- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

How Does AAR Stack Up After Recent Surge and Major Defense Contract Win?

Reviewed by Bailey Pemberton

Thinking about what to do with your AAR shares, or maybe weighing up whether now is the right time to dive in? You are definitely not alone. With the stock closing at $83.01 and showing recent returns that are hard to ignore—up 6.0% in just the last week, 11.0% over the past month, and an impressive 34.8% year-to-date—many investors are taking a closer look. Even the long-term numbers stand out, with gains of 94.4% across three years and a massive 303.5% over five years.

Recent momentum has been boosted by broader market optimism in sectors where AAR operates. Growing chatter about global supply chains returning to strength, alongside expectations for major contract wins in the aerospace industry, have clearly played a part in pushing confidence and the stock price higher. That growth potential is drawing in more eyes, but it is also changing how risk is perceived. As more investors pile in, questions naturally turn to whether the stock is still a bargain, or if the best gains are in the rear-view mirror.

If you are looking at the numbers through a valuation lens, AAR currently earns a value score of 2 out of 6, meaning the company is viewed as undervalued on only two of the six standard criteria. But numbers by themselves do not tell the whole story. Next, we will break down each of those valuation approaches, and later in the article, I will share a smarter, more holistic way to judge whether AAR is truly undervalued or something even better.

AAR scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AAR Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's worth by projecting future cash flows and discounting them back to today's dollars. This method relies on forecasts for how much cash the business will generate and determines what those future dollars are worth right now.

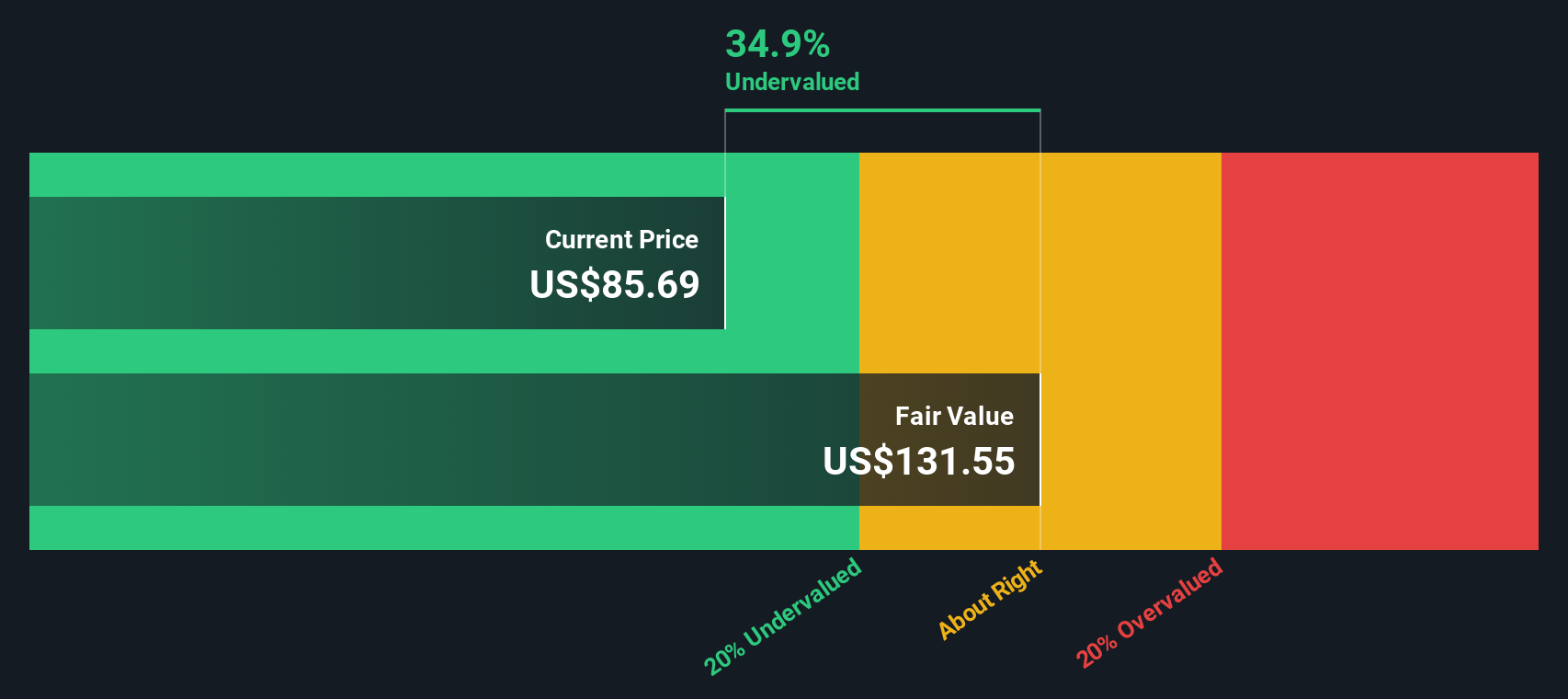

For AAR, current Free Cash Flow (FCF) is reported at negative $27.33 million, meaning the company is currently generating negative free cash. However, analysts expect a dramatic turnaround, forecasting FCF to reach $203 million by 2028, with a steady climb through the next decade according to Simply Wall St projections. By 2035, FCF is projected to top $411.85 million. These projections underpin the two-stage DCF model used here.

Based on these calculations, the intrinsic value of AAR shares comes out to $130.61. With the current price sitting at $83.01, the DCF model suggests the stock is trading at a 36.4% discount. Put simply, if these growth forecasts hold true, AAR appears significantly undervalued relative to its potential future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AAR is undervalued by 36.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AAR Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular and effective metric for gauging the relative value of profitable companies like AAR. It shows how much investors are willing to pay for each dollar of earnings. A high PE ratio often reflects expectations of strong future growth, while a lower PE can signal slower growth or higher risks.

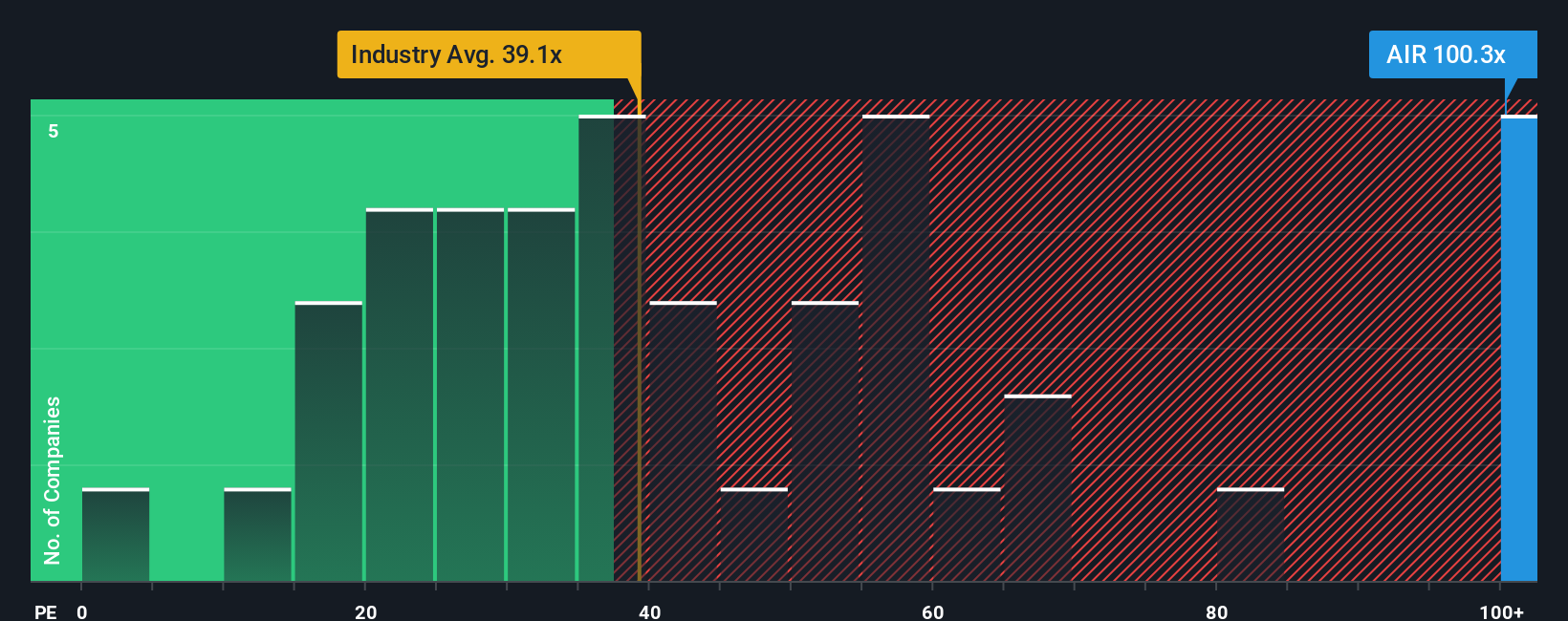

Looking at AAR's metrics, the company currently trades at a PE ratio of 113.6x. This stands out compared to the Aerospace & Defense industry average of 37.5x and the peer group average of 44.0x. These benchmarks help put AAR’s valuation into perspective but do not consider factors unique to AAR's business model or growth outlook.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for AAR is 52.1x, representing what the PE “should be” given the company's earnings growth, margins, industry profile, market cap, and risk factors. Unlike simple industry or peer comparisons, the Fair Ratio adjusts for those unique attributes, making it a more tailored benchmark for whether AAR stock is valued appropriately.

Comparing AAR’s actual PE of 113.6x to the Fair Ratio of 52.1x suggests the shares are currently overvalued by this measure. The premium price investors are paying goes well beyond what is justified by company fundamentals and sector risk, which is worth considering if you are thinking about buying or holding at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AAR Narrative

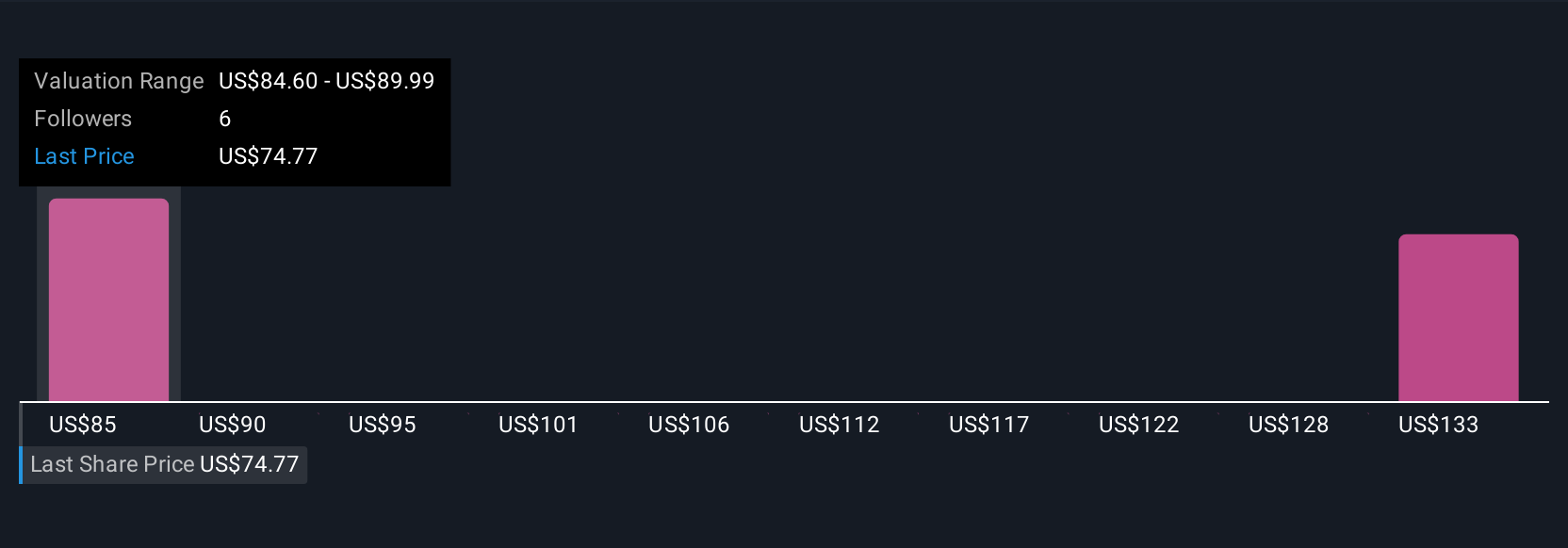

Earlier we mentioned there is an even better way to understand whether AAR is undervalued. Let us introduce you to Narratives. Rather than simply relying on static numbers or industry benchmarks, Narratives allow investors to combine their own outlook on a company with key financial forecasts, connecting the story behind the business with assumptions for its future revenue, earnings, and margins.

A Narrative is your personal perspective, where you lay out why you believe AAR will succeed or struggle, and then anchor that story to concrete growth forecasts and a calculated fair value for the stock. Narratives are easy to create and follow on Simply Wall St’s Community page, where millions of investors share and track their thinking. The real power of this approach is how it helps you decide when to buy or sell by directly comparing your Narrative’s fair value with the live market price.

Plus, Narratives update automatically as new company news or financial results are released, ensuring your investment thesis stays current. For example, some investors believe AAR’s sold-out MRO expansions and leading parts distribution growth justify a much higher fair value, while others highlight profit margin risks and industry disruption as reasons to be more cautious. Narratives let you capture that difference in view and make clearer, more confident investment calls.

Do you think there's more to the story for AAR? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives