- United States

- /

- Aerospace & Defense

- /

- NYSE:AIR

A Look at AAR (AIR) Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for AAR.

Even with today's small dip, AAR's share price is still up more than 30% year-to-date. This suggests that momentum is holding strong after a stretch of steady gains and a 1-year total shareholder return of 25%. The latest move might simply reflect investors locking in profits amid a strong longer-term uptrend.

If you’re sizing up where the next winners might emerge, it’s a good time to broaden your sights and check out See the full list for free..

With impressive gains already booked, the key question now is whether AAR's current valuation leaves further upside for investors or if the market has already accounted for its future growth prospects. Is there still a buying opportunity?

Most Popular Narrative: 10% Undervalued

AAR’s most-followed narrative places the company’s fair value at $91 per share, above its recent closing price of $81.80. With momentum in the stock and impressive profitability forecasts, bulls are closely watching what could drive this view higher.

"The commercialization of additional MRO capacity in Oklahoma City and Miami, both already sold out before opening, positions AAR to capitalize on the expected long-term rise in global air travel and the need for ongoing maintenance of aging aircraft fleets, supporting robust revenue growth and improved earnings visibility."

What’s the secret behind this premium? Analysts’ forecasts are dialed up, hinging on major leaps in both profits and sales, plus a future earnings multiple that might surprise you. Want the real drivers behind that $91 target? Click through and get the entire story to see which bold assumptions power this upbeat scenario.

Result: Fair Value of $91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around AAR’s digital platform rollout and intensifying competition from major OEMs could still derail the bullish outlook for future gains.

Find out about the key risks to this AAR narrative.

Another View: Are the Valuation Ratios Sending a Warning?

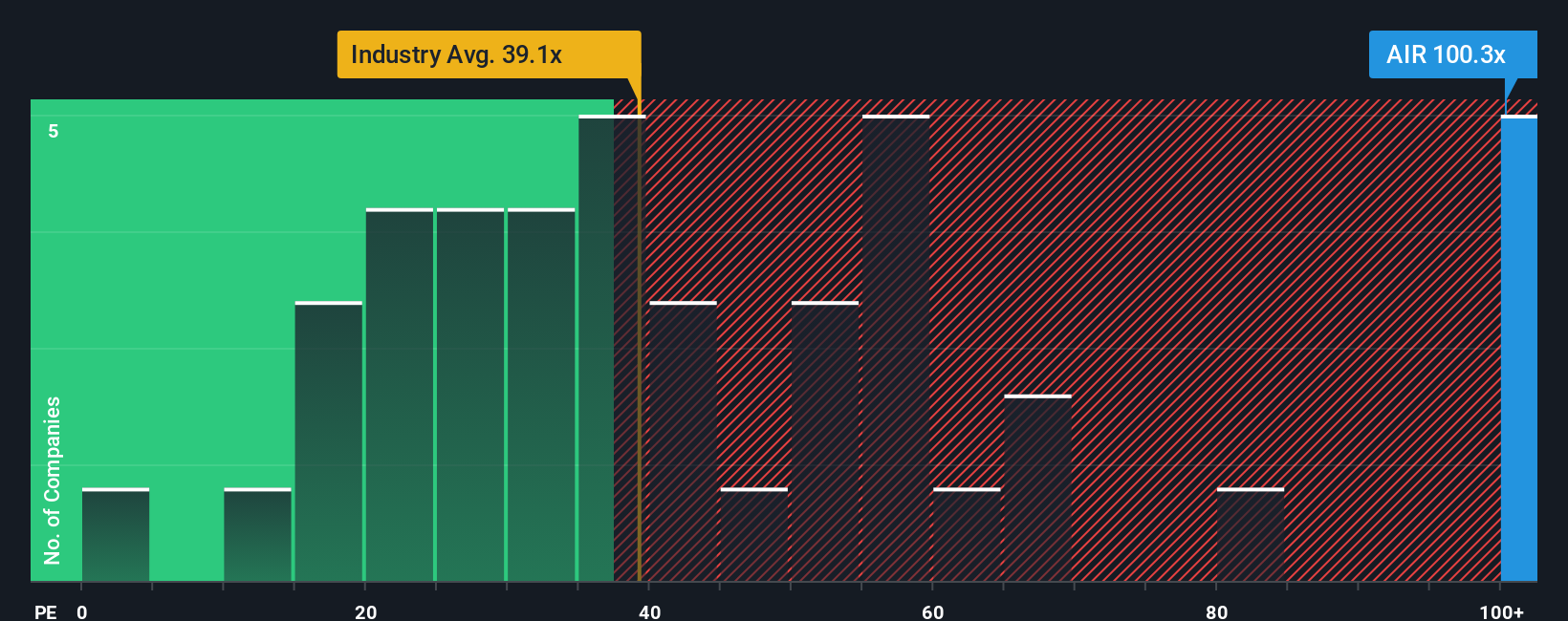

While the fair value narrative paints AAR as undervalued, the story changes when you look at the company’s price-to-earnings ratio. At over 100 times earnings, AAR trades far richer than both the industry average of 39 and its peers at 44. Even compared to a fair ratio of 81, the gap is wide and signals a possible premium that is hard to ignore. Is the optimism already baked in, or could this leave little room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

Prefer a hands-on approach or want to challenge these perspectives? Dive in, explore the numbers, and craft your own take in just minutes. Do it your way.

A great starting point for your AAR research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your potential by focusing on just one stock. Find your next standout investment with research trusted by millions of investors worldwide using the Simply Wall St Screener.

- Uncover tomorrow’s tech leaders shaping the data revolution by researching these 24 AI penny stocks in artificial intelligence and automation.

- Capture reliable income from companies built to share their gains through these 19 dividend stocks with yields > 3% that meet the 3% yield threshold.

- Jump ahead of market trends by evaluating these 3566 penny stocks with strong financials with strong financials that could deliver impressive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIR

AAR

Provides products and services to commercial aviation, government, and defense markets in North America, Europe, Africa, Asia, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.