- United States

- /

- Construction

- /

- NYSE:AGX

Argan (AGX): Assessing Valuation as Insider Selling and Missed Bids Stir Investor Uncertainty

Reviewed by Kshitija Bhandaru

Argan (AGX) has caught investors’ attention following significant insider selling by Director Cynthia Flanders, along with online discussions about missed construction bids. These factors have contributed to fresh questions about the company’s short-term outlook.

See our latest analysis for Argan.

Argan’s latest string of insider sales and chatter over missed bids coincides with a sharp pullback. Its 1-day share price return is -5.16%, but this comes after an exceptional 78.7% gain year-to-date and an outstanding one-year total shareholder return of 127%. Momentum has slowed in the very short term; however, longer-term investors are still well ahead given the stock’s staggering 718% three-year total shareholder return.

If this mix of soaring returns and shifting momentum has you curious about other compelling stories, why not expand your search and discover fast growing stocks with high insider ownership

The real question now is whether recent caution from insiders and mixed online sentiment mean Argan is trading below its true value, or if the market has already factored in all of the company’s impressive growth prospects.

Most Popular Narrative: 10% Undervalued

Argan’s most widely followed narrative sees significant upside from the current last close of $256.15, suggesting the stock is trading below what the narrative considers fair value. This perspective pivots on a set of standout financial results and an optimistic growth story that has captured followers’ attention.

Argan’s project backlog is a major growth catalyst, exceeding $1 billion as of the latest reports. This backlog includes a significant mix of renewable energy projects and provides strong revenue visibility for future quarters. Recent contract wins, particularly in infrastructure and power generation, have bolstered investor confidence and set the stage for sustained top-line growth.

What is behind this bold fair value? There is a catch: the narrative is betting on sustained double-digit revenue growth, margin improvements, and an expanding backlog of megaprojects. Which piece of the puzzle could make all the difference? Dive in to discover the key assumptions fueling this aggressive price target.

Result: Fair Value of $284.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and potential margin compression from fixed-price contracts could quickly undermine even the most optimistic growth forecasts for Argan.

Find out about the key risks to this Argan narrative.

Another View: Are Multiples Telling a Different Story?

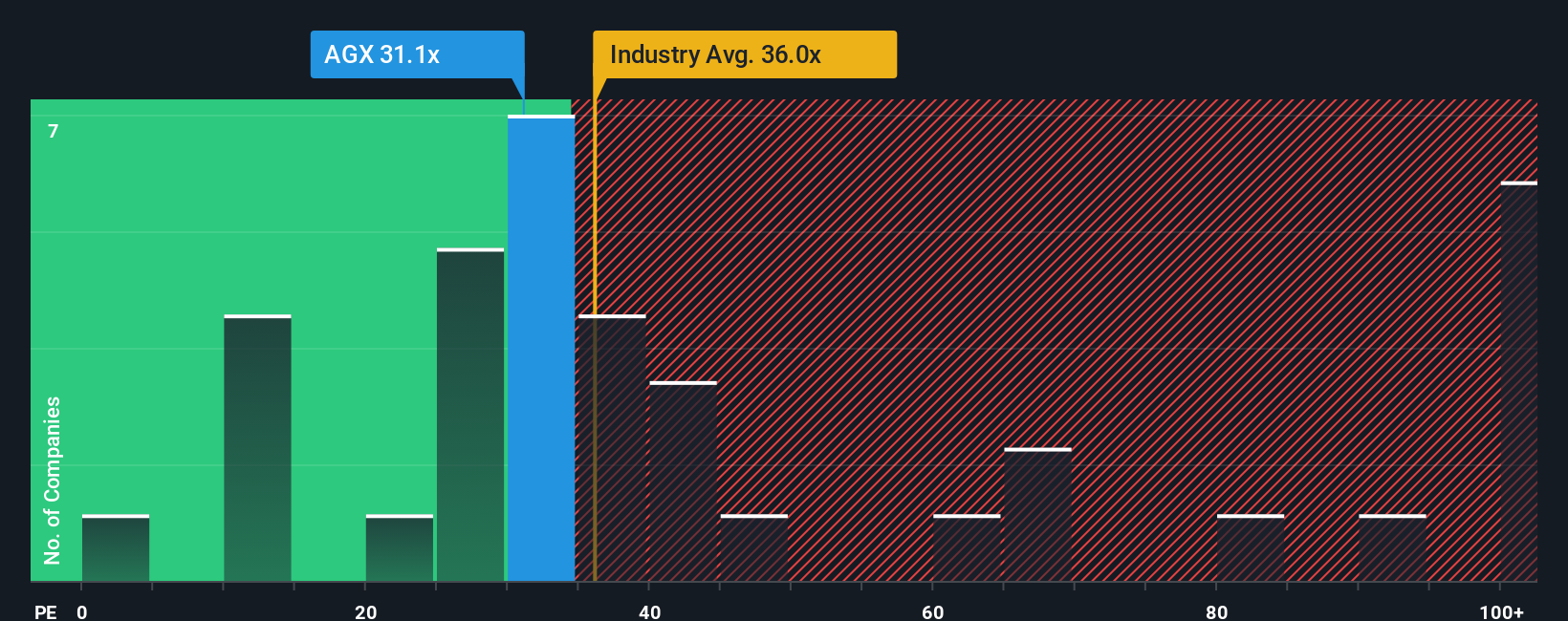

Looking at Argan from a market multiples perspective, the numbers offer a different angle. Its price-to-earnings ratio sits at 30.2x, noticeably below the peer average of 38.1x and the industry average of 35.6x, and is almost identical to its fair ratio of 30.1x. This suggests Argan could be attractively valued relative to rivals. However, when the gap to the fair ratio is this slim, is there still much upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Argan Narrative

If you want to take a fresh look at the numbers and shape your own conclusions, you can build a personalized narrative in just minutes, Do it your way

A great starting point for your Argan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

As markets evolve, some of the strongest opportunities can be found where you least expect. Use the Simply Wall Street Screener to uncover fresh prospects, spot unique trends, and stay one step ahead of the crowd.

- Spot companies harnessing powerful advancements in AI by starting with these 25 AI penny stocks.

- Tap into strong income potential by exploring these 19 dividend stocks with yields > 3%, offering yields above 3% for steady returns.

- Uncover tomorrow’s breakthroughs and fuel your portfolio with progress through these 26 quantum computing stocks, on the cutting edge of computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market in the United States, Republic of Ireland, and the United Kingdom.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives