- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

AAR Corp. (AIR): Evaluating Valuation After $249 Million Equity Raise and Capacity Expansion

Reviewed by Kshitija Bhandaru

AAR (AIR) just completed a follow-on equity offering worth $249 million, selling 3 million shares of common stock. This move provides new capital that could support both growth plans and financial flexibility.

See our latest analysis for AAR.

Shares of AAR have pulled back in the past week but remain up 27.16% year-to-date. The company’s one-year total shareholder return stands at 27.33%. Momentum has been steady rather than explosive, as recent initiatives such as expanding MRO capacity and securing fresh capital signal management’s confidence in the longer-term growth runway.

If this kind of steady outperformance makes you curious about similar opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The real question for investors now is whether AAR’s shares still offer attractive value given the company’s strong results and analyst optimism, or if the market is already pricing in most of its future potential.

Most Popular Narrative: 13.9% Undervalued

Compared to AAR's last close price of $78.32, the most popular narrative sets a fair value of $91, drawing on a bullish outlook rooted in operational expansion and digital transformation. The current price sits meaningfully below this narrative anchor, inviting investors to scrutinize the assumptions behind such a gap.

The commercialization of additional MRO capacity in Oklahoma City and Miami, both already sold out before opening, positions AAR to capitalize on the expected long-term rise in global air travel and the need for ongoing maintenance of aging aircraft fleets. This supports robust revenue growth and improved earnings visibility. AAR's strong growth in new parts Distribution (25%+ organic, significantly above market) directly aligns with increasing demand for resilient supply chains and more diversified inventory management from both commercial and government customers, indicating sustained future revenue expansion and potential for higher margins.

Can you spot the engine of this high valuation? One key assumption here involves a forecast for margins and earnings growth that would surprise even seasoned investors. Want to find out what analyst projections are propelling this price target? Dig in to uncover the bold numbers and financial logic that fuel this narrative’s bullish case.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from OEMs and the risk of commercial aviation slowdowns could quickly test the confidence underlying these bullish forecasts.

Find out about the key risks to this AAR narrative.

Another View: Valuation Is Not All Clear Skies

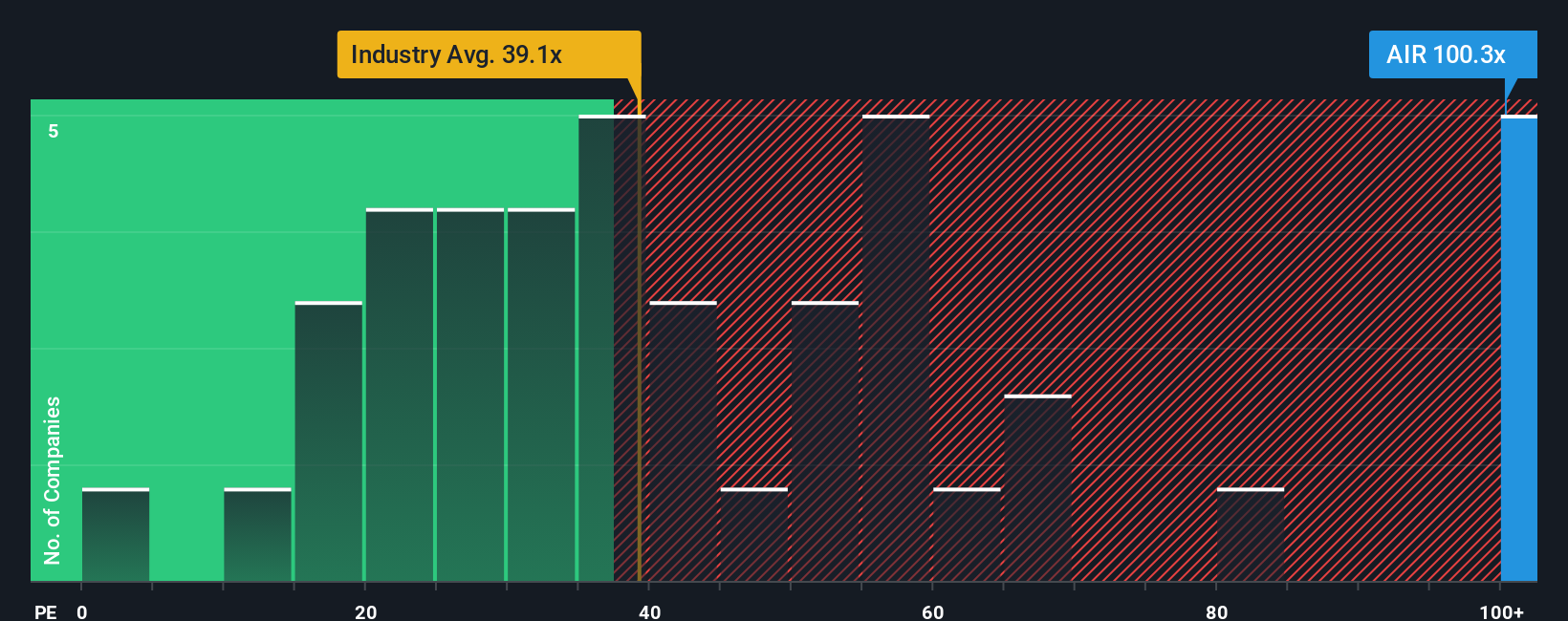

Taking a look at where AAR trades relative to earnings gives us a more cautious perspective. Its current price-to-earnings ratio stands at 107.2x, which is much higher than the US Aerospace & Defense industry average of 38.9x, its peer average of 43.1x, and the market's suggested fair ratio of 51.7x. This signals a valuation premium that could amplify downside risk if growth expectations fall short. Are investors paying too much for the growth story, or could momentum push valuations even higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If you see the story differently or want to dive deeper into the numbers on your own terms, shaping your own view takes just a few minutes, so go ahead, Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Plenty of high-potential stocks are waiting if you know where to look. Stay ahead by tapping these smart filters and don’t risk missing out on the next market leaders.

- Capture consistent income by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for investors seeking reliable cash flow.

- Spot the future of innovation with these 26 quantum computing stocks, where companies are driving transformative change in quantum computing technology.

- Ride market trends with these 893 undervalued stocks based on cash flows featuring stocks trading below intrinsic value based on their cash flows and long-term fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives