- United States

- /

- Construction

- /

- NYSE:AGX

Argan (AGX) Q3 2026: 81% TTM Earnings Surge Reinforces Bullish Profitability Narrative

Reviewed by Simply Wall St

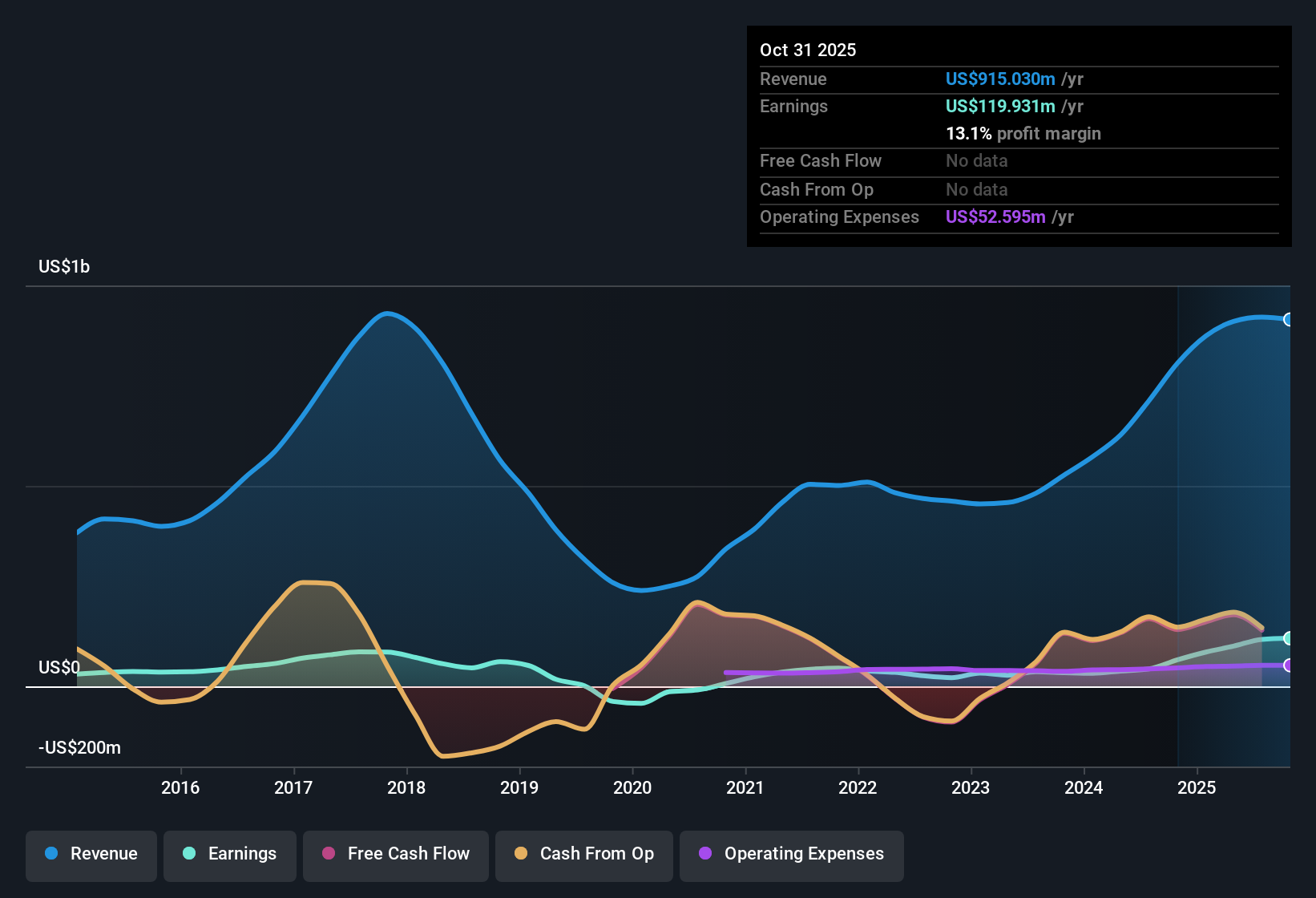

Argan (AGX) has just posted its Q3 2026 scorecard, with revenue of about $251 million and basic EPS of $2.22, while trailing twelve month EPS sits at $8.76 on revenue of roughly $915 million as the business continues to scale. Over the past year, the company has seen net income climb from $66.11 million to $119.93 million on a trailing basis, and EPS step up from $4.94 to $8.76. This gives investors a cleaner read on how improving margins are feeding through to the bottom line.

See our full analysis for Argan.With the headline numbers on the table, the next step is to line them up against the prevailing narratives around Argan to see which storylines the latest results support and which ones they put under pressure.

See what the community is saying about Argan

TTM earnings up 81.4 percent

- Trailing twelve month net income reached about $119.9 million, up from $66.1 million a year ago, with EPS over the same period rising from $4.94 to $8.76 as profit growth outpaced revenue expansion.

- Consensus narrative sees record backlog and strong industry trends supporting multi year revenue and margin growth. The current jump in trailing earnings and EPS helps illustrate how executing larger gas and renewable projects can translate into higher profitability, even if management still warns margins can be lumpy from project to project.

- With revenue over the last twelve months at roughly $915.0 million versus $806.3 million a year earlier, the business is already operating closer to the multi year growth story that consensus links to aging power infrastructure and rising electricity demand.

- The move in net profit margin to 13.1 percent from 8.2 percent lines up with the idea that scale and better execution on complex EPC projects can lift margins over time, though the narrative also notes future margin compression is possible as competition and mix shift.

Bulls argue that if Argan can keep turning backlog into high margin revenue at this pace, today is just the early stage of a multi year compounding story that the raw trailing numbers are only starting to show. 🐂 Argan Bull Case

Margins at 13.1 percent, but forecast to ease

- Net profit margin for the latest twelve months sits at 13.1 percent, above last year’s 8.2 percent. Analysts expect profit margins to move down toward about 9.4 percent over the next three years even as earnings are forecast to grow roughly 13.7 percent per year.

- Bears focus on Argan’s heavy exposure to large gas fired projects and warn that any shift in energy policy or project delays could pressure those margins. The combination of currently elevated profitability with forecasts for lower future margins gives their concern a concrete footing.

- Backlog is described as roughly 61 percent weighted to natural gas plants, so if the power sector accelerates toward renewables faster than expected, it could cap the kind of high margin gas work that helped lift profitability to 13.1 percent.

- Management itself has flagged margins as lumpy, which fits with the idea that a small number of large EPC projects can swing earnings from year to year, especially if cost overruns or cancellations hit the gas heavy backlog that bears are watching.

Skeptics suggest that a 13 percent margin backed by gas heavy mega projects might not be the “new normal” if decarbonization and project volatility bite harder than forecasts assume. 🐻 Argan Bear Case

Premium P/E, but big DCF gap

- At a share price of $313.70, Argan trades on a price to earnings ratio of about 36.3 times, slightly above peer and industry averages in the mid 30s. A DCF fair value of roughly $547.30 implies the stock sits around 42.7 percent below that intrinsic value estimate.

- Consensus narrative highlights strong financial health and multi year growth drivers as reasons some investors are comfortable paying a premium multiple today. The tension between a slightly richer P/E and a much higher DCF fair value underlines how differently the market and long term models are treating the same growth outlook.

- Forecast earnings growth of about 13.7 percent a year is actually a bit slower than the broader US market’s 16.1 percent, which could explain why the market is not fully embracing the upside implied by the DCF model despite recent 81.4 percent earnings growth.

- A forecast revenue growth rate near 20.8 percent per year, backed by a diversified backlog in gas, renewables, water, and recycling projects, offers a concrete path to higher absolute earnings that supports a higher fair value than the current price suggests.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Argan on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light? Use that angle to build your own narrative in just a few minutes, starting now: Do it your way.

A great starting point for your Argan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Argan’s premium valuation, gas heavy backlog, and potentially peaking margins raise questions about how durable today’s profitability and upside really are.

If that mix of rich pricing and uncertain margin sustainability feels uncomfortable, use our these 905 undervalued stocks based on cash flows to immediately focus on ideas where valuation more clearly compensates you for the risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026