- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

Assessing AAR (AIR) Valuation Following Recent Financial Results and Upward Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for AAR.

AAR has been on a strong run, with a 12.5% share price return over the past month and a year-to-date gain of nearly 38%. This kind of momentum follows recent financial updates and adds to an impressive long-term track record. A five-year total shareholder return of 339% makes it clear that investors are rewarding both solid execution and growth potential.

If you’re curious about other stocks showing this kind of momentum, now is an ideal time to broaden your approach and discover fast growing stocks with high insider ownership

With shares climbing and robust results just reported, the big question is whether AAR is still trading at an attractive value or if the market has already factored in all of its future potential growth.

Most Popular Narrative: 6.9% Undervalued

AAR’s fair value, according to the most widely followed narrative, stands at $91 per share. This is slightly above the last close of $84.73, suggesting moderate room for upside if the assumptions play out. This perspective centers around the company’s accelerating growth engines and newly won contracts, setting the stage for a key catalyst.

*Expansion of MRO and distribution capabilities, along with growth in digital platforms, positions AAR for sustained revenue and margin improvement as air travel and supply chain needs rise. Strategic moves into government contracts and operational efficiencies buffer cyclical risks, supporting stability and higher long-term profitability.*

Want to know what powers this bullish narrative? Analysts are betting on a future transformation with bold profit margins, soaring revenue, and an industry-defying valuation multiple. Find out which financial inflection points could change everything for AAR and see how much upside is built in.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising OEM competition and execution risks related to digital investments could quickly challenge this positive outlook and put future gains in jeopardy.

Find out about the key risks to this AAR narrative.

Another View: Multiples Paint a Cautious Picture

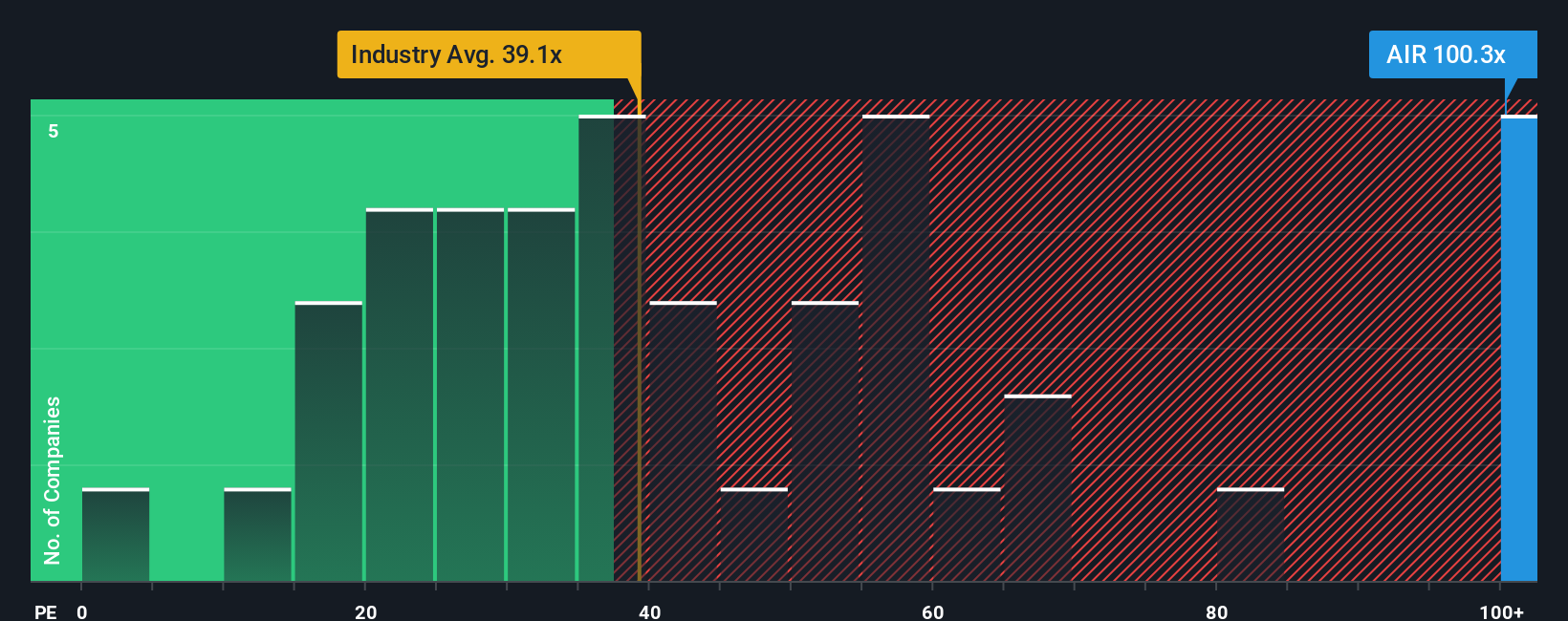

While the earlier narrative sees moderate upside, a look at AAR’s price-to-earnings ratio reveals a much less optimistic view. At 116x, it is not only well above the US Aerospace & Defense industry average of 38.7x, but also higher than peers at 46x and surpasses its fair ratio of 52.2x. This significant gap hints at valuation risk. Could the market’s optimism be overdone, or are investors seeing something others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If you see the numbers differently or want to follow your own instincts, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move stand out. Tap into new opportunities and stay ahead of trends with handpicked stock ideas that could shape your portfolio’s future.

- Spot emerging tech opportunities early and sharpen your edge by checking out these 24 AI penny stocks. These stocks are driving transformative advancements across sectors.

- Fuel your strategy with solid cash flow picks by scanning these 881 undervalued stocks based on cash flows, which may be quietly trading below their true potential.

- Strengthen your hunt for consistent returns and income by browsing these 17 dividend stocks with yields > 3%, featuring yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives