- United States

- /

- Machinery

- /

- NYSE:AGCO

AGCO (NYSE:AGCO): Assessing Valuation After Finnish Expansion and Precision Tech Push

Reviewed by Kshitija Bhandaru

AGCO (NYSE:AGCO) is making waves with its latest investment in Finland, where the company’s AGCO Power division is expanding production facilities to boost both engine manufacturing and remanufacturing capabilities for its flagship brands.

See our latest analysis for AGCO.

AGCO has kept the momentum going throughout the year, with its latest Finnish expansion joining a string of headline moves, including the sale of its stake in TAFE and the rollout of precision ag tech at industry events. This year’s 13% total shareholder return suggests long-term investors are still seeing compelling growth prospects, even as recent share price moves have been modest and steady.

If today’s manufacturing news sparked your interest, you might also want to see what’s happening across global farm and equipment makers. Check out See the full list for free.

But after these strategic moves and solid returns, is AGCO's share price now offering hidden value for buyers? Or has the market already factored in all of this growth potential?

Most Popular Narrative: 13% Undervalued

AGCO’s most widely followed narrative pegs its fair value at $123.77, outpacing the recent close of $107.42. The stage is set for a debate about whether AGCO’s upside is still being overlooked amid bold growth by the company’s premium brands.

Accelerating adoption of precision agriculture and digital solutions is expected to significantly increase demand for AGCO's retrofit technologies (e.g., Precision Planting and PTx). This shift supports higher-margin software-driven revenue, which should enhance future margins and earnings quality.

Curious what numbers push AGCO’s fair value higher? There is a game-changing growth rate baked into the narrative, along with a predicted profit margin leap. The full story breaks down which specific financial forecasts could push AGCO’s value even further and just how bold those projections really are.

Result: Fair Value of $123.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weak demand in key markets or increased costs from global tariffs could quickly challenge AGCO’s current growth assumptions and valuation outlook.

Find out about the key risks to this AGCO narrative.

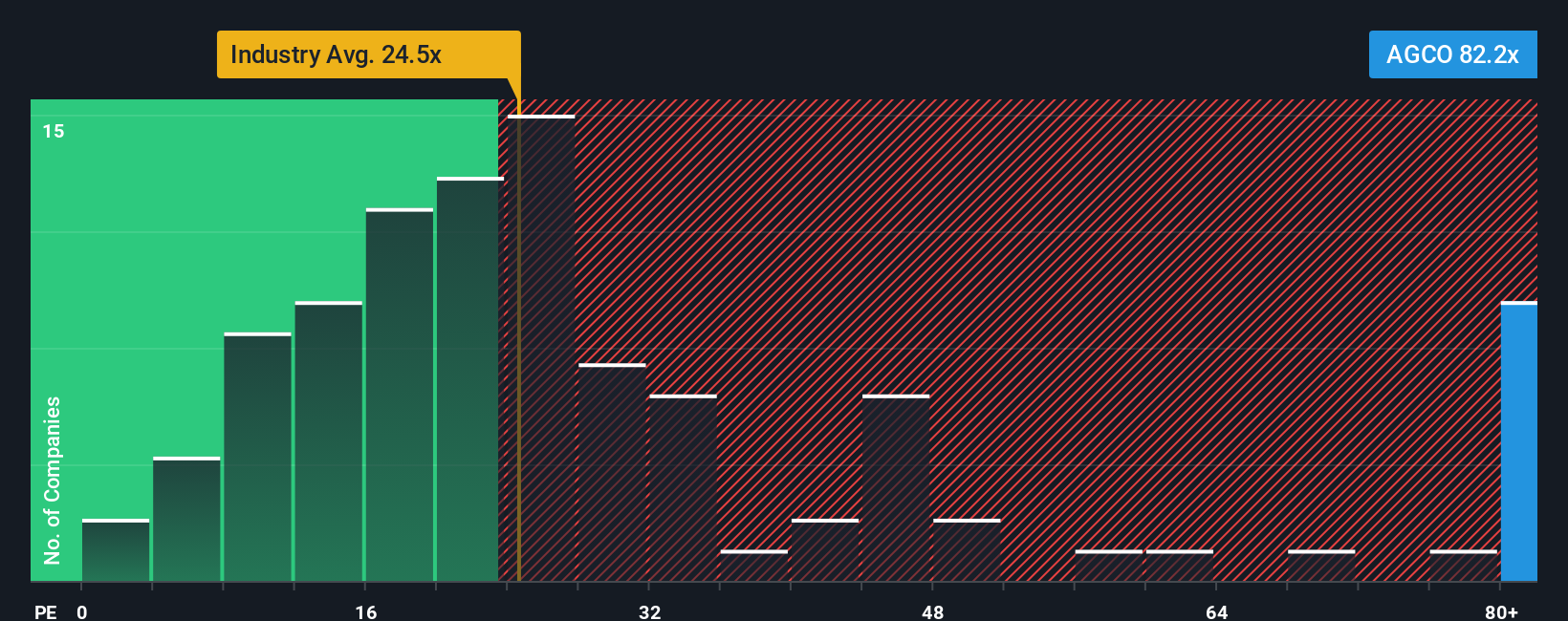

Another View: The Multiple Tells a Different Story

Looking at AGCO’s price-to-earnings ratio, things appear less optimistic. AGCO trades at 80.5x earnings, which is far higher than the industry average of 24.1x and the fair ratio of 40.2x. This significant gap signals that investors might be overpaying compared to peers and raises the stakes for future growth. Could a re-rating be on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AGCO Narrative

Feeling unconvinced or eager to dive deeper into the numbers? You can craft your own AGCO valuation story in just a few minutes: Do it your way

A great starting point for your AGCO research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not stop at just one opportunity. Expand your watchlist and catch what others might miss by looking through these standout strategies available now:

- Capitalize on powerful trends in AI by reviewing these 24 AI penny stocks, which are making headlines with game-changing applications and strong growth signals.

- Lock in attractive yields today when you scan these 19 dividend stocks with yields > 3%, featuring companies with a proven record of paying over 3% and rewarding patient shareholders.

- Seize your chance to find overlooked gems with real upside using these 909 undervalued stocks based on cash flows, where stocks trade at compelling discounts compared to their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGCO

AGCO

Manufactures and distributes agricultural equipment and replacement parts worldwide.

Moderate risk with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives