- United States

- /

- Construction

- /

- NYSE:AGX

Argan (NYSE:AGX) Amends Bylaws To Limit Officers' Liability

Reviewed by Simply Wall St

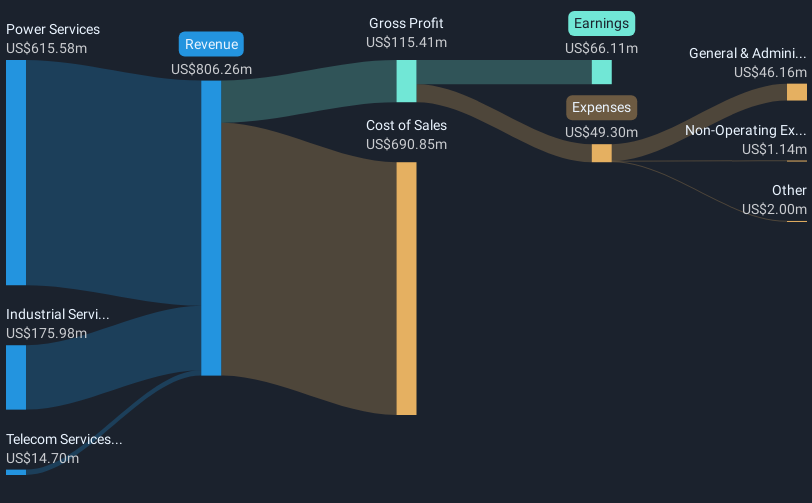

Argan (NYSE:AGX) recently saw its share price rise by 41% last month amid several influential events. Most notably, the company's proposal to amend its bylaws to limit the personal liability of officers reflects a significant governance change, while an increase in its equity buyback plan by $25 million could have bolstered investor confidence. Additionally, the appointment of Lisa Larroque Alexander to the board brought new expertise to leadership. These developments came despite a mixed market environment, with broader markets relatively flat as investors awaited significant interest rate decisions and trade discussion outcomes. Overall, these corporate actions could have positively supported Argan's shareholder returns.

Argan has 1 weakness we think you should know about.

The recent developments at Argan, including the proposed bylaw amendments and a bolstered equity buyback plan, could potentially fortify investor confidence by reinforcing governance and demonstrating a commitment to shareholder returns. These actions might also enhance Argan's operational continuity and leadership strength with the addition of Lisa Larroque Alexander to the board. In terms of revenue and earnings projections, the increased project backlog and strategic expansions in natural gas and solar energy projects suggest promising growth prospects. However, the focus on large-scale projects introduces execution risks which could impact both revenue and net margins.

Over the last five years, Argan's total shareholder return, which factors in both share price and dividends, was a very large 470.76%, signaling substantial value creation over the period. This performance eclipses the broader market and was underpinned by significant earnings growth, as illustrated by a 164.1% increase in earnings over the past year compared to the Construction industry average of 32.2%. In the shorter term, with a price target of US$150, the current share price of US$153.41 represents a minor 2.3% premium, suggesting analysts view the stock as fairly priced at present. Investors should consider this in tandem with the company's robust revenue growth forecast of 11.4% per year, slightly exceeding the US market's 8.4%.

Examine Argan's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives