- United States

- /

- Trade Distributors

- /

- NYSE:AL

Air Lease (AL): Evaluating Current Valuation After a Year of Strong Gains

Reviewed by Simply Wall St

See our latest analysis for Air Lease.

After a year of impressive gains, Air Lease’s momentum shows few signs of slowing. The share price has climbed 32.97% year-to-date, with the latest close at $63.77. Its total shareholder return over the past twelve months stands at a robust 42.53%. Three- and five-year total returns are even stronger, highlighting steady performance and investor confidence despite shifting market sentiment.

If you’re thinking about what else could be gaining traction, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

This strong performance prompts an important question for investors: Is Air Lease still undervalued, or has the market already priced in the company’s future growth? Could there be further upside, or is caution warranted?

Most Popular Narrative: 4.3% Undervalued

Air Lease’s most widely tracked narrative sets fair value at $66.67, slightly above the current close. This suggests analysts see limited but meaningful upside, grounded in detailed projections of how global demand and industry change could power further gains.

The trend towards stricter environmental regulations and airline fleet renewal is supporting higher demand for next-generation, fuel-efficient aircraft. Air Lease's young fleet positions it to capitalize on this shift, enabling premium pricing on leases and improved net margins as airlines seek to reduce emissions and replace older jets.

Curious what powers this premium valuation? It is not just about growth; it is the narrative’s bold financial projections for Air Lease’s future revenue mix, margins, and a surprisingly elevated profit multiple. See what supports these expectations inside.

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising financing costs and uncertainty over nonrecurring insurance gains could challenge Air Lease’s earnings outlook and may temper analyst confidence in near-term growth.

Find out about the key risks to this Air Lease narrative.

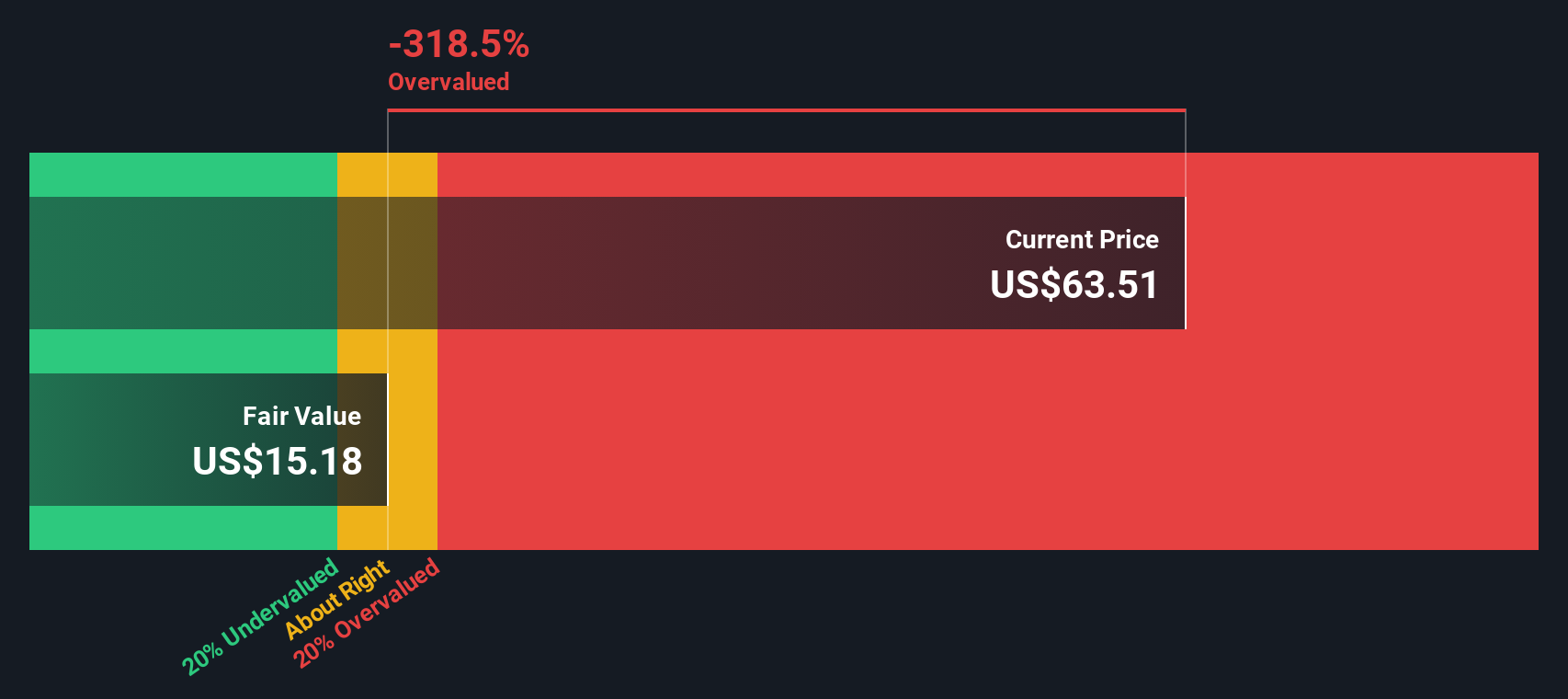

Another View: Discounted Cash Flow Model Differs Sharply

While the analyst consensus sees Air Lease as undervalued, our DCF model paints a starker picture. It suggests the current share price is well above estimated fair value. This may indicate that much of the growth and optimism is already reflected in the price. What should investors make of this split perspective?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Lease for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Lease Narrative

If you see things differently or want to dive into the numbers yourself, you can put together your own perspective in just a few minutes. Do it your way.

A great starting point for your Air Lease research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by while you focus on one stock. There is a world of unique investments ready for your watchlist. Start your search with these curated ideas below:

- Spot income opportunities that go beyond typical growth plays by checking out these 21 dividend stocks with yields > 3% with reliable yields above 3%.

- Capitalize on technological breakthroughs by tapping into these 26 AI penny stocks reshaping industries with artificial intelligence and automation.

- Seize undervalued gems trading below their intrinsic value by scanning these 854 undervalued stocks based on cash flows for strong cash-flow businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AL

Air Lease

An aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines in the Asia Pacific, Europe, the Middle East, Africa, Mexico, Central America, South America, the United States, and Canada.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives