- United States

- /

- Machinery

- /

- NYSE:AIN

Albany International (AIN): Valuation Insights Following Earnings Decline and Strategic Review Uncertainty

Reviewed by Simply Wall St

Albany International reported its third-quarter financials this week, revealing lower sales compared to last year and a shift from profit to net loss. The company also withdrew its full-year guidance as it conducts a strategic review of its Structures business, which adds uncertainty for investors.

See our latest analysis for Albany International.

Albany International’s share price has come under significant pressure lately, dropping 20.4% over the past month and 43% year-to-date. The recent withdrawal of guidance and a deeper third-quarter loss appear to have weighed on sentiment. The one-year total shareholder return stands at -42.8%, which highlights that momentum is fading both in the short and longer term, even as the company continues its share buyback program and strategic review.

If the uncertainty around Albany International has you rethinking your next move, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With such a steep drop in share price and ongoing uncertainty weighing on outlook, investors now face a critical question: is Albany International now undervalued and offering a contrarian opportunity, or is the market already factoring in its weakened growth prospects?

Most Popular Narrative: 23.8% Undervalued

Albany International’s most popular narrative points to a fair value nearly one-quarter above the last close price of $45.13, suggesting significant upside potential. The current valuation hinges on analyst forecasts of stronger profit margins and a rebound in growth, even as the company navigates industry disruption and structural risks.

*Accelerating adoption of lightweight composites in aerospace and defense, demonstrated by expanding content on next generation aircraft, ramping on key programs like CH-53K, LEAP, and Bell 525, and new applications such as 3D woven parts replacing titanium, positions Albany's Engineered Composites segment for significant high-margin revenue and earnings expansion.*

Curious how analysts justify this bold valuation? The narrative hinges on aggressive profit margin expansion and an optimistic earnings trajectory, but not for the reasons you might expect. The underlying calculation could surprise you. What’s the catch?

Result: Fair Value of $59.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in paper goods demand or setbacks in ramping up new aerospace programs could quickly undermine the optimistic outlook priced into Albany shares.

Find out about the key risks to this Albany International narrative.

Another View: Discounted Cash Flow Model Weighs In

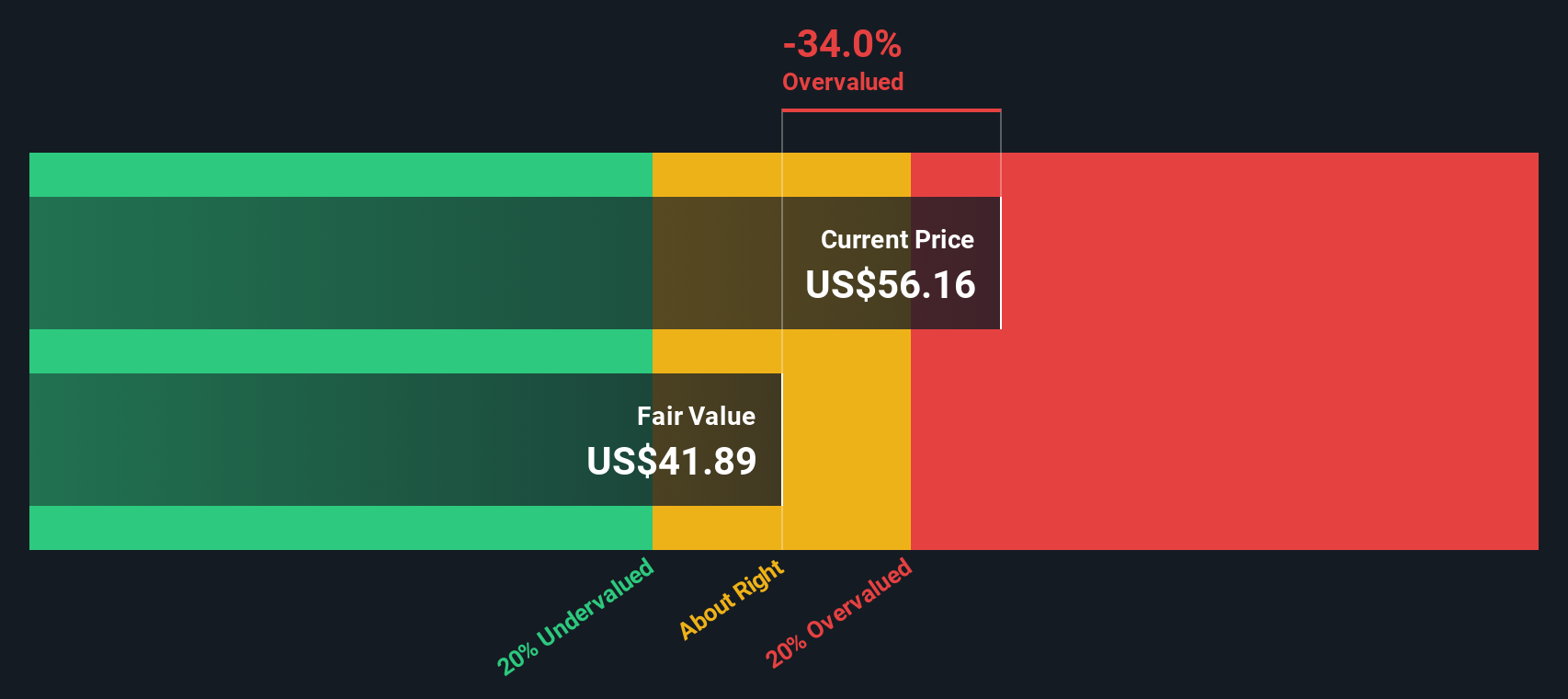

While analysts see upside based on earnings growth and margin expansion, our SWS DCF model suggests a more cautious stance. It estimates Albany International's fair value well below the current share price, which could indicate potential downside if cash flows do not materialize as forecast. With the models in clear disagreement, which scenario is more likely to play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albany International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albany International Narrative

If you have your own perspective or want to dig deeper into the numbers, you can put together your own analysis in just a few minutes and Do it your way.

A great starting point for your Albany International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for the next strong opportunity. Don’t let the best performers slip past you just because you stopped at one name.

- Unlock stable, long-term cash flow by checking out these 17 dividend stocks with yields > 3%, which is packed with companies delivering yields greater than 3%.

- Catch early momentum with these 82 cryptocurrency and blockchain stocks as crypto and blockchain leaders transform digital finance and new-age security.

- Tap into the explosive growth of real AI disruptors by browsing these 26 AI penny stocks, which are set to redefine entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIN

Albany International

Engages in the machine clothing and engineered composites businesses.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives