risks to this Alamo Group narrative.

Another View: Are the Multiples Telling a Different Story?

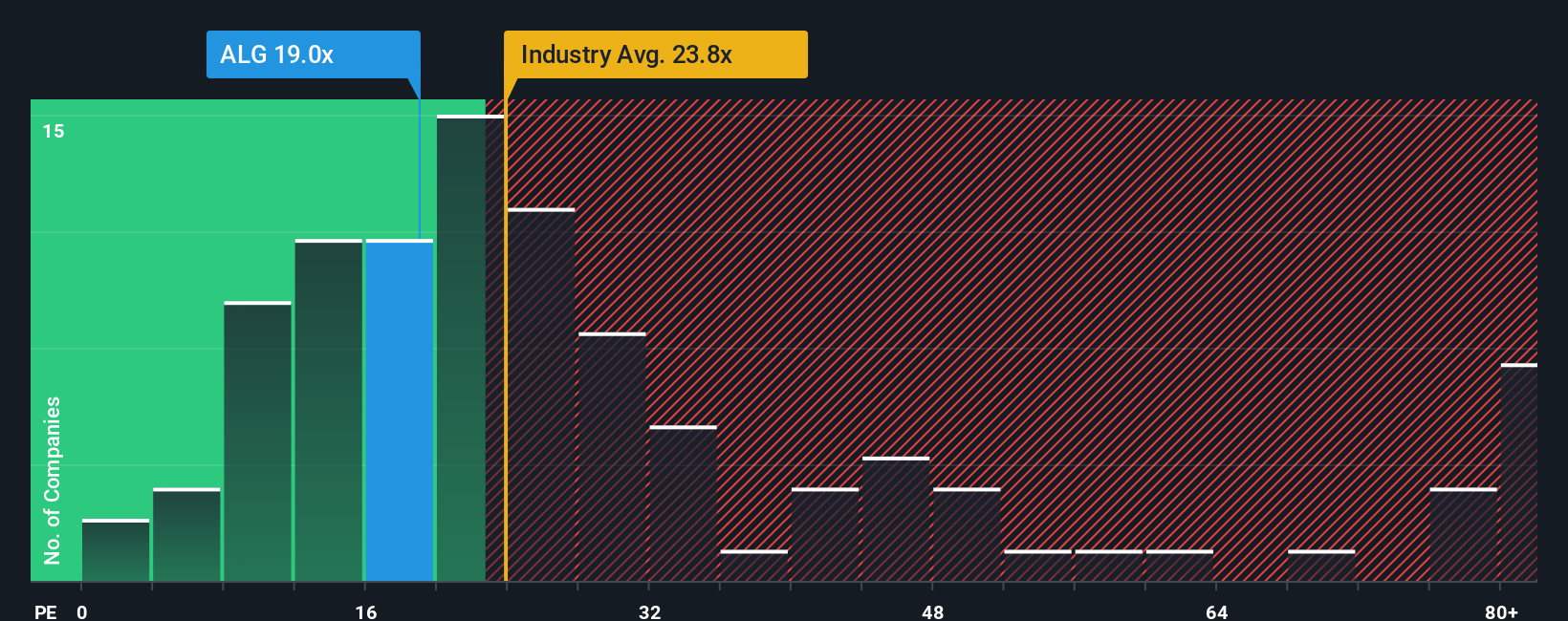

While the consensus fair value highlights meaningful upside, a closer look at Alamo Group’s price-to-earnings ratio shows the stock trading at 19.6x, below both the industry average of 24.5x and its fair ratio of 20.7x. That suggests a margin of safety. Could the market be missing something, or is this a fair discount for slower growth?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alamo Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alamo Group Narrative

If the consensus view doesn’t quite fit your perspective, dive deeper into the data and craft your own investment narrative in just a few minutes with Do it your way

A great starting point for your Alamo Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Move?

Don’t hesitate and risk missing out; let Simply Wall Street’s powerful screener connect you to high-potential stocks designed for smarter, stronger portfolios.

- Uncover opportunities for stable income by analyzing these 19 dividend stocks with yields > 3% that consistently reward shareholders with attractive yields above 3%.

- Seize the potential of breakthrough innovation with these 25 AI penny stocks at the forefront of artificial intelligence-driven market growth.

- Capitalize on overlooked value by spotting these 886 undervalued stocks based on cash flows that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALG

Alamo Group

Designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives