- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

Should AAR’s (AIR) Interim CFO Appointment Reshape Its Capital Allocation and Execution Priorities?

Reviewed by Sasha Jovanovic

- AAR Corp. recently announced that Senior Vice President and Chief Financial Officer Sean M. Gillen resigned earlier this month, with Vice President of Financial Operations Sarah L. Flanagan stepping in as interim CFO to oversee the company’s finance function.

- The move places an experienced internal leader with deep knowledge of AAR’s MRO, parts distribution, and digital initiatives at the center of its capital allocation and growth plans.

- We’ll now examine how appointing long-time insider Sarah Flanagan as interim CFO could influence AAR’s investment narrative and execution priorities.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AAR Investment Narrative Recap

To own AAR today, you need to believe in the long term demand for third party aircraft maintenance, repair, and parts supply, and the company’s ability to convert that into higher earnings despite thin current margins and competition from OEMs. The CFO transition to long time insider Sarah Flanagan looks incremental rather than thesis changing, and the sharpest near term swing factor remains execution on higher margin Parts Supply and digital initiatives versus the risk of a slowdown in commercial aviation demand.

The recent US$249,000,000 follow on equity offering is especially relevant here, because it underlines how much AAR is leaning on shareholder capital to fund growth while its free cash flow has been close to breakeven. That choice can amplify the benefit if AAR’s aftermarket and digital bets pay off, but it also raises the stakes for any stumble in integrating acquisitions or defending share against OEMs in key MRO and parts distribution contracts.

Yet while the growth story can sound compelling, investors should also be aware that...

Read the full narrative on AAR (it's free!)

AAR’s narrative projects $3.2 billion revenue and $293.3 million earnings by 2028. This requires 4.8% yearly revenue growth and a roughly $280.8 million earnings increase from $12.5 million today.

Uncover how AAR's forecasts yield a $92.25 fair value, a 12% upside to its current price.

Exploring Other Perspectives

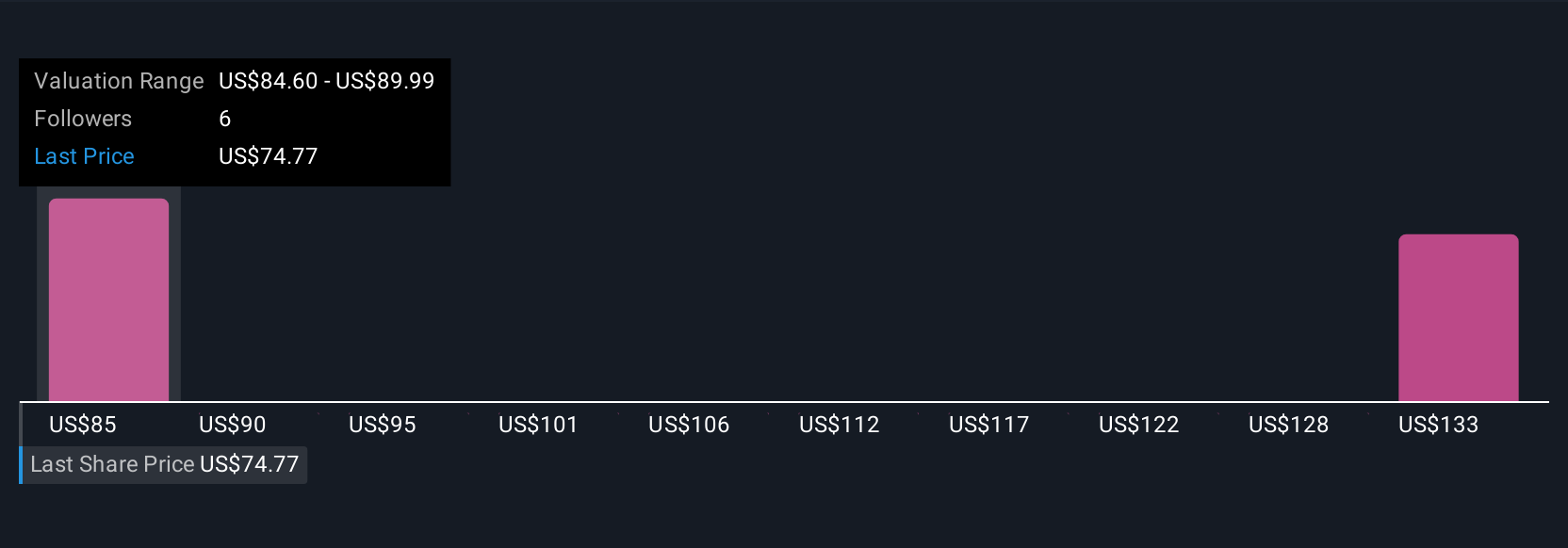

Three Simply Wall St Community fair value estimates for AAR range from US$76.69 to US$191.82, underscoring how far apart individual views can be. Set these wide valuation gaps against the concentration of risk in AAR’s commercial aviation exposed Parts Supply business, and you can see why it pays to weigh several viewpoints before deciding how this stock might fit in your portfolio.

Explore 3 other fair value estimates on AAR - why the stock might be worth 7% less than the current price!

Build Your Own AAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AAR's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026