- United States

- /

- Construction

- /

- NYSE:AGX

Is Now the Right Moment for Argan After Shares Surge Nearly 19% This Month?

Reviewed by Bailey Pemberton

If you have been watching Argan’s stock lately, you know it has been hard to ignore. Maybe you are wondering if now is the moment to get on board, trim your position, or stay patient. It is a fair question, especially with the stock up a staggering 10.8% in just the past week and nearly 18.6% over the past month. Year to date, Argan has returned 98.1%, and if you had the hindsight to invest three or five years ago, you would be sitting on 824.5% and 661.1% gains, respectively. It is easy to see why investors and analysts alike are talking about what is driving these price moves and what might come next.

A factor that cannot be ignored is the wider market momentum fueling optimism in certain sectors. This environment is reflected in Argan’s recent price action. As growth and risk perceptions shift, Argan has benefited from renewed investor confidence amid market developments relevant to its business. But while momentum and market excitement are important, the real question for smart investors is whether Argan is undervalued, fairly valued, or getting ahead of itself.

Looking at the numbers, Argan currently earns a value score of 3 out of 6, meaning it is undervalued in three out of six standard valuation checks. For anyone making a buy or sell decision, breaking down these checks could reveal if the rally is built on solid ground. Next, let us walk through each valuation method. For those looking for a more holistic approach, stay tuned for an even better way to understand what Argan might really be worth.

Approach 1: Argan Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates how much a business is worth today by projecting its future cash flows and discounting them back to the present. In Argan's case, analysts and financial models use expected Free Cash Flow (FCF) figures to calculate this value.

Currently, Argan's Free Cash Flow stands at $140.1 million. Projections indicate that by 2028, annual FCF could reach $180 million. Estimates stretch over the next decade, gradually rising to around $268.6 million by 2035. For the first five years, these projections are supported by analyst forecasts. Later years rely on systematic extrapolation using industry-standard growth rates.

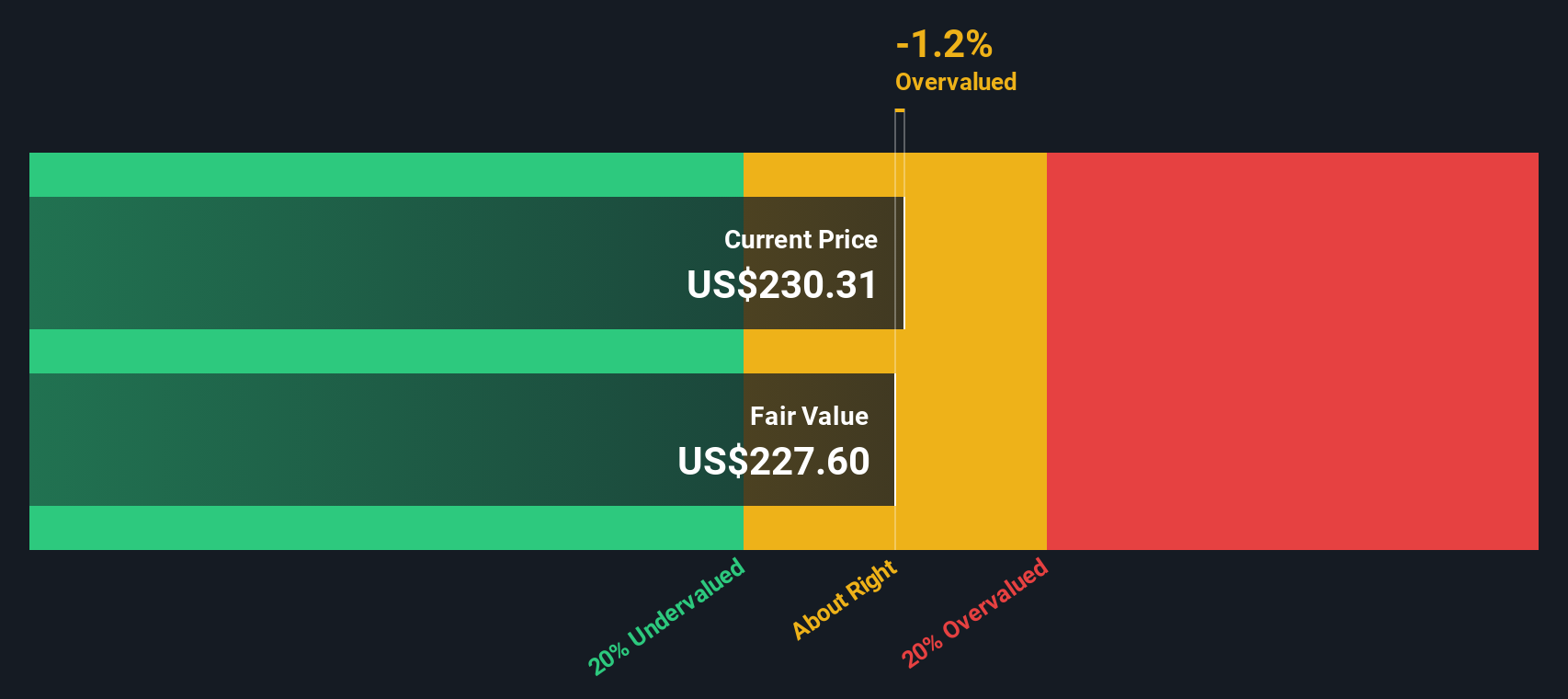

Based on this 2 Stage Free Cash Flow to Equity model, the intrinsic or "fair" value of Argan shares is $276.91. However, comparing this intrinsic value to the present market price shows the stock is trading at a 2.5% premium. This suggests it is slightly overvalued according to the DCF approach.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Argan's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Argan Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially appropriate for consistently profitable companies like Argan. It provides a relative measure of how much investors are willing to pay for each dollar of earnings. As profitability improves and growth expectations rise, companies often trade at higher PE ratios, while elevated risks can warrant a discount.

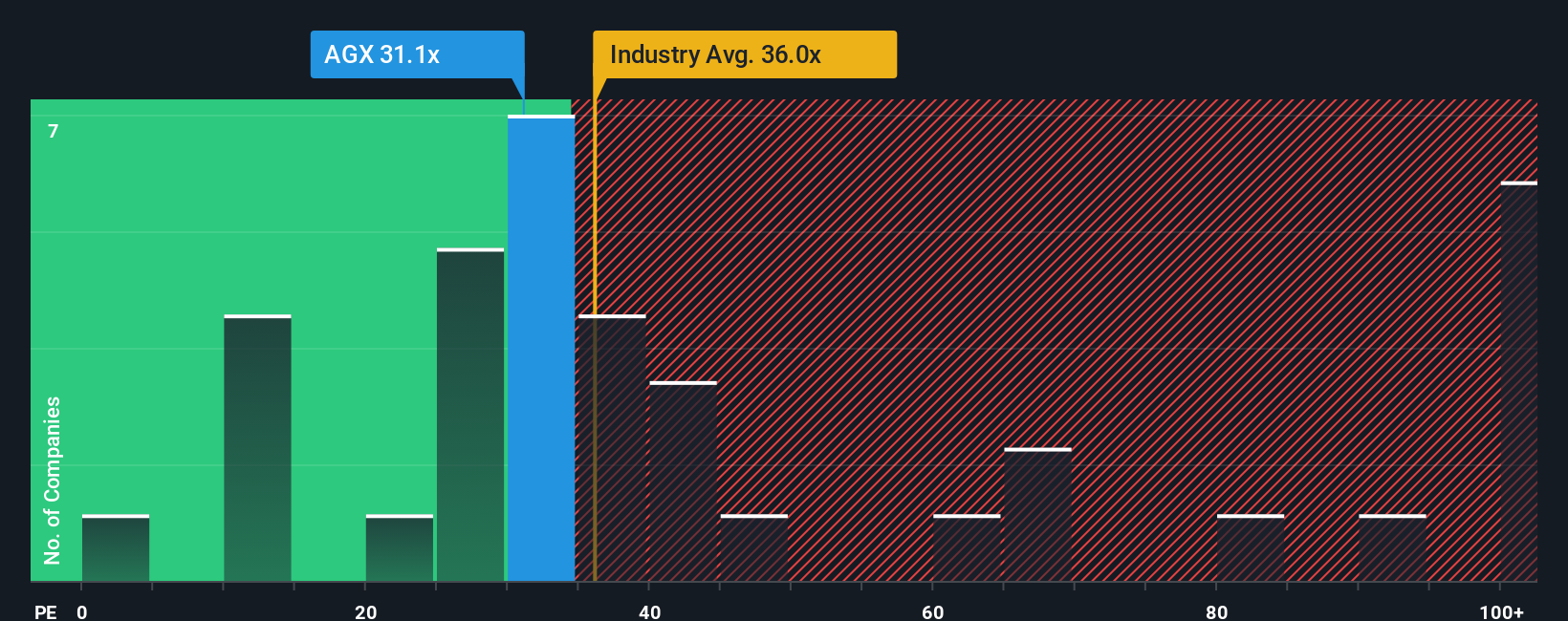

Argan currently trades at a PE ratio of 33.5x. This sits just below the construction industry average of 35.9x, and also below its peer average of 39.0x. These benchmarks give context, but they do not fully account for all the specific factors relevant to Argan's current and future outlook.

That is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated as 36.0x for Argan, is designed to provide a more tailored benchmark. It factors in the company’s expected earnings growth, profit margins, market capitalization, risks, and industry profile, offering a more holistic view than simply comparing to peers or the broad industry average. Because it is tailored to the business and sector, the Fair Ratio can reveal whether the current valuation appropriately reflects both opportunities and challenges Argan faces.

Comparing Argan’s actual PE ratio of 33.5x to its Fair Ratio of 36.0x shows the company is trading very close to what would be expected, given its financials and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Argan Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple framework for investment decisions that goes beyond the numbers. It lets you connect your unique perspective on a company’s future with your expectations for growth, profitability, and what you think is a fair value.

With Narratives, you tell the story behind the stock: what you believe about Argan’s strengths, risks, and future opportunities, and how those beliefs shape the forecasts you make. Narratives link this story to a specific forecast of revenues, margins, and earnings, helping you define your own Fair Value and compare it directly to the current share price.

Available to millions of investors on Simply Wall St’s Community page, Narratives are easy to create and update. They adapt automatically when new developments, such as earnings results or major news, appear. This means your fair value estimates always reflect the latest facts, supporting clearer buy, hold, or sell decisions.

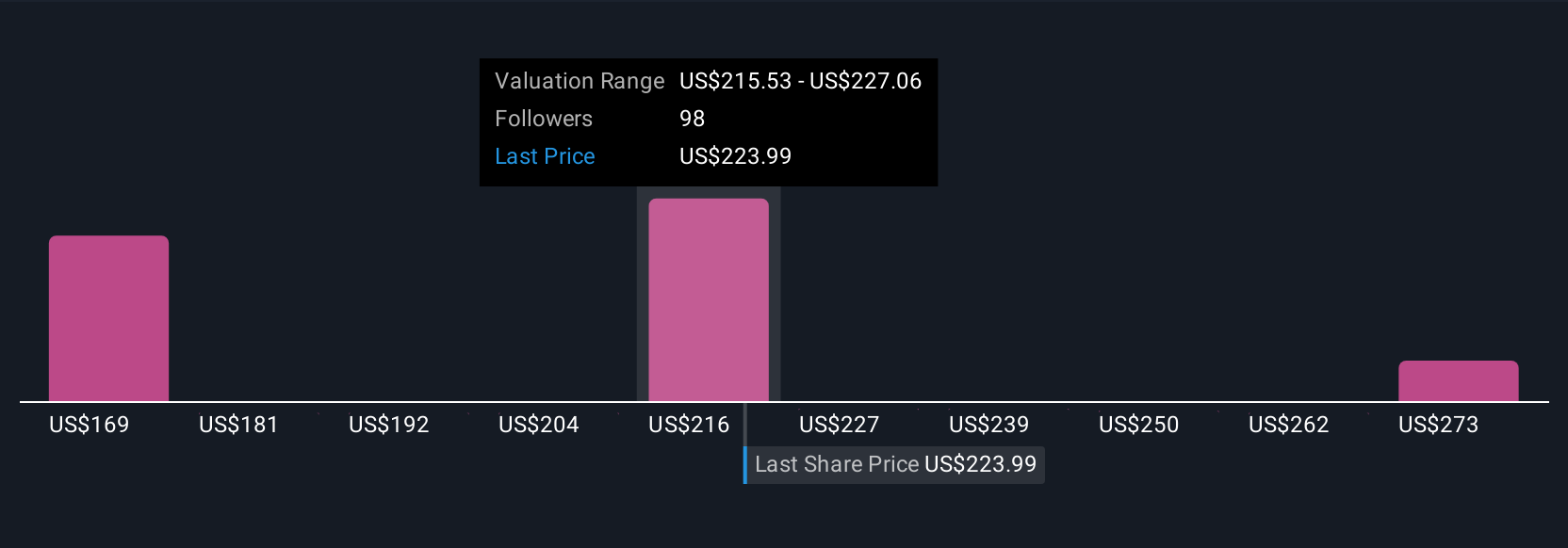

For Argan, you will find a range of Narratives. Some investors expect accelerating revenue growth and premium valuations, projecting fair values as high as $284.68 per share, while others take a more cautious stance and see fair value closer to $230.33. Your Narrative helps guide what action makes sense for you.

For Argan, here are previews of two leading Argan Narratives:

-

Fair Value: $284.68

Undervalued by: -0.3%

Projected Revenue Growth: 13.31%

- Argan has shown exceptional recent revenue and net income growth, driven by its Power Services segment. The company currently has a record $1.9 billion project backlog focused on both traditional and renewable energy.

- Management is credited with rising profit margins, a debt-free balance sheet with $546.5 million in cash, and a consistent record of exceeding analyst forecasts.

- Main risks include material and labor cost inflation and the challenges of fixed-price contracts. However, operational agility and financial strength contribute to resilience and positioning for sustained growth.

-

Fair Value: $262.00

Overvalued by: 8.4%

Projected Revenue Growth: 17.88%

- Argan is well-positioned for growth through its diversified project backlog and robust industry trends in grid modernization and AI-driven power demand, which support margin expansion and higher earnings.

- Overexposure to natural gas projects, cyclicality, and concentrated large-scale projects introduce long-term risks from market shifts, decarbonization, and potential project volatility.

- Recent analyst upgrades and dividend increases reflect optimism. However, some caution that much of the future growth may already be priced in and that profitability could fluctuate with execution and competition.

Do you think there's more to the story for Argan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives